Michael Riley: The Reality of Providence Pension Liability

Tuesday, October 07, 2014

So the pension liability discussion has heated up and for the purposes of educating the public and some candidates I have calculated the TRUE pension liability given certain relevant assumption. Let me first say that if Bondholders did not currently have first lien on Tax revenues, due to a 2011 law passed by the assembly placing public workers and taxpayers at the end of the line, then Providence, Rhode Island would already be rated “junk” by Moody’s, S&P etc. and would have very little flexibility to finance anything.

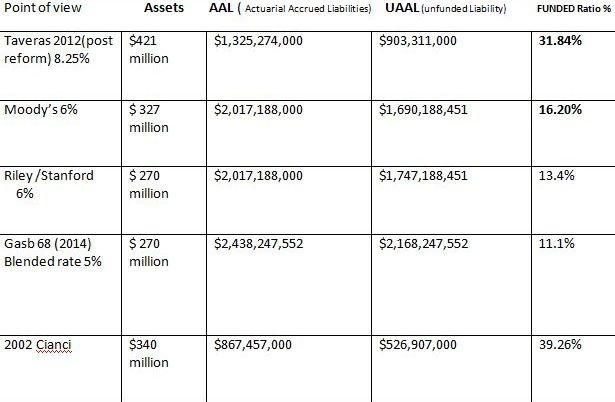

Mayor Taveras uses among the highest discount rate in the country 8.25%. Moody’s will use and analyze using between 5.5% and 6%. We will use 6% for their analysis and a blended rate based on crossover points indicating 70% muni rate and 30% the providence assumption for returns. The 2012 CAFR is used and assets were then reported as $421 million dollars ( even though assets in the fund were only $247 million) First we will adjust assets down by $57 million based on the auditors admonition against Taveras accounting gimmick, next we will use market value as prescribed by gasb 67.

This table reveals the truth through analysis, if you want to believe Taveras lies then keep reading the Projo and WPRI. If you are an accountant or actuary including those employed by Providence please refute these numbers in public.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTAnalysis of Providence Pension Liabilities Taveras vs Reality

The true Status on Providence Pension funding ratio is between 11 and 16%. The people have been misled by Taveras and Cicilline, and the media that dutifully repeats his lies without independent analysis and confirmation.

Providence is in true Crisis. 3 years of a flat to down stock market will virtually bankrupt the pension plan. The math is simple benefits cost nearly $100 million a year. Contributions are about $68 million (including arc).If there is no gain in the investment account and /or contributions from the government decline to $60 million there will be less than one year of benefits left in the fund. The next step is IOU’s once tried in California or receivership.

Just for fun, I added the reported Pension Fund status in 2002 showing the very poor condition of the plan and the lack of progress or urgency in 2002 by Buddy Cianci. I have not yet heard a plan from Elorza or Cianci to deal with reality in 2015.

Michael G. Riley is vice chair at Rhode Island Center for Freedom and Prosperity, and is managing member and founder of Coastal Management Group, LLC. Riley has 35 years of experience in the financial industry, having managed divisions of PaineWebber, LETCO, and TD Securities (TD Bank). He has been quoted in Barron’s, Wall Street Transcript, NY Post, and various other print media and also appeared on NBC news, Yahoo TV, and CNBC.

Related Articles

- Michael Riley: Taveras and Polisena No-Shows at Pension Commission

- Michael Riley: Moody’s Lowers the Bomb…Look Out Rhode Island

- Michael Riley: RI Municipal Pension Study Comm. Is in Failure Mode

- Michael Riley: Rhode Island’s Potential Pension Nightmare

- Michael Riley: State Pension Fix in Limbo as Municipal Debt Grows

- Michael Riley: These RI Cities + Towns Could Be Next in Bankruptcy

- Michael Riley: Providence Vying for Worst Funded City in America

- Michael Riley: The Municipal Pension Study Commission Is A Failure

- Michael Riley: Analysing A Crisis

- Michael Riley: The Pension Study Commission Needs To Face Reality

- Michael Riley: The Harsh Reality of the Pension and OPEB Crisis

- Michael Riley: Municipal Pension Commission Comes Unglued

- Michael Riley: Don’t Pay

- Michael Riley: Rhode Island Treasurer is About Integrity and Experience

- Michael Riley: The RI Treasurer Democratic Primary Race Gets Uglier

- Michael Riley: Can Taveras Clean Up His Act for the New Mayor?

- Michael Riley: Pension Obligation Bonds? Oh My!!

- Michael Riley: Integrity? Whatever…

- Michael Riley: From Head-start to Harvard to the Hoosegow Part 2

- Michael Riley: From Head-start to Harvard to the Hoosegow?

- Michael Riley: Failed Pension Commission Ponders Permanent Oversight Commission

- Michael Riley: West Warwick and Gallogly Pull Hoax on Taxpayers

- Michael Riley: 38 Studios Insider Trade and Municipal Fraud

- Michael Riley: GASB 68 Portends Huge Problems for City and State