Michael Riley: Municipal Pension Commission Comes Unglued

Tuesday, May 06, 2014

The hapless Rhode Island Pension commission met last week Monday April 28 and was on full display as a prototype for dysfunctional committees that have been producing nothing under a dysfunctional Governor. A full month after last month’s Pension Commission decision to review the status of all funding improvement plans now a year past due, the commission once again started this meeting without a quorum. But before the quorum could be achieved, Mayor Polisena of Johnston took to the microphone for a ten minute rant that covered 38 studios, Don Carcieri, “Auditor Genius Ernie Almonte,” and yours truly the loser candidate “wannabe” Michael Riley.

I am used to this kind of outburst from politicians, especially ineffective ones, but I want to sincerely apologize to Mr. Carcieri and Mr. Almonte for triggering this classless diatribe. Mr. Polisena is typical of the massive leadership problem we have in this state. The fact that Mr. Polisena was unable to update the committee on the status of the Johnston FIP plan that he submitted to the commission many months ago was indeed troubling. His hemming and hawing was reminiscent of Ralph Cramden in the Honeymooners. But even more troubling was the behavior of Chair Gallogly who didn’t even ask a single question about Johnstons’ status. Mayor Polisena’s presentation on Johnstons status was one fifth as long as his early diatribe and he said literally nothing about his funding improvement plan, preferring to focus instead on an ING lawsuit that has little to do with whether he anticipates paying his ARC in 2014, 2015 and 100% from 2017 on as he said he would in his plan. The ARC is roughly $10,000,000 for the pension and even larger for OPEB. Johnston has been paying only $3 million in total annually for both liabilities since 2007.

Say it ain’t so Joe

Upon further inspection it appears that Johnston, under Mayor Polisena’s close watch, has pulled as fast one. He’s been funding the APC not the ARC. Whoops!! Like Narragansett Rhode Island who hasn’t contributed since 2003, it also appears that Johnston under Mayor Polisena may have never contributed a dime to the Pension Plan or to fund OPEB in his 8 years as Mayor. Not one single dime. Instead he ran the incredibly irresponsible “pay as you go” plan and ignored the deepening abyss. Was he ignorant of that fact or complicit in burying the next generation of Johnston citizens? Either way they are screwed. In the accounting world, this kind of financial mismanagement is inexcusable and shows the Mayor has no handle on municipal finances. It is also clear that he has no intention to make the cuts necessary to fund pension promises already made (ARC) that aren’t funded. The most recent CAFR 2013 shows Johnston has a $109 million dollar Unfunded pension liability and an extraordinarily large $187 million in OPEB liabilities making the burden on Johnston Households $26,435 per household, dwarfing the average citizens state debt burden.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTGASB 68

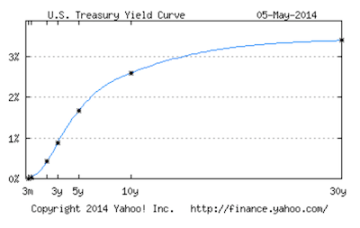

Johnston is using a 7.5 % discount rate to determine funding status which is the same rate as the state . Both Johnston and the state need to take the rate several notches lower to near or below 6%. It is ironic that Denis Hoyle explained for yet again another time to this commission that GASB 68 is now in play. We have been talking about this for months and the changes at Moody’s. This change has been known for years at the State and town level and is part of the job of managing a town or a finance department. GASB 68 states that underfunded plans must use a rate that reflects the “under-funded status” and strongly suggests a 20 year AA municipal curve rate which is roughly 3.9%. This is the reality of today’s low interest rate environment and why it’s almost impossible to plan on achieving more than 6%.The math is simple, more money needs to be set aside and invested now if the returns are 6% than they were 10%.

Municipal Pension Commissions role

The commission has been struggling with its mission since the first meeting 2 and a half years ago. They have virtually accomplished nothing. Todays list of pension FIP status was filled with towns who didn’t respond like Cumberland or will get back to Ms Greschner like 6 or 7 towns or were “still in talks”. Mayor Taveras missed his 30 th meeting and sent no one to represent him thus rendering his Town of Providence and any other “critical status” town as not worthy of his time. He is by far the most irresponsible member of the commission and should be officially removed. Several other members no longer attend this “kick the can” circus, including former State Senator Michael Lenihan.

Why do we care?

Rhode Island is in “crisis” and this Chairman and Governor are treating municipal officials like kindergartners. They seem afraid to confront and criticize and/or demand performance and action. Instead they avoid fact-finding and disclosure. Their preferred method is constantly worrying about pestering or “bugging “ various town officials. Let’s get this straight, these are Town Officials who work for us and either have significant pay and benefits that from taxpayers or the official wields significant political power. We deserve answers and actions from these employees, in order to address this crisis . At least 5 times this week and 10 times at last months’ meeting we heard the Municipal Finance Director of the State of Rhode Island say, regarding obtaining information from towns on the status of plans,.. “we sent them an email but we haven’t heard back” ..this is going on 2 ½ years now. Are you kidding me?

What is the status of the plans?

A full detailing of the current status of each “critical status town” as woefully described in this meeting will be available on my blog at http://rishrugs.blogspot.com/ .

Do not expect an encouraging report and please ask your town officials what they are doing to head off this crisis because our Commission or Municipal Finance Director can’t seem to get answers.

GASB 67 & 68

Projected benefit payments are required to be discounted to their actuarial present value using the single rate that reflects (1) a long-term expected rate of return on pension plan investments to the extent that the pension plan’s fiduciary net position is projected to be sufficient to pay benefits and pension plan assets are expected to be invested using a strategy to achieve that return and (2) a tax-exempt, high-quality municipal bond rate to the extent that the conditions for use of the long-term expected rate of return are not met.

Related Slideshow: RI Public Pension Reform: Wall Street’s License To Steal

See the key findings from Forbes' columnist Edward Siedle, who unveiled his investigative report into the RI pension system, "License to Steal," in October 2013.

"The Employee Retirement System of Rhode Island has secretly agreed to permit hedge fund managers to keep the state pension in the dark regarding how its assets are being invested; to grant mystery hedge fund investors a license to steal, or profit at its expense using inside information; and to engage in potentially illegal nondisclosure practices," said Siedle.