Michael Riley: State Pension Fix in Limbo as Municipal Debt Grows

Tuesday, April 29, 2014

Unfortunately, I could not attend Monday’s RI Local and OPEB Study Commission meeting but I have read the agenda and after last month's disappointing meeting I think the commission owes the public some clear explanation about what exactly has been accomplished so far and what the goal of this commission is. In the three weeks since the last pension meeting, the circus in Coventry has added a new twist as the Central Coventry Fire District is now in limbo. The outcome has an obvious impact on Coventry as a whole. However, the revenue director and commission have been oblivious to this long developing nightmare and should have intervened in Coventry over a year ago. So now, the Central Coventry fire district is being liquidated or is it?

The Assembly Strikes Back?

The general assembly appears to be overwhelmingly interested in allowing all fire districts in Rhode Island to be under the jurisdiction of the revenue director, if in “critical status” and presumably the pension study commission as prescribed by the Fiscal Stability Act. It is inconceivable that the state would intervene only in the fire district without taking into account the very vulnerable financial condition of the entire town of Coventry. The assembly acted after watching several votes of the people and a judge ordered liquidation. They suddenly decided that Judge Stern’s ruling and the people of the fire districts’ vote was not relevant and attempted to retroactively define the fire district under the Fiscal stability Act. This assembly effort may indicate that the worsening relationship between the General Assembly and the judiciary is coming to a boil. The assembly, after passing Pension reform in 2011 was clearly miffed at Governor Chafee’s yearlong meddling and efforts to use Judge Carter-Taft “court ordered mediation” to help out his friends in the public sector unions. After a year of negotiations, the mediation has ended in disaster proving that it’s never too late for this Governor to screw up a deal.

What about the “year of Cities and Towns”

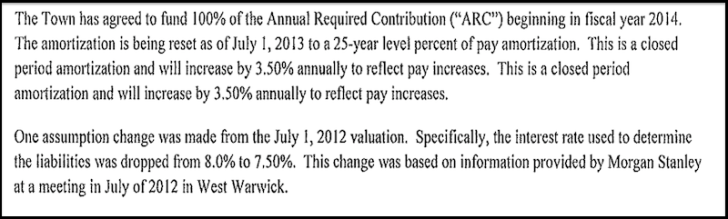

Now that taxpayers and unions are going to court over an already passed law it is important to be aware that Mr. Chafee is not done destroying this state. In late 2011 Mr. Chafee became extremely concerned about the financial condition of cities and towns especially the Pension issues. He declared that 2012 would be the “Year of Cities and Towns”. The key tool for addressing municipal pension debt and OPEB liabilities became the Rhode Island Pension Study Commission headed by his direct report Revenue Director Rosemary Beth Gallogly. The commission’s effort matches the dithering, wandering personality of the Governor. After more than two years this commission cannot even tell us how well each City and Town has done relative to the Funding Improvement plans issued over a year ago. The revenue director, has outside the commission, produced news puff pieces claiming two towns specifically, West Warwick and Narragansett have complied with the Funding Improvement Plans (FIP) they submitted a year ago. Yet there is no evidence of this and at the last Pension Study Commission meeting none was presented. I have directly asked the Town of Narragansett for evidence and they will not even return an email. West Warwick FIP filing highlights from 15 months ago appear below:

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

So one obvious function of the Commission is to report on progress. Ms Gallogly claimed in public that West Warwick and Narragansett had achieved success and she was proud of the cooperation. We can see how they did if someone publishes the data. The commission should review the progress, if any, versus the FIP. We can then check off all the items they agreed to accomplish and identify those that they said they would do but failed. Let’s make them accountable. The process of comparing the Funding Improvement Plans to actual progress and reporting to the citizens of this State should have taken place months ago. The fact is , on April 28 , 2014 , more than 2 years after this commission was formed we still have no idea about the progress of these “critical status” towns and further there is no indication as to a plan for the future. What happens if the town ignores the commission and ignores their own submitted plans? Will this be like the General Auditor attempts for compliance? Will elected officials just violate commission edicts as they please?

The Pension Study Commission has failed to produce any progress of note and instead impedes progress by allowing town officials to stall and commission members to use their appointments as political platforms. The Chafee appointed Union members have to be absolutely thrilled with this commission and Mr. Chafee’s latest debacle.

The only path to avoid multiple bankruptcies involves receivership and that is up to Director Rosemary Beth Gallogly and she doesn’t have Governors support or the intestinal fortitude to do what’s right to save this state.

Michael G. Riley is vice chair at Rhode Island Center for Freedom and Prosperity, and is managing member and founder of Coastal Management Group, LLC. Riley has 35 years of experience in the financial industry, having managed divisions of PaineWebber, LETCO, and TD Securities (TD Bank). He has been quoted in Barron’s, Wall Street Transcript, NY Post, and various other print media and also appeared on NBC news, Yahoo TV, and CNBC.

Related Slideshow: Providence Pension Liability

A new report shows that Providence’s pension fund—even after the recent reform—is still in trouble. The below slides break out the key numbers for the pension fund, including the unfunded liability, the assumed and actual rates of return, the current level of benefits, and how long it will take the city to pay off the unfunded liability. Figures are current as of July 1, 2013 and are taken from the new Jan. 31 actuarial report from Segal Consulting.

Related Articles

- Michael Riley: Providence Vying for Worst Funded City in America

- Michael Riley: West Warwick Is Headed For Disaster

- Michael Riley: RI Municipal Pension Study Comm. Is in Failure Mode

- NEW: Riley Blasts Langevin for Skipping WPRO Debate

- Michael Riley: Rhode Island’s Potential Pension Nightmare

- NEW: Riley Concedes, Warns RI Headed for ‘Disaster’

- Guest MINDSETTER™ Mike Riley: Rhode Island is More Conservative than You Think

- Michael Riley: Taveras and Polisena No-Shows at Pension Commission

- NEW: Riley Releases New Attack Ad on Langevin

- Guest MINDSETTER™ Mike Riley: Right-to-Work is Right for Rhode Island

- Michael Riley: The Harsh Reality of the Pension and OPEB Crisis

- Riley Charges Langevin is Guilty of Playing “Rhodopoly”

- Michael Riley: Analysing A Crisis

- Michael Riley: The Municipal Pension Study Commission Is A Failure

- Riley: Cranston and Mayor Fung Play the Hand that was Dealt

- Michael Riley: Is the RI Pension Commission Making Up Numbers?

- Michael Riley: The Pension Study Commission Needs To Face Reality

- Riley: Providence Debt is Epic Disaster, Other RI Towns Even Worse

- Michael Riley: Moody’s Lowers the Bomb…Look Out Rhode Island

- Michael Riley: These RI Cities + Towns Could Be Next in Bankruptcy

- Riley: RI Ignoring The Financial Disaster Staring It In The Face

2013.png)

.png)