Court Delays Award of $11M to St. Joseph Pensioners After AG and Foundation Lawyers Object

Monday, September 10, 2018

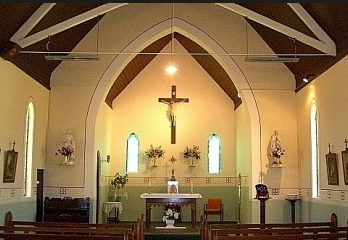

What looked to be the first sign of good news for the 2,700 members of the failed St. Joseph pension fund just last week turned into another legal joust and delay by the plethora of attorneys representing multiple corporate entities tied to the failed St. Joseph pension fund.

Leading the fight to block the transfer more than $11 million from the CharterCARE Foundation to the receivership was lawyers for the Attorneys for Attorney General Peter Kilmartin and CharterCARE Foundation.

The St. Joseph pension fund has a more than 2,700 members and a $118 million shortfall.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTSean Lyness of the Attorney General's office argued that the funds were intended for charitable purposes.

Special investigator Max Wistow ridiculed the opposition for blocking the payment by pointing out that the funds should not be used for other uses as the retirees had the first claim on the funds.

“These objections are the height of hypocrisy,” said Wistow.

Retirees' Needs -- and "Charitable Giving"

Wistow charged that the beyond the obligation to the retirees, that the fund was spending more on administration as it was on grant giving.

According to IRS documents for the year 2015 the most recent year available, CharterCare provided grants of $135,097 and scholarships of $58,250.

During that year, the organization has administrative fees tied to staffing of $191,876 for that year, according to the organization’s IRS 990 submission.

“I am not impressed with the charitable standing of the foundation,” said Wistow in the hearing late Friday afternoon before Superior Court Judge Brian Stern.

Russell Conn of the Boston-based law firm Conn Kavanaugh Rosenthal Peisch & Ford, LLP representing CharterCARE Foundation sought to block the transfer of the Foundation’s assets and called the move an “illegal transfer.”

Wistow responded that “it is easy to be charitable with someone else’s money.”

Stern on Friday delayed the transfer of the more than $11 million until at least mid-October.

As one retiree asked receiver Stephen Del Sesto while walking out of the court, “Will we see any money before I die?’

Millions in Foundation Coffers While Retirees Face $118 Million Shortfall

According to documents received by the court earlier in the week secured by GoLocal, the receiver and de facto, the old charitable function of St. Joseph Hospital — the CharterCARE Community Board, had reached a settlement for the transfer of the $11 million plus.

The pension plan was thrust into receivership in August 2017 and has an estimated shortfall of more than $118 million. It is the largest pension failure in Rhode Island's history and affects more than 2,700 plan members.

“Petitions this Court to approve the proposed settlement (“Proposed Settlement”) of claims the Receiver has asserted against CharterCARE Community Board (“CCCB”), St. Joseph Health Services of Rhode Island (“SJHSRI”), and the corporation Roger Williams Hospital (“RWH”) (collectively the “Settling Defendants”), in a lawsuit filed in the United States District Court for the District of Rhode Island,” reads the settlement.

Specifically, settlement documents submitted to the court state, “Immediate payment of the Initial Lump Sum of a minimum of $11,150,000, which is 95% of the Settling Defendants’ combined liquid operating assets of $11,525,000, up to a maximum of approximately $11,900,000 if the Rhode Island Department of Labor and Training releases the entire DLT Escrow in the amount of approximately $750,000 prior to the due date for payment of the Initial Lump Sum…”

The package of documents submitted to the court totals 476 pages. Stern's decision on Friday delays the petition for the settlement.

This settlement is highly complicated and the monetary value could increase as the settling party -- CharterCARE Community Board -- has additional assets, and one asset has tremendous value.

“In connection with the 2014 Asset Sale, Settling Defendant CCCB received a 15% membership interest in Prospect CharterCare, LLC, which indirectly owns and operates Roger Williams Hospital and Our Lady of Fatima Hospital. The current value of those interests is unknown to Plaintiffs,” states the settlement.

In June, two related massive lawsuits were filed simultaneously in state and federal court by the receiver in the collapsed St. Joseph pension fund - the largest pension failure in Rhode Island history.

Related Slideshow: 10 Shocking Elements of the St. Joseph Pension Fund Lawsuit Against the Diocese and Others

Related Articles

- Kilmartin Tries to Block Release of Records in St. Joseph Pension Fund Collapse

- Callaci: Memorial Hospital’s Closure & St. Joseph Pension Failure Show State of Healthcare

- Diocese Fights to Quash Subpoena for St. Joseph Pension Fund, Wistow Fires Back

- Judge Slams Kilmartin for Delaying Release of Documents in St. Joseph Pension Fund Collapse

- Diocese, Kilmartin’s Legal Delays Are Increasing Costs to Recover Monies For St. Joseph Pension

- St. Joseph Pensioner Quinn Worked 34-Years and Now Facing Cuts to Her $500 a Month Payment

- Wistow Files First Subpoena in St. Joseph Pension Fund Receivership Case

- Investigation: Diocese Claims False - Board Directed Only $14M in Payment to St. Joseph Pension Fund

- Five Major Developments in St. Joseph Pension Fund Collapse

- Should Hospital Merger Process Be Changed After St. Joseph Pension Fund Receivership?

- St. Joseph Receiver Del Sesto Warns Cuts Are Likely to Be Implemented in 2018

- Coming Monday - INVESTIGATION: The Real Cost of the St. Joseph Pension Fund Collapse

- INVESTIGATION: Diocese Underfunded St. Joseph Pension Fund by $100 Million

- St. Joseph Pension Plan, UHIP Progress & More: This Week at the State House

- Massive Lawsuits: Lawyers for Failed St. Joseph Pension Fund Sue Catholic Church and CharterCare

- 10 Shocking Elements of the St. Joseph Pension Fund Lawsuit Against the Diocese and Others

- 900K+ Documents Reviewed in Filing Lawsuits, Says St. Joseph Pension Fund Receiver Del Sesto on LIVE

- Senate Passes Bill Encouraging Settlements in St. Joseph Pension Fund Collapse

- Feds Issue Subpoenas on St. Joseph Pension Fund Collapse

- Key Trust Document Shows Bishop of Providence Has Oversight of Failed St. Joseph Pension Fund

- Judge Stern Shoots Down Prospect and Attorney General in St. Joseph Pension Fund Collapse

- DelSesto, Receiver for Failed St. Joseph Pension Fund, Unveils Next Steps in Investigation

- Subpoena Issued to RI Foundation on $8.2M Questionable Gift Tied to St. Joseph Pension Fund Collapse

- St. Joseph Pension Fund Collects $11M, Puts Pressure on Diocese and CharterCare