War of the Roses Breaks Out Between Mattiello and Raimondo

Sunday, February 26, 2017

On Thursday morning, Governor Gina Raimondo and Speaker Nick Mattiello sat together and beamed in the shared success of landing Norwegian Air to T.F. Green. But, by Friday the state’s two most powerful leaders were publicly ripping one another over car tax proposals and free college proposals.

The uncharacteristic eruption seemed to be sparked by Raimondo going to the Cranston Herald and critiquing the Speaker over his opposition of her free college proposal and her alternative 30 percent car tax cut.

Taking the issue to the Speaker’s backyard is an unusual tactic and a, de facto, declaration of political war. The strategy is unusual. Even when speakers and governors were of different parties, public wars are unusual. It was rare for GOP Governors like Ed DiPrete, Lincoln Almond, or Don Carcieri to publicly chest thump speakers like Matty Smith Joe DeAngelis, John Harwood, Bill Murphy or Gordon Fox. However, the Mattiello and Raimondo tensions have been building for years.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTAlmost two years ago to the day, Raimondo and Mattiello had a very public spat when Raimondo publicly criticized Mattiello’s budget process while she was attending the National Governor’s Association (NGA) meeting. At the conference in February 2015, Raimondo said that the General Assembly and lobbyists take the governor’s proposed budget and “hack it up every which way.” Ironically, she is attending the NGA this weekend.

Raimondo claimed in 2015 that her job as Governor is “to shine a light” on the process.

Mattiello fired back at the time that Raimondo’s criticism was an “inaccurate depiction” of the budget process. Within days she apologized to the Speaker.

Replay in 2017 — Two Years Later

According to State House sources, Speaker Mattiello was furious that Raimondo took their disagreements over the car tax and her free college proposal not only public, but directly to his district.

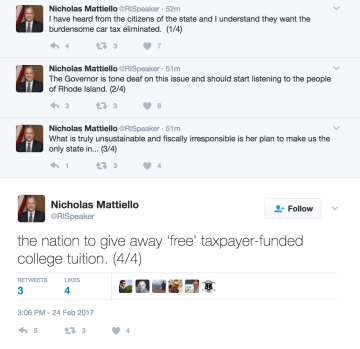

By Friday afternoon Mattiello responded and launched a series of four tweets calling Raimondo “tone deaf on the issue this issue (eliminating the car tax) and should start listening to the people of Rhode Island.”

Mattiello went on to critique Raimondo for offering a free college tuition plan, “truly unsustainable and fiscally irresponsible is her plan to make us the only state in... the nation to give away ‘free’ taxpayer-funded college tuition.”

I have heard from the citizens of the state and I understand they want the burdensome car tax eliminated. (1/4)

The Governor is tone deaf on this issue and should start listening to the people of Rhode Island. (2/4)

What is truly unsustainable and fiscally irresponsible is her plan to make us the only state in... (3/4)

the nation to give away ‘free’ taxpayer-funded college tuition. (4/4)

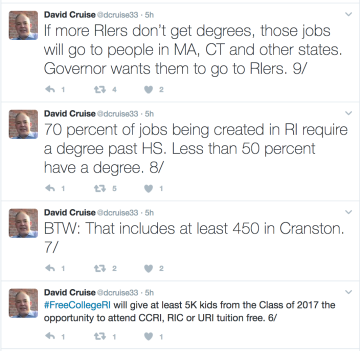

The Governor’s office issued a statement and top staffer David Cruise tweeted back at Mattiello.

“Governor Raimondo is standing up for middle class families. Her car tax relief will put money back into Rhode Islanders’ pockets and her college proposal will make college a possibility for all Rhode Island students,” said Michael Raia, of Raimondo’s office. “The truth is, 70 percent of jobs coming to Rhode Island require a degree past high school and Governor Raimondo wants those jobs to be filled by Rhode Islanders. Governor Raimondo ran for office so that Rhode Island could be a leader and she’ll work with anyone who is willing to help propel Rhode Island forward.”

Cruise issued nine tweets back at the Speaker late on Friday.

The very public battle is an indication of a frayed relationship between the two. Both Mattiello and Raimondo have chinks in their armor and see running "against" the other as a smart political strategy. Mattiello won re-election by under 100 votes and has overseen a House plagued by issues of malfeasance — see Ray Gallison and John Carnevale.

Correspondingly, Raimondo won the Democratic primary for Governor in 2014 with just 42.7 percent of the vote in a three way race against Angel Taveras and Clay Pell, then squeaked into the Governor’s office with just 40 percent of the vote in another three way race against GOP Allan Fung and the late Bob Healey.

Raimondo is facing a difficult re-election in 2018. With the Rhode Island economy still stagnant and major promises — drivers licenses for undocumented and Superman building — still vacant to name a few unfulfilled. Pressure is building for Raimondo.

What’s Next?

The now public battle is unlikely to subside and could spread beyond car tax and free college.

With Raimondo vulnerable on the failed UHIP program, she could face a far more aggressive House Oversight Committee. The Committee Chair Pat Serpa has called for the State Auditor to do an independent investigation. “This is a serious problem that has impacted all Rhode Islanders. UHIP’s failures had a dramatic effect on our recipients and providers who depended on these services, but the broken system has also impacted all of our state's taxpayers who must foot the bills for this botched effort,” said Representative Serpa.

UHIP’s failure plays on Raimondo’s Achille's heel — that she lacks compassion for average Rhode Islanders.

House leadership could also create greater restrictions on RI Commerce Corporation’s subsidies which were recently characterized by former Governor Lincoln Chafee as a “candy store.”

Related Slideshow: Winners and Losers in Raimondo’s FY18 Budget Proposal

Related Articles

- Mattiello Calls Raimondo “Tone Deaf” on Public’s Support for Elimination the Car Tax

- Raimondo, Chafee and Mattiello All on GoLocal LIVE - See the Schedule

- Moore: A Mattiello Defeat May Be a Hollow Victory for GOP

- Chafee Calls Out Raimondo Administration for “Candy Store” Economic Development Strategy

- 1-on-1 With Mattiello on 2017: Car Tax, Marijuana, 38 Studios, and More

- GoLocalTV: Mattiello Calls on Commerce to Take a Second Look at $3.6M for CA Developer

- “I am Sorry” Says Raimondo About Failed UHIP Rollout

- Moore: Feroce Destroys Raimondo’s Economic Strategy

- Mattiello, Common Cause Leading Fight to Pass Question #2 — Concerns About MA Ballot Item Confusion

- ABC6’s “In The Arena” - Raimondo and 38 Studios and Trump Chaos

- Governor Raimondo On GoLocal LIVE and Talks UHIP, 38 Studios, and Free College Tuition

- Moore: Will Mattiello Appease Progressives?

- GoLocalTV: Speaker Mattiello Proposes Cuts to Car Tax

- Raimondo’s Interim HHS Boss to Resurrect UHIP Oversaw Failed VT Healthcare System

- VIDEO: Mattiello Declares Victory

- EXCLUSIVE: RI GOP’s Secret Plan to Influence State House if Mattiello Loses

- NEW: Frias Calls for Investigation Into Mattiello’s Mail Ballot Votes

- Battle Looming Between Raimondo, Mattiello on RI Car Tax Repeal

- RI GOP Calls for Investigation Into Campaign Violations from Mattiello’s PAC

- NEW: Board of Election Finds 208 Misplaced Ballots in Mattiello and Frias Race

- Mattiello and Shekarchi to Lead Rhode Island House

- Moore: Mattiello’s Curious Case of Joe Shekarchi

- GOP’s Steve Frias Not Ready to Concede to Mattiello

- NEW: Mattiello Tops Frias in House District 15, Following Mail Ballot Count

- Raimondo Administration Starts Process for Locating New Innovation Campus

- NEW: Mattiello Declares Victory in Cranston

- Moore: Raimondo Badmouths Deloitte, Then Breaks Bread With Them

- Raimondo Agrees to GoLocal’s Demands, Pledges to Release State Police Records on 38 Studios

- Horowitz: Raimondo’s Free College Tuition Proposal - A Smart Investment in RI’s Future

- LIVE: Dickinson, Former Asst AG & GoLocal’s Attorney Discusses Raimondo’s 38 Studios Announcement

- Raimondo Headlining Deloitte-Sponsored Event in California

- Legislative Leaders Fire Back at Raimondo’s Claim They Pressured Her on UHIP Launch