Moore: Forget GE, RI Can’t Even Retain Teespring

Monday, July 27, 2015

“…We pulled out of Rhode Island 15 years ago because of the crazy tax burden there. And that is something you can’t do in these times,” Former General Electric CEO Jack Welch, ABC “This Week”, October, 2009.

Someone I know recently mentioned that General Electric is considering leaving the state of Connecticut because of that state’s exorbitant taxes. He then wondered if there was anything Rhode Island could do to lure the company, just one state away, to move back here. (General Electric left Rhode Island over two decades ago because it didn’t think RI was good for business.)

My first reaction was, “did we legalize marijuana without anyone telling me”?

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTAll kidding aside, the fact that GoLocal reported this week that the state of Rhode Island didn’t even bother meeting with the leaders of Teespring to attempt to retain the company and its 300 jobs, shows that our leaders aren’t serious about improving the Rhode Island economy. The company is moving to California and Kentucky, and taking its Rhode Island based jobs along with it.

It's not like Teespring wasn't a big deal. The Brown start-up has been compared to an Uber or AirBNB type of company and is expected to do over $200 million in sales in 2015. Over the past two years, the company has raised about $55 million in venture capital from some of the biggest funds in the country. The company produces customized t-shirts for small to medium sized businesses, non-profits, and fundraising campaigns.

“Jobs and the Economy”

Yet Governor Gina Raimondo, who always talks about improving the economy and laughably refers to the state budget she proposed as a “jobs budget”, and House Speaker “jobs and the economy” Nicholas Mattiello, never bothered to meet with the founders of Teespring. (I guess the Teespring founders don’t know the people connected to the state government in Rhode Island, or make the right campaign contributions.)

Everybody gives former Governor Lincoln Chafee a tough time for his frustrating term in office, but at least Chafee tried to lure GE Capital to Rhode Island back in 2011. Sure, his offer wasn't substantial enough to win the company back, but he did try.That's more than Raimondo can say about Teespring--a company that was already here.

For the Speaker's part, instead of reaching out to Teesping, Mattiello prefers to focus on finding a way to lay out the red carpet for the wealthy, connected owners of the Pawtucket Red Sox, who are currently going around the state begging Rhode Islanders to support a plan that would force us to fund their brand new stadium. The Pawsox owners have also begun throwing people who disagree with them out of meetings held in public buildings. They’re nice guys, aren’t they? The only people who deserved to be thrown out, of Rhode Island that is, are the politicians and connected businessman who use the Rhode Island state government as their own personal atm machine to benefit themselves and their friends and families at the expense of the rest of the state’s population.

What Mattiello and Raimondo should have been doing was meeting with the young, enterprising founders of Teespring to find out what could be done to make sure the company stayed in Rhode Island. What’s the point of having excellent colleges and universities here if the state can’t keep the jobs that the students create?

Here’s what’s most mindboggling: the owners of Teespring were only promised a tax incentive of $2.5 million dollars by the state of Kentucky to move there, according to a press release on that state’s website! While Rhode Island was mulling handing the Pawtucket Red Sox owners $100 million, one of the hottest companies in America, located right here, was only looking for $2.5 million.

RI Refuses To Compete

If Rhode Island leaders aren't even competent enough to even try to retain a company that was incubated here, we can rest assured that the state isn’t going to be able to convince one of the biggest companies in the country to return home. (GE left Rhode Island two decades ago.)

Not that GE CEO Jeff Immelt could even be convinced anyhow. It’s true that Immelt has said he is considering a moving the company to a state with a “more pro-business environment.” Several state have already reached out to Immelt, but they include places like Florida and Texas, low tax and cost state’s that don’t have income taxes, and Indiana, who recently took out a full-page ad in the Wall Street Journal asking the company to move to the Hoosier State, because “friends don’t let friends pay higher taxes”.

Jack Welch, the iconic retired General Electric CEO, has said that “Rhode Island drives business away”, over and over again to anyone who will listen. But Rhode Island’s reputation for having a bad business and regulatory environment is well-deserved. And the state can’t make the bold, innovative changes it needs because powerful special interests groups will always block the meaningful economic reforms the state needs to become more competitive on a regional, national, and yes, international level.

The Status Quo

For instance, instead of merely lowering the corporate tax here in Rhode Island, the state should eliminate it completely. The state needs to do something big, drastic even, to show that we’re serious about reforming this ineffective status quo. Tinkering around the edges and making small changes might make good headlines, but it won’t entice big or small business leaders to expand or move here.

Here’s how things work in Rhode Island. If you’re a business leader that has connections to the Rhode Island government—if you know the right people, make the right campaign contributions—Rhode Island leaders will roll out the red carpet for you and treat you like a family member—like the Pawtucket Red Sox owners who knew the late James Skeffington. But if you’re someone without those connections—like the leaders of Teespring—you’re treated like an adversary. Rhode Island is the ultimate good ole boys and girls club.

Until Rhode Island changes the need to know a guy culture that has permeated the state for so many decades, we’ll continue to lose good companies like Teespring to places with good government and lower taxes. And we can forget about ever landing a Fortune 100 company.

Russell Moore has worked on both sides of the desk in Rhode Island media, both for newspapers and on political campaigns. Send him email at [email protected] Follow him on twitter @russmoore713

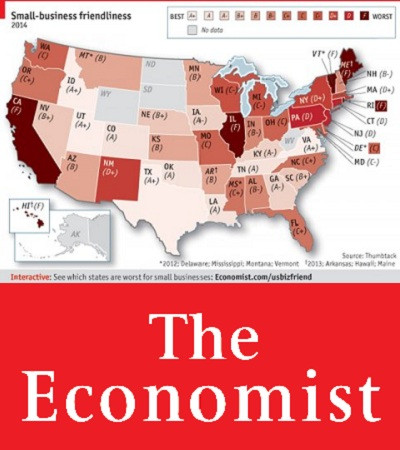

Related Slideshow: RI Business Rankings in US

See how Rhode Island stacked up.

Related Articles

- Moore: Is Platoon Reduction a Ploy to Elminate Firefighters?

- Moore: Ask Not Who the Toll is For; It’s For You

- Moore: Will Magaziner Protect Rhode Island or Wall St.?

- Moore: Elorza Shows Bravery by Taking on Firefighters

- Moore: Mattiello Must Leave Pawsox Fate Up To Voters

- Moore: Elorza Should Prioritize Students, Not Trolleys

- Moore: Elorza Must Pursue Pension Reform

- Moore: Mello Takes Over a Fire Department In Turmoil

- Moore: Can New Ed Commissioner Wagner Handle RI?

- Moore: Nellie Gorbea’s Insensitivity

- Moore: Legislature Recesses! Is Worst Yet To Come?

- Moore: RI Republicans Forfeit Credibility

_400_400_90_400_400_90.jpg)

_400_400_90.jpg)

_400_400_90_80_80_90_c1.jpg)

_80_80_90_c1.jpg)