Michael Riley: Alerting Treasurers, Governors: Providence Pension Fund Collapsing

Tuesday, October 14, 2014

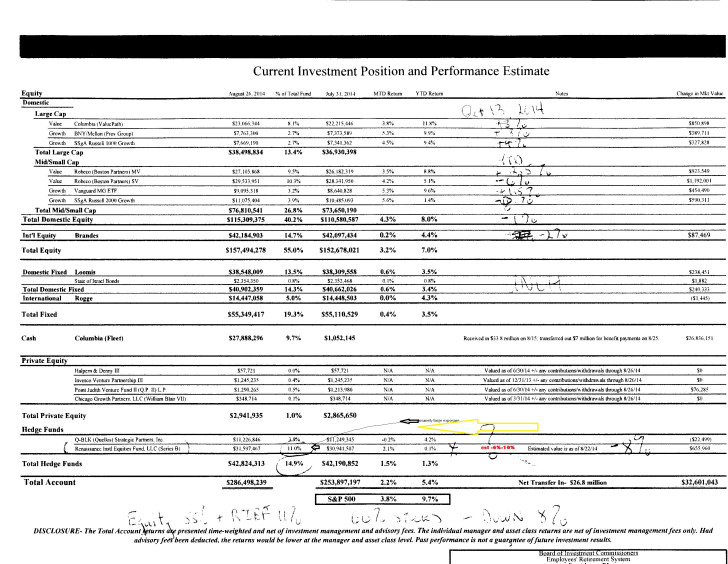

Providence Rhode Island has a troubled pension fund that is in real danger of insolvency due to persistent underfunding ,negative cash flow, misleading accounting and the recent drop in equity prices. Angel Taveras and David Cicilline before him decided to take above average risk by investing 11% of the portfolio in a single Hedge Fund ,Renaissance Institutional Equities Fund LLC series B. As of late August this hedge fund investment was up 0.1 % YTD vs the S&P + 9.7% (on August 26th). A very poor performance indeed, but its likely way down for the year now after the dive of the last 6 weeks (I estimate -7% as of Oct 13, 2014)) but Providence and Taveras also made other large bets on the riskiest part of equity markets. Roughly 25% of the portfolio and 40% of equity exposure has been crashing lately as it is invested in small and medium cap growth funds. Robeco, Vanguard and Russell 2000 have all gotten hit as well as international investments in Brandes Funds.

This drop of between 6% and 10 % in 6 weeks is very dangerous for the pension fund (roughly $280 million) and a lesson in why many consider the current risk in Taveras pension Portfolio as ridiculously high. Especially when compared to the funded ratio of the pension plan which I estimate at between 11% and 17%. The real funds in the plan likely lost between $13 and $25 million dollars over the last 6 weeks at the same time liabilities marched relentlessly forward. Providence has not hedged as opposed to the admittedly expensive Hedge Fund Investments by Raimondo designed to hedge against bad markets. Hedge fund strategies differ widely and Providence loaded up on a risky hedge fund and has been badly lagging the market for a year now and is down for 2014. The State has absolute return and stable value or “market neutral” hedge fund exposure so the portfolio is much less risky than Taveras portfolio.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTThe relevant point here is that Rhode Island s economic health depends almost entirely on Providence’s financial health. Taveras has failed miserably in Pension plan health yet the Mayoral Candidates dance around the subject. The candidates for Treasurer, Almonte and Magaziner avoid the precarious situation in Providence as well. We will need a Treasurer and a Governor who is focused on the importance of Providence future and its potential impact on state taxpayers and state budgeting. Raimondo knows full well how important and poorly managed Providence and its Pension system is yet she does not discuss it. Almonte also knows how poorly constructed the portfolio is and should challenge Magaziner and Raimondo to produce a plan in the event of Bankruptcy. If the markets dropped another 10 % Providence will be forced to start liquidating positions in the portfolio to pay for benefits and will severely damage long term chances for solvency.

Maybe some agree with Taveras and want to play stock market and gamble with public retirements using taxpayer money. Many believe it doesn’t matter how the fund performs because the City still owes the retirees what they “promised”. Others say, this collapse in equities can bankrupt the city and thanks to the generally assembly law passed in 2011, bondholders are guaranteed first lien on tax revenue and will be paid off. This will leave taxpayers and retirees to figure out how to come up with $3 billion in liability. Taxes yes but again thanks to the assembly 75% of the liability will be assumed by the State. That means we will all pay for Providence mismanagement big time.

The reality is we are all exposed, everyone in Rhode Island, to the horrible decisions and lack of funding and increased spending of the Taveras and Cicilline administrations. Now they are gambling and if the market goes up, they win and if it goes down the state taxpayer loses. This is a politicians dream and there is no doubt Buddy will add to risk by issuing pension bonds as he has attempted before. Does everyone in the State realize who will actually be bearing that risk? It’s the rest of the state not just Providence.

Michael G. Riley is vice chair at Rhode Island Center for Freedom and Prosperity, and is managing member and founder of Coastal Management Group, LLC. Riley has 35 years of experience in the financial industry, having managed divisions of PaineWebber, LETCO, and TD Securities (TD Bank). He has been quoted in Barron’s, Wall Street Transcript, NY Post, and various other print media and also appeared on NBC news, Yahoo TV, and CNBC.

Related Slideshow: 5 Ways Taveras Could Have Grown Jobs in Providence

During Angel Taveras' tenure as Mayor of Providence, the unemployment rate ballooned. According, to US Department of Labor statistics, Providence hit a 12.5% unemployment level in the spring on 2014.

Hispanic unemployment is among the worst in the United States. GoLocal looked at tangible, revenue neutral ways Taveras' Administration could have grown jobs.

Related Articles

- Michael Riley: Failed Pension Commission Ponders Permanent Oversight Commission

- Michael Riley: West Warwick and Gallogly Pull Hoax on Taxpayers

- Michael Riley: 38 Studios Insider Trade and Municipal Fraud

- Michael Riley: GASB 68 Portends Huge Problems for City and State

- Michael Riley: Don’t Pay

- Michael Riley: Municipal Pension Commission Comes Unglued

- Michael Riley: State Pension Fix in Limbo as Municipal Debt Grows

- Michael Riley: From Head-start to Harvard to the Hoosegow?

- Michael Riley: Pension Obligation Bonds? Oh My!!

- Michael Riley: Can Taveras Clean Up His Act for the New Mayor?

- Michael Riley: Integrity? Whatever…

- Michael Riley: The Reality of Providence Pension Liability

- Michael Riley: Rhode Island Treasurer is About Integrity and Experience

- Michael Riley: From Head-start to Harvard to the Hoosegow Part 2

- Michael Riley: The RI Treasurer Democratic Primary Race Gets Uglier

- Riley: CF Bailout: Largest Theft of Taxpayer Money in RI History?

- Michael Riley: RI Municipal Pension Study Comm. Is in Failure Mode

- Michael Riley: Rhode Island’s Potential Pension Nightmare

- Riley: Cranston and Mayor Fung Play the Hand that was Dealt

- Riley: Mancini, Wainwright and Taveras Part 2

- Riley: Let the Rhode Island Treasurer’s Race Begin with Facts

- Riley: Caprio Track Record Good, Seth Magaziner Claims Questioned

- Riley: RI Treasurer’s Race Part 4: Public Fund Summit 2014

- Riley: Taveras, Mancini & Wainwright Investment Counsel, LLC