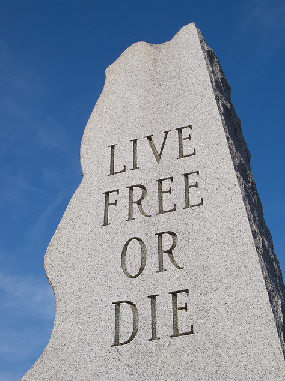

John Hazen White’s LOOKOUT: Is RI the New Taxachusetts?

Tuesday, December 03, 2013

There’s not much happening at the State House these days in the annual hiatus period between the end of the legislative session in July and the start of the new session come January, except for one notable activity: the study commission that’s holding hearings on reform/repeal of the state sales tax. In meetings held to date (the commission meets again this week), the commission has heard from a number of state officials, tax experts and economists on the potential impact and feasibility of eliminating the tax or at least lowering it to be more competitive.

This group is led by Warren Democrat Representative Jan Malik, an advocate for getting rid of the sales tax altogether. Malik has a personal business interest in vanquishing the sales tax: he owns a liquor store by the state line and has experienced loss of sales from customers who are attracted to go over the border to Massachusetts, which currently does not apply the sales tax to alcohol.

Though his bill to kill the sales tax did not pass in the last legislative session (probably because the world is not about to end, which is the only way we could do that), he did have success in getting legislation passed to eliminate the sales tax on wine and spirits, effective this month, but not on beer, which one would imagine represents the highest volume of sales for any retail outlet. However, lowering or even eliminating the sales tax on anything within state borders is a good thing. And he got a commission to actually look at the question in all its ramifications.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTRhode Island -- The New Taxachusetts?

The Ocean State’s sales tax at 7 percent is one of the highest in the nation, exceeded only by California’s 7.5 percent. It is also the second largest revenue stream for the state after the personal income tax, and it brought in almost $900 million through the end of the last fiscal year.

Retail sales over the Thanksgiving weekend and extending into Cyber Monday will deliver a substantial revenue boost to the state, if shoppers open their wallets this year. But every day, across every retail hour, the sales tax bells rings constantly, with every purchase, small and large, that every individual in the state makes on a vast variety of items.

The sales tax is the most pervasive and regressive tax of all because it does not distinguish between the purchase of any item subject to the tax, whether it’s made by a millionaire or someone unemployed, whether it’s a hot takeout meal or a hot sports car. Everyone who makes a retail purchase of just about any kind, save for protected items like everyday clothes and groceries, pays the tax at the same rate.

With Rhode Island now recognized to be the tax hell that Massachusetts no longer is, focus on taxes in general and the sales tax in particular have become a matter of concern to state lawmakers, policy advisors and the public, because our reputation for high taxes, as well as poor strategic management of the state’s economy, now define our state. Everyone recognizes that something must be done to steer Rhode Island into more stable and prosperous waters before we head over the waterfall.

Big Issues -- Bigger Questions

The big question is how we can do that as we face even larger indebtedness (the deficit for fiscal 2014-15 is currently estimated at $140 million), plus impacting reversals in fortune in the 38 Studios implosion and the prospect of significant revenue losses when the slot parlor and casinos in Massachusetts get up and running. How do you lower a tax like the sales tax, never mind eliminate it, in the face of such a daunting fiscal future?

Governor Chafee, over two years ago, attempted to lower the sales tax while extending its overall reach. That is one attempt at reforming the tax but, as events proved, not an easy one to accomplish, because even with a lower overall tax rate the negative impact on those newly affected by the tax extension prompted a major pushback. And with good reason.

Chafee wanted to tax manufacturers, those of us who remain here, even as we already struggle under the state’s heavy tax environment. (The added tax burden on Taco, we estimated, was going to amount to a million more dollars a year.) With the business community up in arms about the prospect of an even higher sales tax burden, the legislature elected to extend the sales tax to just a few minor things, and even these were opposed and retracted for the most part. Before the wine and spirits tweak to the sales tax, the tax had been extended to sales of high price clothes and footwear, considered to be “luxury” items. No one seems to have complained much about that.

Experts testifying before the sales tax commission have painted a rosy picture of the Ocean State’s future economy with no sales tax at all in place. Despite acknowledging giving up a significant portion in state revenue each and every year, these voices claim elimination of the sales tax would create jobs, boost incomes and spending power, and vault Rhode Island into the top tier of business-friendly states. Too bad it’s not that easy.

While these are most laudable and necessary objectives for Rhode Island, how do we stand still and hold our breath in the meantime? The central problem we face is the size of our government(s). As they are presently structured, our state and local governments need every dime they can take in. Our pension reform is in question and massive healthcare obligations are forthcoming. The only way we can afford to significantly change our tax climate is to overhaul how government operates in our city-state, which is a major task that only a landmark constitutional convention can achieve.

More on the promise of a constitutional convention in future columns...

John Hazen White, Jr. is President and CEO of Taco, Inc. in Cranston and is the founder of Lookout RI.

Related Slideshow: Best and Worst Run States in New England

How well do the New England states stack up against each other in terms of how they're currently run?

According to Wall Street 24/7, looking at a state's debt per capita, budget deficit, unemployment, median household income, and percentage below the poverty line are all indicators of a state's level operational success - or lack thereof.

Below are how the New England states were ranked compared to each other, based on data from 2012 -- as well as the "best run" and "worst run" states in the country.

Related Articles

- John Hazen White’s LOOKOUT: In Defense of Gina Raimondo

- John Hazen White’s LOOKOUT: Rhode Island Should Celebrate Amgen

- John Hazen White’s LOOKOUT RI Moves to GoLocalProv

- NEW: John Hazen White, Jr. Forum Established at Brookings Institution

- John Hazen White’s LOOKOUT: Is RI the New Taxachusetts?

- John Hazen White’s LOOKOUT: RI Needs a Competitive Tax Policy

- John Hazen White’s LOOKOUT: Rhode Island Needs to Talk Twin River

- John Hazen White’s LOOKOUT: Rising Doubts on Deepwater Wind

- John Hazen White’s Lookout: Superman Lights Will Shine Again