Raimondo’s Preferred Hedge Fund is About to Plead Guilty to Federal Corruption Charges, Say Reports

Thursday, September 29, 2016

According to reports, the favorite hedge-fund of the Gina Raimondo term as General Treasurer will imminently admit to federal corruption charges.

“The admission of guilt, which could come as early as Thursday, is part of a settlement with the Justice Department and the Securities and Exchange Commission after a complex five-year investigation into graft worth hundreds of millions of dollars, shell companies, oil and diamonds. The company has set aside more than $400 million for fines and penalties,” reports Bloomberg. More about the alleged global corruption scheme can be read at Bloomberg.

As GoLocalProv reported in May 2, 2014,

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

The hedge fund receiving the most in fees from the Gina Raimondo's employee retirement fund is being investigated by the Securities and Exchange Commission.

The firm Och-Ziff has received millions in fees from the Employee Retirement System of Rhode Island - the board selecting Och-Ziff is chaired by Raimondo. Her strategy to shift large portions of the state's pension dollars over to hedge funds has come under criticism by Ted Siedle of Forbes and a forensic investigator, Matt Taibbi of First Look Media (formerly Rolling Stone magazine), public unions and former General Treasurer Frank Caprio. He is running for General Treasurer in 2014 after a failed campaign for Governor in 2010.

The SEC announced an investigation of Och-Ziff for violations of the Foreign Corrupt Practices Act.

"Under Raimondo's secrecy scheme, there's no way for the public to know that Rhode Island pension fund investments are being investigated in violation of law, said Siedle in an interview with GoLocal Thursday night.

Raimondo, who was elected as General Treasurer in 2010, has defended the investments in hedge funds as important to diversify the state's investments. Raimondo is a 2014 candidate for Governor.

Related Slideshow: Hedge Fund Reports Censored

Below are excerpts of the redacted reports on hedge funds the state Treasurer provided to GoLocalProv. The documents are known as Due Diligence reports. They are used to help the State Investment Commission evaluate hedge funds before making decisions about investments. There are two types of the reports: one on the fund’s investments and one on the fund’s operations. With each excerpt, is a brief description of the information it contains.

View Larger +

View Larger +

Prev

Next

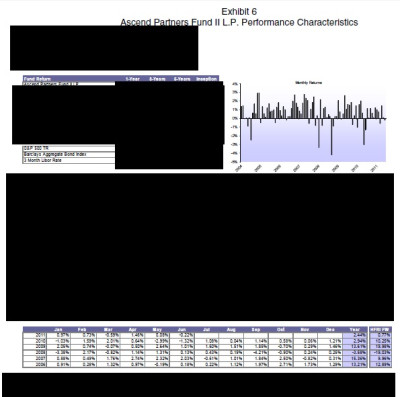

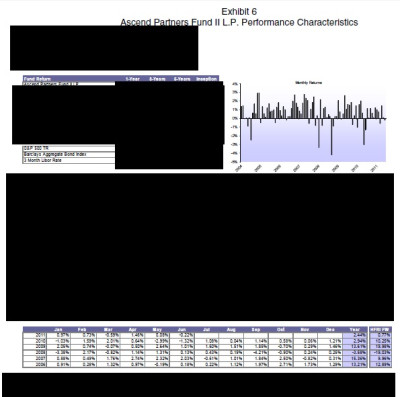

Hedge Fund Performance

Investment Due Diligence Report

August 2011

Hedge Fund: Ascend Partners Fund I and II

Description: The image on the left is from Page 10 of the 17-page due diligence report on Ascend Partners prepared by Cliffwater Associates for the State Investment Commission. In the selected excerpt, just about all the information pertaining to the performance of the hedge fund has been redacted. The section preceding the table states that the second fund launched by the firm had an annualized return of 8.12 percent. The redacted exhibit is said to contain “more detailed performance data” including “statistics pertaining to more recent returns.”

View Larger +

View Larger +

Prev

Next

Secret Scores

Operations Due Diligence Report

September 2010

Hedge Fund: Ascend Partners Fund I and II

Description: To the left, is the top of the second page in the due diligence report Cliffwater prepared on Ascend Partners. As the context makes clear, no actual proprietary information about the fund itself is discussed in the page. Instead, the “scores” that a reviewer at Cliffwater gave to the hedge fund—on everything from business to risk management are redacted. Even the name of the fund’s external administrator is withheld.

View Larger +

View Larger +

Prev

Next

No Simple Yes or No

September 2010

Hedge Fund: Ascend Partners Fund I and II

Description: To the left, is the third page of the same document from the preceding slide. The table appears to be a standard form that Cliffwater uses in its evaluation of all hedge funds. Note that the redactions encompass critical information about the fund’s compliance with SEC regulations and the protections it has for investors—in this case, state retirees. Not only are the standard measures it employs blacked out, but whether the hedge fund meets those measures—a simple “yes” or “no” is blocked too.

View Larger +

View Larger +

Prev

Next

Veiled Valuation

Operations Due Diligence Report

September 2010

Hedge Fund: Ascend Partners Fund I and II

Description: The valuation process is critical to determining the value of one’s investments. The redacted excerpt shown to the left briefly explains that the hedge fund does not determine the own valuations. Instead, those are determined by third-party services. The report purports to give an example of one of those services. But apparently that too is considered confidential information by state authorities. Notably, even though the hedge fund does not have a valuation committee, the section on the next page about the valuation committee members is still redacted.

View Larger +

View Larger +

Prev

Next

Short Summary

Operations Due Diligence Report

November 2010

Hedge Fund: Viking Global Equities

Description: The summary section for most due diligence reports on hedge fund operations are usually the least redacted portions of the reports, but not here, where so much has been redacted it’s nearly impossible to infer anything about the information that has been withheld.

View Larger +

View Larger +

Prev

Next

Behind Closed Doors

Operations Due Diligence Report

November 2010

Hedge Fund: Viking Global Equities

Description: The redactions to the left again raise the question as to how trade secrets and proprietary information are defined by the state Treasurer’s office. Here even attendees at meetings between Cliffwater, the state’s investment adviser, and the managers of the hedge fund under review are blacked out.

View Larger +

View Larger +

Prev

Next

No Name Partners

Investment Due Diligence Report

January 2011

Hedge Fund: Third Point Partners

Description: Under the state’s interpretation of confidentiality rules it is apparently permissible to name the CEO but not his partners. GoLocalProv checked the firm’s Web site and its current partners who compromise the executive team—including their education and prior experience—are listed. But none of their backgrounds matched those of the partners mentioned here. None of which explains why the names are redacted.

View Larger +

View Larger +

Prev

Next

What Risk?

Investment Due Diligence Report

January 2011

Hedge Fund: Third Point Partners

Description: To the left is what appears at the top of Page 11 in a 23-page report on investment performance and management by Third Point Partners. The two blocks shown here are in a series of black boxes which supposedly contains examples of the firm’s investment strategy. Here even the subhead describing the investment is partially redacted.

View Larger +

View Larger +

Prev

Next

Three Strikes

Investment Due Diligence Report

July 2011

Hedge Fund: Winton Capital Management

Description: Many of the redactions are as surprising for what is redacted as for what is revealed. In this table of key staff at Winton Capital Management, most are listed, along with their years of experience and their educational background. The table even notes that the second-in-command position at the firm is occupied by the nephew of its chairman and founder. But three names are deleted for no apparent reason. Were these employees fired? Or did they leave for other work? Either way does such information fall under the category of trade secrets or proprietary information?

View Larger +

View Larger +

Prev

Next

Dark Money

Investment Due Diligence Report

July 2011

Hedge Fund: Winton Capital Management

Description: One can understand why a hedge fund might not want to disclose details of how it compensates its staff—as that is the primary means of incentivizing high performance among employees. But what about the public’s right to know? Or the right of state employees to know whether their pension savings are supporting outrageously high bonuses for hedge fund executives?

Related Articles

Enjoy this post? Share it with others.