Friday Financial Five – October 30, 2015

Friday, October 30, 2015

Jane McAuliffe, GoLocalWorcester Business Contributor

Open Enrollment for Obamacare starts this weekend, November 1st

Consumers who are purchasing healthcare coverage through exchanges will find that their cost of coverage will be higher for 2016, as they begin to select health insurance plans this weekend. Premiums, as well as penalties for not purchasing insurance, will be increasing next year. The average cost increase for the “silver plan”, the second cheapest option on the federal exchange, will cost approximately 7.5% more next year according to the Department of Health and Human Services, with a projected 10 million people purchasing through the exchanges. To obtain coverage by January 1st, consumers will need to choose coverage by December 15th, 2015. For 2016, the penalties for going without coverage are $695 per adult, and $347.50 per child or 2.5% of family income (whichever is greater) with a maximum of $2,085 per household. The penalties for 2015 were $325 per adult, $162.50 per child, or 2% of income (whichever is greater) with a maximum of $975 per household.

Widowed Spouses and collecting Social Security Survivors Benefits

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

Anyone who is currently collecting social security benefits has a once in a lifetime opportunity to withdraw their application to receive benefits within the first 12 months of claiming them in order to claim a higher amount in the future. Does this same opportunity apply to widowers who have already claimed survivors benefits, but want to stop collecting in order to receive a larger benefit amount later on? The answer is yes, but there is no 12 month stipulation, according to the Social Security Administration. Surviving spouses are eligible to receive 100% of what their deceased spouse collected or was entitled to collect at the time of their death if surviving spouse is at least full retirement age. Survivor benefits are available as early as age 60, but benefits are reduced to 71.5% of the deceased workers benefit. An important factor to look into is that your full retirement age may be different than the age of eligibility to receive full survivors benefits.

China is now allowing couples to have 2 kids

Back in the 70’s, China instituted a “one child policy” to prevent overpopulation and stave off a threat to their nation’s resources. Since then, China’s explosive economic growth over the past few decades has led them to become the world’s second biggest economy. Now, they are faced with a demographic time-bomb: an aging population coupled with declining birth rates, which has produced a smaller pool of workers to draw from. The economic ramifications of this outdated policy will result in a holdback of growth in their economy while worker’s wages dramatically increase. Even worse, it may force leading companies to move their factories to other lower cost nations. On Thursday of this week, as China’s leaders met to hash out a 5 year economic framework, they ended their demographic experiment now allowing families to have 2 children in an effort to foster population growth.

Budget Bill passes the House to end key social security claiming strategies

Recently, congressional leaders crafted a bill that would end two popular strategies for couples claiming social security benefits. The strategies, known as “file and suspend” and “restricted application for benefits”, have provided tens of thousands of dollars to a couple’s lifetime income by allowing one spouse to claim as many as 4 more years of spousal benefits and collecting delayed retirement credits. Under the bill, anyone 62 or older this year will be able to file a restricted application at 66 or older to receive only a spousal benefit. For those younger than 62, the restricted application strategy will no longer be available. This may cause people who are nearing retirement and banking on utilizing this strategy to now either work longer, or tap into their nest egg sooner than expected. The bill, which passed the House on Wednesday and now moves to Senate, will take effect 6 months after the budget bill goes into effect.

Women, Divorce and Finances

We all hear that almost 50% of marriages end up in divorce. Some studies show that folks remain in a marriage long after it has broken down due to finances. Women are primarily affected by this, as they often take time off from their careers to raise family, re-enter the work force at lower paying jobs and miss out during their peak earning years in contributing to social security and their retirement plans. In addition, many women leave the financial decisions up to their husbands, and find themselves at a point of confusion when facing a divorce, and having to make key decisions during an emotional time. One of the up and coming trends in the financial services industry is the CDFA certification (Certified Divorce Financial Analyst). This specialist helps clients determine the most “equitable” division of assets and analyzes the various outcomes of a divorce proposal.

Jane McAuliffe is an Investment Advisor Representative at the firm Forbes Financial Planning, Inc in East Greenwich, RI and can be reached at [email protected]. Jane is also currently pursuing her CDFA certification.

Related Slideshow: RI Business Rankings in US

See how Rhode Island stacked up.

View Larger +

View Larger +

Prev

Next

WalletHub

Rhode Island has 2015's eighth highest insurance premium penalties for high risk drivers, according to a WalletHub report.

Rhode Island ranks fifth overall in the category of speeding over 20 mph annual premium increase at $482. While ranking third overall in the category of 2 accidents annual premium increase at $2,721.

Rhode Island ranks ninth overall under the reckless driving annual premium increase at $749.

View Larger +

View Larger +

Prev

Next

WalletHub

Rhode Island has been ranked as the 8th most eco-friendly state in the country, according to a recent study by WalletHub.

Rhode Island ranks third in environmental quality and 16th in Eco-Friendly Behaviors Ran landing them in 8th overall.

RI is behind Washington and New Hampshire who are in the six and seven spots respectively, and in front of Connecticut and Hawaii who come in at the nine and ten spot.

View Larger +

View Larger +

Prev

Next

WalletHub

Rhode Island is 2015's 4th Worst State to be a taxpayer, according to a recent WalletHub report.

Rhode Island ranks 48th of 51 with an average state and local tax price of $7,159 which is good for a 27% difference from the national average.

The states that are directly behind Rhode Island are Wisconsin at $7,159, Nebraska at $7,298 and Illinois at $7,719 for a 37% difference from the national average.

View Larger +

View Larger +

Prev

Next

WalletHub

Rhode Island has the highest vehicle property taxes in the country, paying an average of $1,133 according to a report from WalletHub.

Virginia and Kansas are the two states just ahead of Rhode Island in the 49 and 50 spots, paying $962 and $905 respectively.

RI also ranks 42nd in average real estate tax, paying an average of $2,779, according to the WalletHub report.

View Larger +

View Larger +

Prev

Next

Gallup

Providence-metro ranks at the bottom for job creation in 2014

Rhode Island has been ranked amongst the worst in job creation, according to a recent survey done by Gallup.

Gallup gives the Prov-metro area an index score of 23, the lowest score is the New York- New Jersey area with 20.

Salt Lake City, Utah and Austin-round Rock, Texas rank the highest with a score of 37.

See the rest of the rankings here.

View Larger +

View Larger +

Prev

Next

Forbes

The 2014 state rankings by Forbes has just been released and Rhode Island moved up two spots from #48 in 2013 to #46 in 2014.

What does Forbes say about RI's business environment"

After Michigan and Illinois, Rhode Island has experienced the third worst net migration out of its state in the country over the past five years. With a recent unemployment rate of 7.6%—lower than only Georgia and Mississippi—residents are leaving the state in search of jobs. Rhode Island has been stuck in the bottom five overall for six straight years. One plus: labor costs are 5% below the national average, which stands out in the expensive Northeast.

_400_400_90_400_400_90.jpg) View Larger +

View Larger +

Prev

Next

Tax Foundation

Findings from The State Business Tax Climate Index were released this morning by Tax Foundation which found Rhode Island to have the 45th best tax climate for businesses for 2015. The state's rank has not changed since last year after The Index analyzed 100 different tax variables in multiple categories.

Read more about the report here

View Larger +

View Larger +

Prev

Next

Thumbtack/Kauffman

Providence is the second worst city in America for small business, according to a new survey conducted by Thumbtack.com and the Kauffman Foundation.

More than 12,000 small businesses in 82 cities across the country participate in the survey. Providence received an overall "F" grade for small business friendliness.

Full Survey Results Here.

View Larger +

View Larger +

Prev

Next

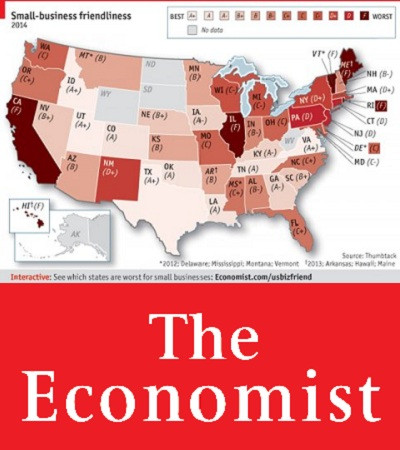

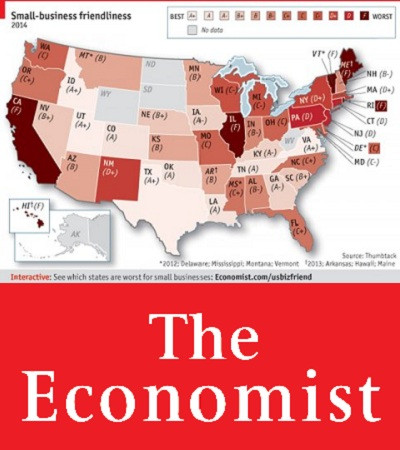

The Economist

Small Business Friendliness Grade: F

The Economist grades states on an A+ to F grading scale for its small business climate. Rhode Island is one of just 6 states to earn an "F" grade.

Overbearing bureaucracy and excessive licensing is stifling small business in America.

Read More About The Economist Grade Here

View Larger +

View Larger +

Prev

Next

Forbes

Forbes ranks each state in business costs, economic climate, and growth prospects. RI is third worst in 2013.

The most damning in the commentary:

After Michigan, Rhode Island has experienced the second worst net migration in the country over the past five years.

Read More About Forbes Ranking Here

_400_400_90.jpg) View Larger +

View Larger +

Prev

Next

Tax Foundation

#46 Tax Foundation

Tax Foundation ranks each state in corporate tax rank, sales tax rank, and unemployment insurance tax rank.

Rhode Island and the other states in the bottom ten suffer from the same afflictions: complex, non-neutral taxes with comparatively high rates.

Read More About Tax Foundation Ranking Here

View Larger +

View Larger +

Prev

Next

ALEC

#47 ALEC

ALEC ranks each state in economic performance and outlook.

Although Rhode Island ranked low in economic performance, a forward-looking forecast is based on the state’s standing in 15 important state policy variables. Some of these variables include top marginal personal income tax rate and sales tax burden.

Read More About ALEC Ranking Here

View Larger +

View Larger +

Prev

Next

Kauffman Foundation

#50 Kauffman Foundation

Kauffman Foundation ranks each state in entrepreneurship.

Entrepreneurial activity generally is highest in Western and Southern states

and lowest in Midwestern and Northeastern states.

Read More About Kauffman Ranking Here

View Larger +

View Larger +

Prev

Next

Free Enterprise

#47 Free Enterprise

Free Enterprise ranks each state in performance, exports, innovation + entrepreneurship, business climate, talent pipeline, infrastructure.

Rhode Island has continued to feel the direct impact and ripples from the recent recession—it ranks 47th overall in economic performance. However, positive rankings of 15th in talent pipeline and 16th in innovation and entrepreneurship suggest the existence of a foundation on which to build the future.

Read More About Free Enterprise Ranking Here

View Larger +

View Larger +

Prev

Next

Gallup

10th Worst in Gallup's Annual Ranking of State Job Markets 2014

Rhode Island has been ranked 10th worst for job creation in Gallup's annual ranking of state job markets in 2014 with a job creation index number of 21

Rhode Island is one of two (Connecticut) states to rank in the bottom ten each year since 2008.

The 2014 State level findings have were drawn from 201,254 interviews with employed adults across the nation.

See the full list of rankings here.

Related Articles

- Friday Financial Five – June 19, 2015

- Friday Financial Five – June 12, 2015

- Friday Financial Five – July 3, 2015

- Friday Financial Five - July 10, 2015

- Friday Financial Five – July 17, 2015

- Friday Financial Five – June 5, 2015

- Friday Financial Five – May 29, 2015

- Friday Financial Five – May 8, 2015

- Friday Financial Five – May 15, 2015

- Roger Williams Park Carousel Village to Host Food Truck Friday

- Friday Financial Five – May 22, 2015

- Friday Financial Five – July 24, 2015

- Newport Folk: Top Friday Acts

- Friday Financial Five - September 18, 2015

- Friday Financial Five – September 11, 2015

- Friday Financial Five – September 25, 2015

- Friday Financial Five – October 2, 2015

- Friday Financial Five – October 9, 2015

- Friday Financial Five – September 4, 2015

- Friday Financial Five - August 21, 2015

- Friday Financial Five – July 31, 2015

- Newport Jazz Festival 2015: Friday Highlights

- Friday Financial Five – August 7, 2015

- Friday Financial Five - August 14, 2015

- Friday Financial Five – October 23, 2015

Enjoy this post? Share it with others.

_400_400_90_400_400_90.jpg)

_400_400_90.jpg)

_400_400_90_80_80_90_c1.jpg)

_80_80_90_c1.jpg)