Travis Rowley: Democrats – Taxing the Poor

Saturday, February 02, 2013

“Socialism is a philosophy of failure, the creed of ignorance, and the gospel of envy. Its inherent virtue is the equal sharing of misery.” – Winston Churchill

Local progressives were all giddy this week after a study by the Institute on Taxation and Economic Policy (ITEP) spawned what the Rhode Island Left clearly viewed as fortunate headlines. “Study: RI Taxes Take Most From Poorest, Least From the Top 1%,” reported WPRI’s Ted Nesi.

The Projo’s Kathy Gregg penned an article titled, “Study Finds R.I. Poor Pay Heavy Burden: Poorest Pay 12.1% of Their Income In State, Local Taxes, Among Highest in Nation.”

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTThe revelation had progressives salivating. According to the Projo, Kate Brewster of the Economic Progress Institute (formerly known as the “Poverty Institute”) views such findings as “ammunition for the campaign by organized labor and others to persuade state lawmakers to ask the wealthy to ‘pay a little more’ by creating a new tax bracket.” Brewster stated, “This report provides clear evidence that our tax structure is very regressive and policies are needed to improve fairness for the state’s low- and modest-income taxpayers.”

Unsurprisingly, the progressive solution to high taxes on the poor is not to decrease tax rates on the poor, but to increase taxes on the rich – and then redistribute the wealth.

Specifically, they would raise income tax rates for upper income earners to where they were several years ago (5.5% percent back up to 9.9%) and enact a virtual increase to the corporate tax rate by proposing “combined reporting” laws – both measures that have proven to injure the poor with layoffs, decreased benefits, deflated wages, inflated prices, and a flight of capital from the state.

We also shouldn’t forget that these same people never fail to support the highest income tax hike being proposed by DC Democrats. Yes, progressives would not think twice about raising taxes overnight by at least 10 percent on the State’s most productive citizens.

That’s who we’re dealing with.

Taxes: The Whole Truth

The political Left is famous for wailing over “regressive taxation,” speaking as if the rich get away with murder in order to garner support for going after a greater share of their take-home pay. Somehow, however, progressives always fail to mention that nearly half of all Americans pay no federal income taxes at all, while the top 10% of income earners pay nearly 70% of all federal income taxes, and the top 1% pay nearly 40% of all federal income taxes.

If progressives were honest, the billions of dollars that Rhode Island receives in “federal aid” each year would be calculated into the state tax burden that our high-income earners shoulder – the money that progressives recklessly strip from successful Rhode Islanders at rates of over 40% (when all federal taxes and fees are considered).

Okay, progressives, now try to define “tax equity.”

Progressive activists pounced on the ITEP’s report – as well as Nesi’s and Gregg’s headlines – in an attempt to portray them as a validation of their economic worldview. Bob Plain of the far-left blog RIFuture.org expressed the Left’s exuberance with a post titled, “Report Confirms Rhode Island Taxes Are Regressive.”

The only problem is that the report actually confirms what conservatives have long contended – that socialism, as Margaret Thatcher would say, only makes “the poor poorer.”

It remains a reality that progressives cannot escape from: Rhode Island has been run by big-government Democrats for 70 years. And it is here where we find the poor among the most destitute.

A Spending Problem

To make their case, progressives focus like a laser beam on the state income tax rates that steadily began to decline in 2006 – aiming to convince people that this was the origin of Rhode Island’s high property taxes. But the fact of the matter is that our local property taxes were among the nation’s highest before the 2006 reform. In fact, the General Assembly passed “property tax cap” legislation in the 1980s in response to localities’ efforts to keep up with their costs (read: unions).

But these facts never stop progressives from suggesting that Rhode Islanders will likely see a drop in their property tax bill if they would only throw their support behind the campaign for “tax equity.”

Progressives will never confront this simple truth: You don’t need taxes unless there’s a bill. And you don’t need high tax rates unless there are larger bills. And the case study that is Rhode Island only helps to prove that, no matter who picks up the tab for high government expenditures, the poor will ultimately suffer the most.

Several weeks ago the New York Times ran a story on the “cost of living” in New York City – a place renowned for relying on the “rich” to pick up most of the public tab. One resident called the financial burdens “horrifying,” something that continues to “[shock] transplants from Kansas and elsewhere, and threaten[s] natives with the specter of an economic apocalypse that will empty the city of all but a few hardy plutocrats.” Another resident complained, “Virtually everything costs more…[Especially] housing.” The story went on to explain that “someone making $70,000 a year in other parts of the country would need to make $166,000 in Manhattan to enjoy the same purchasing power.”

Sounds lovely. Nice work, Democrats.

The Equal Sharing of Misery

One can witness just how disingenuous progressives actually are in their quest to relieve the poor of regressive taxation by observing their refusal to decrease those tax rates that they admit hurt the poor disproportionately.

Progressives often lament the fact that “the sales tax hits the poor more heavily than any of the other taxes do.” Yet, they are the ones responsible for imposing one of the highest sales tax rates in the country and offer little support to the Republican legislators currently fighting for the entire abolition of the state sales tax.

With no economic imagination – and with no faith in free people to carve out their own lives – progressives prefer to place as much of the economy as possible under their control, rather than fostering the conditions of a free, prosperous, and expanding marketplace.

For progressives, it’s not about helping the poor. It’s about safeguarding their kingdom, which means protecting current revenue and spending levels. For progressives, every dollar cut out of the state budget is a step backwards. Getting rid of the state sales tax simply isn’t an option, because that would mean that the “rich” would be exempt from it as well.

After Kate Brewster “acknowledged” the negative impact that the sales tax has on Rhode Island’s most vulnerable citizens, rather than suggest a decrease to the sales tax rate she “voiced hope lawmakers would look at the ‘combined impact of all state and local taxes…If you look at the overall impact, it appears there is more room to ask upper-income households to pay more, through the personal income tax.”

How Brewster would help to alleviate poor people’s tax bills would be to place as many of them as possible underneath a “poverty line.” As the Projo reports, Brewster would “help the poor by increasing the size of the refund available through the state’s earned-income tax credit.”

Translation: More redistribution.

Brewster and company would have as many people qualify as “poor” as they possibly could – and tempt as many people as possible with the life of government dependence. Rather than abolish the sales and property tax, progressives would rather enable poor people to bypass it. After all, people on food stamps and other government programs never feel the impact of a consumption tax. The costs are simply built in to the subsidy. And there simply is no property tax on government housing.

The more people in the wagon, the better. Because progressives always think the “rich” will be there to pull.

Rhode Island’s own history proves otherwise.

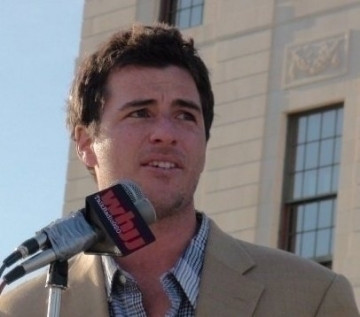

Travis Rowley (TravisRowley.com) is the author of The RI Republican: An Indictment of the Rhode Island Left.

Related Articles

- Travis Rowley: Gay Marriage is a Sham

- Travis Rowley: Religion First

- Travis Rowley: Gay Marriage: The Odds of Error

- Travis Rowley: Republicans Told You So

- Travis Rowley: Imagine No Democrats

- Travis Rowley: Left and Right - A Starting Point

- Travis Rowley: Rowley Challenges Rhode Island Voters

- Travis Rowley: And So it Begins

- Travis Rowley: Let it Trickle Down

- Travis Rowley: Success, Notwithstanding the Government

- Travis Rowley: Dependency and Democrats

- Travis Rowley: Liberty By Law

- Travis Rowley: The Cost of Liberalism

- Travis Rowley: Females and Latinos Must Appeal More to Republicans

- Travis Rowley: Now Jim Langevin is Lying

- Travis Rowley: The Rich Must Get Richer

- Travis Rowley: Fire Radical Teachers

- Travis Rowley: Politics & the Pope