Thousands Of RI Students Default On Loans

Wednesday, September 14, 2011

Since 2007, nearly 4,000 student loan borrowers in Rhode Island defaulted within two years of entering repayment, a new report from the U.S. Department of Education shows.

The numbers reflect a sharp increase in the two-year cohort default rates among borrowers nationwide, with a large percentage of defaults coming from those who attended for-profit schools. Across the country, 8.8 percent of borrowers who entered repayment in 2009 had defaulted by the end of 2010.

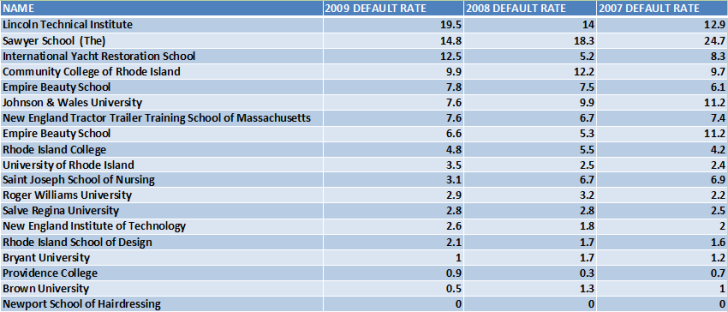

Rhode Island is no different. Lincoln Tech, a for-profit institution, had a 19.5 percent two-year default rate for students leaving school in 2009. Since 2007, 857 borrowers from the school defaulted on their loans within two years. By comparison, Brown University saw just 26 students default two years after leaving school over the same period.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTJust The Tip Of The Iceberg

The Department of Education’s data did not factor in students receiving private or PLUS loans and only looks at the two-year rates, leading one student debt analyst to suggest that default numbers could be significantly higher.

“Two-year cohort default rates are just the tip of the iceberg when it comes to demonstrating the extent of borrower difficulty,” said Debbie Cochrane, program director at the Institute for College Access & Success (TICAS), home of the Project on Student Debt. “Research indicates that most student loan borrowers who default do so after the two-year window is over.”

In Rhode Island, the two highest default rates were Lincoln Tech and the Sawyer School, which are both for-profit institutions. Cochrane said the data clearly shows students attending a for-profit college are at greater risk of defaulting.

“The weak economy does not explain the tremendous variation in default rates by type of school. These data make clear that students who attend for-profit colleges are at much greater risk of defaulting than students who attend other colleges,” she said. “That’s not just because the default rates of borrowers is so much higher, but also because students at for-profit colleges are so much more likely to borrow in the first place.”

An Obligation To Make Changes

But the for-profits aren’t the only schools with high default rates. At the Community College of Rhode Island, 90 students defaulted just two years after leaving school in 2009, giving the two-year school a 9.9 percent default rate.

According to Simon Moore, Executive Director of College Visions, too many students are being saddled with debt.

“This is a national issue of economic justice that needs to be approached with urgency,” Moore said. “As a nation, we talk about college as a path to economic security, career options, and personal fulfillment. But this is quickly becoming a myth for thousands of young adults because they are saddled with crushing student debt.”

Moore, whose organization works with low-income high school students to help prepare them to apply to college and ultimately select the school that will offer them the right financial aid package as well as the best education, said it’s important for student and families to make sound decisions around student debt. But Moore also said a shift in policy is needed.

“At the policy level, we need to increase the level of grant funding available for students with need; offer incentives for higher education to keep cost in check and offer more generous need-based aid; and develop stronger regulations that prevent unscrupulous colleges from encouraging families to take on unmanageable debt - the latter category refers to many non-profit institutions, not just the for profits that get all the press,” he said.

“I Can’t Even Get A Store Credit Card”

For Tom Pratt, it’s already too late. Pratt graduated from Johnson & Wales (JWU) with over $60,000 in student debt and said he didn’t realize the majority of culinary students don’t immediately become chefs at top restaurants. And while JWU has seen its rates drop each year, 1,437 students still defaulted within two years since 2007. Pratt said his situation was no different.

“I had a couple of loans that I was paying, but I got in trouble with my big loan,” Pratt said. “It’s ruining my credit and they refuse to work with me. They basically told me if I didn’t pay what they wanted me to pay, they would send it to collections.”

They is the Rhode Island Student Loan Authority (RISLA), which offers state-backed loans to students going to colleges or universities in Rhode Island.

Pratt claims he has been harassed over his failure to pay his loans, with one debt collector even threatening to go after his grandparents, who served as his cosigners. He said he wishes the school would have offered more information about just how much his loans were going to cost him. Now he’s concerned about what a default means for his future.

“Right now I don’t even own anything so they can’t even put a lien on me,” he said. “But I just got married and I’d like to buy a house someday and I can’t even get a store credit card.”

More Work Needs To Be Done

But at RISLA, staffers are spinning a different story. Charlie Kelley, the organization’s Executive Director, said despite having one of the highest unemployment rates in the country, the state has one of the lowest default rates.

He said there are a few factors as to why Rhode Island’s numbers aren’t as high as other states.

“We do a lot of customer service,” he said. “We also don’t have a lot of for-profit schools. We have some world class institutions here.”

Still, Kelley acknowledged that more work needs to be done to educate families on the costs of college.

“We put a great emphasis on going to college,” he said. “But the rate of students don’t finish and end up defaulting is three-or-four to one [compared with those who do graduate.] What we don’t want to keep seeing is students with loans but no degree because they won’t make the salary to pay the loans.”

If you valued this article, please LIKE GoLocalProv.com on Facebook by clicking HERE.