Magaziner’s Municipal Pension Plan May Help Some But Little for Providence

Sunday, April 02, 2017

General Treasurer Seth Magaziner talked extensively with GoLocal on Friday and outlined how his recently released Healthy Local Pension proposal could help some of the smaller municipal pension programs.

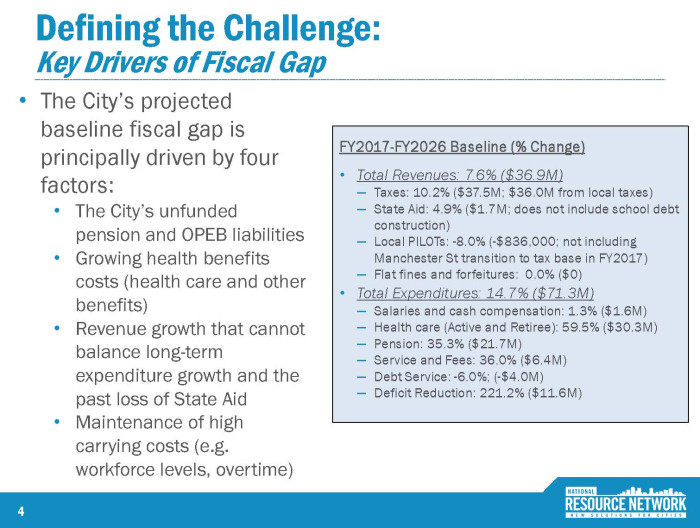

But, Magaziner admitted that his plan is not the immediate solution to the significant and longstanding pension problems in Providence. The capital city’s unfunded pension obligation boarders on $1 billion.

“Ultimately it's going to be on Providence and their labor groups to do the heavy lifting of finding a solution together. We're offering choices, they can decide,” said Magaziner.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTThe Magaziner Plan

“So big picture, there are 150 local pension plans, and 116 are managed through MERS (Municipal Employee Retirement System) already and 34 are locally managed. The 116 are on average 83% funded - none are below 60%,” said Magaziner.

According to the proposed legislation This legislation provides municipal pension plans with a more flexible pathway to enter MERS — if they choose to do so. The advantage for these pension plans is that this offers longer amortization periods and allowing certain parts of the benefit structure to conform to MERS benefits gradually instead of immediately—provided they still meet acceptable actuarial guidelines, and benefits are not more generous than other MERS plans.

“Most locally managed plans (outside the state system) are in pretty tough shape -- of the 34, a majority are below 60%, and a lot even below 40% funded,” said Magaziner.

Magaziner told GoLocal that there are clear advantages to the systems and to retirees.

“Why does MERS do better? One is the economy of scale -- an $8B system has a broader-based spread cost. It's 10 basis points for legal, actuarial, and administrative costs -- low overhead, because we're so much larger,” said Magaziner.

For Providence and other Communities in Distress - the Problems are Big and Complex

Magaziner admitted that his team is still collecting a lot of data and that his plan is not going to fix communities like Providence.

“We've never claimed this is the cure to every pension problem in the state -- there is no silver bullet, no perfect solution.But we can provide value by lowering costs and improving investment performance,” said Magaziner.

A number of business leaders including former Hasbro CEO Alan Hassenfeld claim that the pension obligations are so detrimental that the City should seek bankruptcy to shed the pension obligations.

"The reporting is shoddy by community - we've asked for administrative costs. Based on initial data we see so far, there will be savings," said Magaziner.

• The MERS pathway may make sense for municipal plans where:

o Local benefits are less generous than MERS;

o Employee contributions are more expensive than MERS;

o The local plan has a longer amortization period than MERS;

o Critical underfunding has made entry unaffordable under current option.

When asked if the shift to the state system would shift cost burdens, Magaziner said no,"The state of RI will pay nothing -- MERS is support by communities. When a community comes in and new costs are theirs."

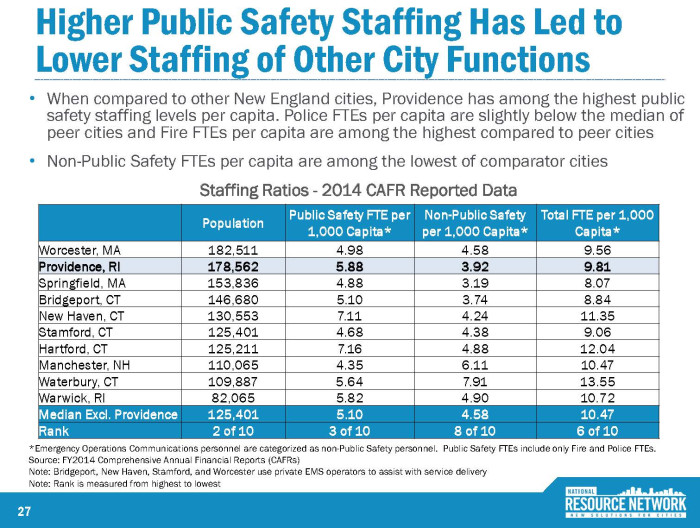

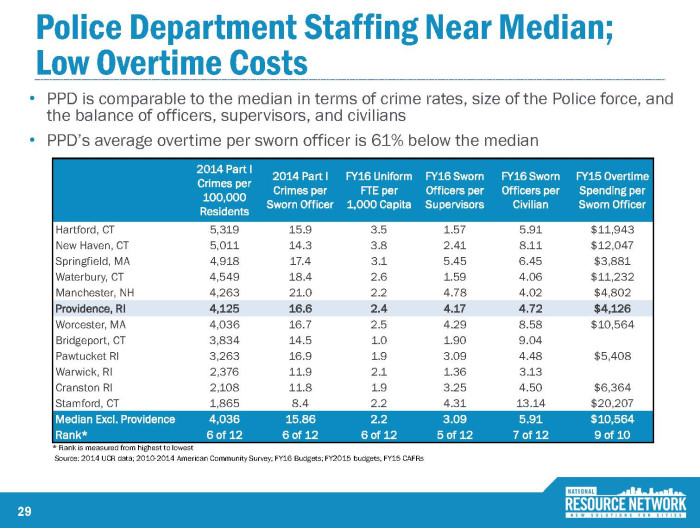

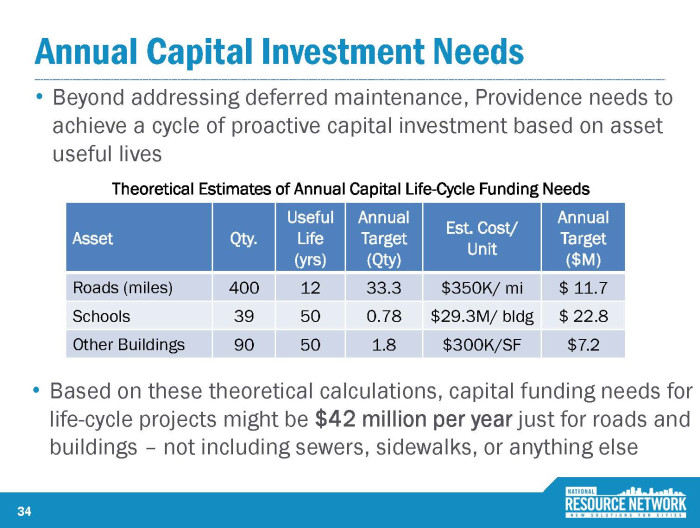

Related Slideshow: Providence Finances - Benchmark Report - 2016

Related Articles

- Riley: Providence in Big Trouble - Pension Plan Assets Lowest Since 2007

- Riley: Brexit Slams RI Pension Funds

- Tom Brady Will Not Continue Legal Process, Serve 4 Game Suspension

- Riley: Lousy Pension Returns Put One More Nail in Providence Coffin

- Proposed Providence Pension Changes Could Cost City $4 Million

- RI’s Pension Fund Haunted by 27-Year-Old Real Estate Investment and Legacy of Failure

- Riley: Pension Assets Valuation Scam, Elorza Style

- Tom Brady’s 4-Game Deflategate Suspension Reinstated by US Appeals Court

- Riley: Magaziner & Elorza Pension Assumptions Ridiculed by Special Master Feinberg

- Riley: Elorza - Providence Has Plan to Make Pension Payment on Time

- Riley: RI Pension Shortfall Far Outweighs Budget Surplus

- Brady is Trying to Move on After Making “Personal Decision” to Accept Suspension

- Moore: Raimondo’s Pension Fund Experiment Fails

- Riley: Time to Review Why 16 RI Municipal Pension Funds Shouldn’t Be Shut Down

- Siedle: Red Flags Pepper RI Pension’s Investment In Governor Raimondo’s Venture Fund

- Siedle: RI State Pension Fiduciaries’ History Of Not Cooperating With SEC

- Filippi Submits Bill to Create More Transparency in RI Pension Fund Investments

- Student Loan Forgiveness, Millitary Pensions Exempt: This Week at the State House

- Carnevale Still Serves on Prov. Retirement Board—Voted to Keep Pension of Fired Police Officer

- RI Pension Investigator Siedle in NYT for $1M Indiana Settlement, Coming to RI in October

- Riley: More Providence Pension Abuse of Public Employees

- Providence Lowers Pension Forecast to 8% - City Treasurer Calls Move “Band-Aid on Shotgun Wound”

- Riley: 2017 RI Projected Pension Returns Scary and Worsening

- Riley: Politics and Pensions - Has Raimondo Given Up?