INVESTIGATION: Despite Reform, Pensions Will Cost RI More in 2013

Thursday, June 27, 2013

Despite pension reform taking effect, the cost of the state retirement system has increased this year by about $20 million, according to state financial records and reports reviewed by GoLocalProv.

When pension reform passed in November 2011, General Treasurer Gina Raimondo’s office issued a press release touting the improved financial health to the state pension system and the savings for taxpayers. All told, taxpayers were supposed to save $4 billion over the next 24 years, the release said—a figure which averages out to $166 million annually. But one key detail was not advertised: taxpayers would not see immediate decreases in pension costs even after the reform took effect in July 2012.

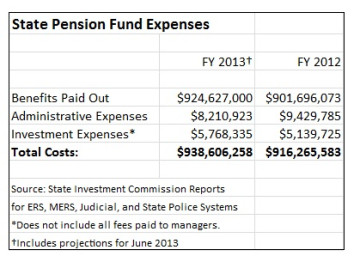

In fiscal year 2012, $916.2 million flowed out of the state pensions system. Pension payments to retirees consumed $901.6 million, with remainder split between $9.4 million in administrative expenses and $5.1 million in investment expenses.GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

The total cost for the current fiscal year is $938.6 million, an increase of $22.4 million, or about 2.5 percent. (See table.)

Taxpayer-funded contributions to the state pension system are increasing as well. In fact, that’s exactly what the state actuary, Gabriel Roeder Smith, predicted would happen, in a November 14, 2011 report assessing the impact of pension reform changes.

The amount the state was required to contribute from taxpayer funds to pensions for retired state workers and teachers did dip down from $376.7 million in 2012 to $345.1 million in 2013, according to the actuarial report. But it will bounce back up to $379.2 million in the upcoming fiscal year.

For fiscal year 2015, the state contribution to those two funds will total $419.7 million.

A February 2013 actuarial report showed the state pension fund performance was on track with the predictions from a year and a half earlier, said Raimondo spokeswoman Joy Fox. The fact that actual costs are in line with projections is, she suggested, a positive sign.

“As evidenced by the actuarial analysis presented to the General Assembly in November 2011, an increase in the annual required contribution was anticipated,” Fox said.

Pension reform was about limiting projected increases

Former state treasurer Frank Caprio told GoLocalProv that a number of factors could be driving the continuing increases in state pension costs. He pointed to two: the wave of Baby Boomer retirements starting to take effect and increasing longevity thanks to modern health care.

Before pension reform, those demographic factors and others were expected to cause annual pension costs to spike. Pension reform slowed down those increases, according to Caprio.

“The treasurer’s top priority continues to be retirement security,” Fox said. “The new design encompasses safeguards to prevent the annual pension line item in the state budget from spiking to unaffordable levels in the future. It also balances the current cost burdens, across all stakeholders—employees, retirees, and taxpayers.”

Absent pension reform, employer contributions to the system would have been “upwards of $600 million” this fiscal year, according to Fox.

Others, however, aren’t convinced those projections were realistic in the first place.

“The truth is that the pension outlays—the actual money paid to retirees—was only expected to go up about 3 percent this year, before pension reform. During the debate about pensions in 2011, no one seemed to be asking why we needed 50 percent increases to pay for a 3 percent rise in benefit costs,” said Tom Sgouros, a progressive policy expert and former candidate for state treasurer. “The ‘reform’ avoided those 50 percent increases, but taking it out on the retirees was apparently easier than asking the hard questions of why we have to choose such an expensive way to pay for pensions.”

“And as you see, it didn’t really lower the cost, just avoided the insane demands of inappropriate accounting rules,” he concluded.

One pension reform supporter, however, said it’s much too early to really be able to assess how much money has been saved through pension reform. Lisa Blais, spokesperson for OSTPA, said the assessment should be based on a comparison of the cost of retirees going out under the old pension system and the cost of post-reform retirees whose income will come from a 401(k)-style defined contribution plan, unlike traditional pensions.

Union leader questions continued rise in costs

The increasing pension costs were no surprise to Philip Keefe, president of SEIU Local 580. “It’s not, when you have a treasurer who is paying huge sums of money to Wall Street to manage funds,” Keefe said.

In fact, the full cost of fees related to management of pensions is not reflected in the above figures, particularly the usual 20 percent profit-sharing fees that hedge fund managers receive. Those figures, which have not been released for the current fiscal year, would only add to the increase over last year.

“People should be asking the question why have costs gone up as dramatically as they have,” Keefe said, when Raimondo has been “beating the drum” to improve the funding of the pension system.

The increase between 2012 and 2013 does not appear to be anomaly.

The state pension payroll also went up by double digits between fiscal years 2011 and 2012—from $865.6 million to $901.8 million, according to figures culled from the monthly and year-end cash flow reports that are provided to the State Investment Commission, which oversees how the money in the pension system is invested.

Taxpayers will continue to pay for recession losses

One reason taxpayer contributions continue to rise is the “five-year smoothing policy” the state has in determining contribution rates, according to Fox. “As of 2011, there were still three years remaining on the large deferred asset losses created by 2009,” Fox said, referring to the market crash at the start of the recession.

In other words: instead of taking a big one-time hit, the increase in taxpayer contributions—necessary to cover losses from investments—will be spread out over time.

As a result, Rhode Islanders will still be paying for those 2009 losses until 2014, Sgouros noted.

Sgouros criticized the state’s approach to dealing with the losses, saying it is designed to benefit investors at the expense of others. “The system is rigged to create an enormous pool of investable capital, at great expense to the sponsoring city, county, or state. It benefits people who earn their keep charging a commission on investing it, but it doesn't benefit taxpayers or retirees nearly as much as advertised,” Sgouros said.

Stephen Beale can be reached at [email protected]. Follow him on Twitter @bealenews

Related Articles

- EXCLUSIVE: COLAs Killing State Pension System

- EXCLUSIVE: State Pension Fund Lost $200M under Raimondo

- No Prosecutions for State Pension Fraud Since 2001

- RI’s Out-of-State Pension Tab: $142 Million

- State Pension Solutions Unveiled

- State Pension System to be Investigated by Siedle

- UPDATED: ‘Deficiency in Controls’ Over State Pension Reporting