Elorza, Igliozzi Refute Magaziner’s Claim That 8% Pension Fund Rate of Return is “Unrealistic”

Wednesday, May 01, 2019

Providence Mayor Jorge Elorza unveiled his Fiscal Year 2020 budget proposal on Tuesday which calls for a budget of over $772 million for a total increase of 3.1% over the current fiscal year — including millions in new spending — after the recent property revolution Is expected to yield the city an increase of over $12 million.

Elorza’s proposal, however, does not address any systemic changes to address the city’s $1.356 billion unfunded pension liabilities — not including the billion dollar post-employment benefit obligation. Currently, the Providence pension system is funded at 26.3 percent, Rhode Island General Treasurer Seth Magaziner deemed the Providence pension fund in “critical status” in his latest report issues this week - and warned the projected 8% rate of return “might not be realistic.” The state employee retirement system is currently at 7.0%. No other city or town in Rhode Island assume an

A look at the latest investment return assumptions by the National Association of State Retirement Administrators showed that for more than 125 statewide plans across the country, only 6 currently use a projected return of 8%, with the majority ranging between 7 and 7.75% — and 15 ranging between 5.25 and 6.90%.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTOn Tuesday, Elorza said that he believed the 8% return — and not a lower one, which would increase the city’s unfunded liability — was correct.

“If you look at our actual rate of return over the past ten years it’s pretty close to 8%. We’re comfortable that’s at the right level right now. But what’s important is making sure you’re making the pension payments every single year and you’re making them on a timely basis and you’re managing your finances so you finish the year with a surplus so you can build up that rainy day fund,” said Elorza.

“The worst thing is to be in that perilous position where one bad year — one downturn — leads us into the red and leads us into receivership," said Elorza. "What we’ve done over the years is we’ve built up that reserve where we’re in as resilient a position to weather a financial storm as we’ve been in at least a decade. The money comes out of the same pool [and]we manage our finances responsibly to be ready for wherever comes our way.”

Providence pension critic Michael Riley, who in 2018 wrote "Elorza Purposely Underfunds Disastrous Providence Pension Plans," said Tuesday that the city “should be realistic and move their assumption down to less than 7%."

“Purposely maintaining a high discount rate is purposefully underfunding their pension plan,” said Riley. “They’re bankrupt either way.”

Council President, Finance Chair Respond

City Council President Sabina Matos said following Elorza's budget address that while she does not believe in the 8% projection, the city can’t absorb lowering the rate.

“I have always been a believer that 8% is wishful thinking. But at the same time, right now I don’t think we can afford to lower the rate at this moment,” saId Matos. “I understand the concerns, but the council is going to be working on plans to address the budget [and] pension problems for the City of Providence — so stay tuned.”

In April, Elorza abandoned his plan to sell the Providence water supply as a path to resolving the city’s $2 billion in unfunded pension and post-employment liabilities -- and offered no alternative for a significant means to address the obligation.

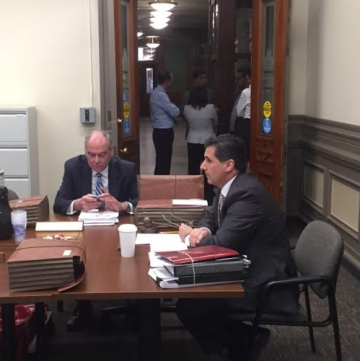

City Council Finance Chair John Igliozzi on Tuesday addressed the 8% issue, and how he said he thinks the city can address its pension problem.

“Whenever you lower [the rate of return] it creates a dramatic impact on your unfunded liability. You can’t be cavalier about it. Luckily the city’s rate of return has been very good — we’ve actually beat the state’s rate of return for the past 25 years. On the investment structure itself, Wainwright’s done a great job,” said Igliozzi. “The problem, of course, is we just don’t have enough money in the account. So although we make a good rate of return we don’t have enough money to address the unfunded liability which keeps on growing.”

“Lowering the rate of return will have an automatic negative impact in increased unfunded liability but right now we’ve been able to manage that. Whether it’s 8%, or 7.75%, that’s not the biggest problem. The biggest issue right now is adding and creating more money to go back into the system,” said Igliozzi. “What’s a way to do that? All new hires for the City of Providence — they should probably have to pay more, get less, and take longer to get their pension. There’s an example where you have the average city worker paying X percent into the system, a new worker would pay more into it. So now what happens is you don’t impact anybody on the job now, you don’t impact anyone who’s retired, you impact all new hires. The past couple years, the City of Providence has hired 300 to 400 new workers — at least.”

“So if you think about it, if you have those workers start paying more and getting less — and take longer to get to pensions — it helps mitigate it,” said Igliozzi. “Does it solve it? No. But then after you do that, the next step is to talk to the workers that are presently in the system and asking them to contribute more. It’s their pension that they need to have at the end when they retire.”

Related Articles

- Magaziner Issues 2018 Rhode Island Pension Fund Report

- Diocese Fights Federal Fraud Lawsuit On St. Joseph Pension Fund - Denies Any Responsibility

- Teamsters Fire Back at Prov’s School Bus Co. Student First — Union Affirms Pension Fund’s Health

- Kilmartin “Failed to Mind the Store” Says Receiver in St. Joseph Pension Collapse

- Witman Unveils Plan to Stabilize Providence’s Pension Plan on GoLocal LIVE

- Magaziner on Recent Pension Performance, National Reporting Award, and More on LIVE

- RI’s Pension Fund Earns $323 Million in January

- St. Joseph Pensioners: 18 Who Made a Difference in 2018

- Court Delays Award of $11M to St. Joseph Pensioners After AG and Foundation Lawyers Object

- Ruggerio Introduces Bills to Bring More Transparency to St. Joseph Pension Plan

- Raimondo Signs Bills to Help Settle Lawsuits in St. Joseph’s Pension Collapse

- Guest MINDSETTER™ Siedle: Seeking Justice for RI Pension Stakeholders

- RI Pension Fund Earns $125 Million in July

- St. Joseph Pension Fund Collects $11M, Puts Pressure on Diocese and CharterCare

- Judge Stern’s Ruling Green Lights Millions in St. Joseph Pension Fund Case, Set Back for CharterCare

- Prov GOP to Elorza After Backing Off Monetizing Water Supply: Get Out of Pension Business

- RI Pension Fund Earns $106 Million in February

- As St. Joseph Pension Fund Legal Cases Drag On, 58 Retirees Have Died and Fund is Depleting

- Providence’s Pension Plan in “Critical” Status — $1.3B Underfunded, 20 Other Funds in Distress

- Elorza’s 2020 Budget: Millions in New Spending — No Plan for $1.3B in Unfunded Pension Obligation

- Rhode Island State Pension May Never Be Able To Exit Gina Raimondo Loser: Guest MINDSETTER™ Siedle