Lifespan and Care New England Merger Faces Growing Financial and Regulatory Challenges

Friday, October 08, 2021

The merger between the two largest hospital groups in Rhode Island -- Lifespan and Care New England -- is facing a growing list of challenges.

A top healthcare merger expert tells GoLocal that the challenges are both financial and regulatory and can only be overcome by the state of Rhode Island creating an entirely new regulatory agency.

Brent McDonald, an “attorney and senior investment banker at Juniper Advisory in Chicago, said, “They need to be able to pass FTC [Federal Trade Commission] review or the state needs to create a COPA.”

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST“The FTC has different triggers and concentration of market share of 40% to 50% would trigger the ‘second request’ tool,” said McDonald, who has 25 plus years in healthcare consulting.

The second request law forbids merging firms from consummating a transaction until the companies have substantially complied with the additional investigatory request. In some cases, it is a death knell.

To avoid the FTC, the proposed merger would need the general assembly to create a new regulatory structure that could issue Certificates of Public Advantage (COPA).

A COPA provides state action immunity to the hospitals from state and federal antitrust laws by replacing competition with state regulatory structure. De facto, the COPA is the only way to circumvent the FTC regulatory structure.

“The [FTC] had gotten much more aggressive,” said McDonald.

FTC legal actions have been a blow in a number of hospital deals. A proposal for Methodist Le Bonheur to buy two Memphis-area hospitals from Tenet Healthcare was called off late last year after a lawsuit from the FTC alleged the acquisition would harm access to care in the city metropolitan area.

As aggressive as the FTC has been even under President Donald Trump's administration, the agency is expected to get more restrictive.

In July, President Joe Biden issued a sweeping executive order that pressed the federal government to review and revise guidelines for hospital mergers that can lead to higher prices.

Biden specifically called out hospital mergers that have “left many areas, especially rural communities, without good options for convenient and affordable healthcare service."

“Thanks to unchecked mergers, the 10 largest systems now control a quarter of the market," cites the order.

Monopoly in Rhode Island"

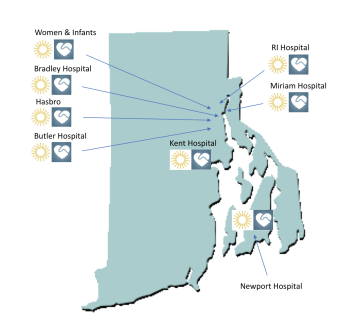

A website launched to support the merger states, "With co-investment from Lifespan, Care New England and Brown University, we bring together the system’s premier teaching hospitals — Lifespan’s Rhode Island, Miriam, Hasbro, Newport and Bradley hospitals, and Care New England’s Women & Infants, Kent, and Butler hospitals — with Brown’s leading research and medical education from The Warren Alpert Medical School."

But, that colossal list of healthcare organizations may be the trouble. A combined Lifespan and CNE would create a monopoly in Rhode Island, according to CNE's financial data.

According to financial reports from the hospital group, CNE serves about 28% of the market, and Lifespan's hospitals on average serve 49% of the market -- a total of 77%. The next largest hospital group is CharterCARE with just 10% of the market.

A combined Lifespan, CNE, and Brown group could dominate pricing, access and quality for better or worse.

Over the past three-plus years, CNE’s financial position has been littered with financial losses. In 2018, CNE had a net operating loss of $28 million, in 2019 a net gain operating gain of $3.7 million, and in 2020 a net operating loss of $28 million. Through three quarters of the 2021 fiscal year it has a $41 million gain, but only after receiving $77.5 million in federal funds in COVID stimulus grants.

Lifespan's spokesperson Kathleen Hart refused to respond to questions.

Status of the Merger

The merger was announced last November and made it an exclusive agreement -- thus, blocking CNE from potentially talking to other suitors.

In December, GoLocal exclusively reported that according to a letter to the board of CNE, StoneBridge Healthcare was offering a financial package of $550 million comprised of a purchase price of $250 million and a $300 million investment in the hospital group. CNE rejected the proposal without review citing that they were in an exclusive negotiating period with Lifespan.

Lifespan and CNE have not completed a merger application to state regulators under the RI hospital conversion act. "The HCA process is still underway for Lifespan/CNE. We continue to collect the information we need from the parties in order to deem the application complete. I’m not able to comment on further details at this time," said Kristy dosReis of Attorney General Peter Neronha's office.