Lardaro Report: RI’s Economy Struggles to Sustain Momentum

Monday, January 13, 2020

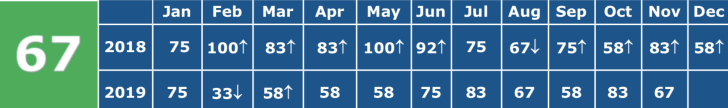

As we move further into the fourth quarter, Rhode Island’s economy appears to be experiencing some difficulty sustaining its recent momentum. The first half of 2019 started with a bang then quickly faded through mid-year. Since June, Rhode Island’s economic performance has clearly firmed. What I find puzzling, however, which I discussed in last month’s report, is how often momentum seems to weaken following each “pop” in the Current Conditions Index value. While this might appear to be related to seasonality issues, my guess is that there is more at work here, so that such a simple explanation is not adequate.

The more likely possibility, which is related to second-half data, concerns data re benchmarking - the upcoming revisions to this year’s data. Historically, labor market data from August through December are those most likely to be revised, either higher or lower, causing us to reassess how well the second-half performance actually was. I suspect we might see this with the 2019 data. The periods most likely to be revised often show large jumps in payroll employment, reflecting rates of increase well beyond those of the preceding months.

I truly hope the existing values prove to be accurate, and the underlying strength we are witnessing at present remains in tact. I am a bit skeptical, though. The reason, first and foremost, is that recent data revisions, most notably those concerning real GDP for Rhode Island, have been nothing short of brutal, entailing substantial downward revisions to prior data. Eventually, all of the data series are revised to be consistent with each other. It won’t be until February, with the 2019 data revisions, that we know where Rhode Island’s economic momentum actually stands.

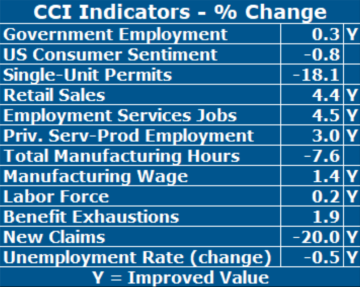

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTThe Current Conditions Index for November fell from its October value of 83, which was tied for its highest value in 2019, to 67 as only eight of the twelve CCI indicators improved. As happens all too often, November’s CCI failed to beat its year-earlier value. Up to this point, we have only bettered the prior-year value for two months this year. While November’s CCI value was somewhat disappointing compared to that last month, there were several strong indicator performances, nonetheless. As I have noted many times in prior months, it is necessary to look “under the hood” at individual indicators and their underlying trends in order to arrive at a meaningful interpretation of Rhode Island’s economic performance. For November, the overall strength displayed by individual indicators was only so-so.

Two factors in Rhode Island’s performance continue to merit attention. While Rhode Island’s Unemployment Rate has been falling for quite some time now and remains at its recent low (3.5%), much of that decline has been associated with a prolonged decline in our Labor Force, both overall and relative to our resident population (i.e., our labor force participation rate has been declining). Accompanying this, resident employment (the number of employed RI residents) has remained well below its 2006 value, and until recently, falling overall and relative to our resident population (the employment rate).

The most encouraging trends of late are that on a monthly basis, our Labor Force and labor force participation rates have been rising since June, and along with this, resident employment has risen since May, increasing the employment rate. These trends indicate that our Unemployment Rate is finally behaving as it should (for the right reasons). Furthermore, several other CCI indicators that have been performing badly on a yearly basis have begun to show promising monthly improvements. We will need to see whether these trends are sustained with data rebenchmarking.

In November, while eight CCI indicators improved, the greatest concern continues to be with manufacturing, where Total Manufacturing Hours, a proxy for manufacturing output, fell for the fourteenth consecutive month (-7.6%), although the Manufacturing Wage rose. US Consumer Sentiment failed to improve again, while Single-Unit Permits, which reflect new home construction, fell. Long-term unemployment, in terms of Benefit Exhaustions, failed to improve and reestablish a downtrend. New Claims for Unemployment Insurance, the most timely measure of layoffs, improved in November, the sixth time in the last seven months. Retail Sales remained our star performer (+4.4%), Employment Service Jobs, a leading indictor of employment, showed strength, as did Private Service Producing Employment (+3.0%).

Related Articles

- Lardaro: Rhode Island’s Economy Sees Big Gains in May

- Lardaro Report: April Conditions Hit Lowest Value Since 2016

- Lardaro: RI Ends 2nd Quarter on Positive Note, But June Below May

- Lardaro Report: RI’s Economy Stumbles in July

- Lardaro Report: Current Conditions Fall to Lowest Value of Year

- Lardaro Report: RI Ends Quarter 1 on Precautionary Note

- Lardaro Report: RI’s Economic Progress is “Very Promising”

- Lardaro Report: Economic Conditions Improve in 4th Quarter, But Issues Warning

- Lardaro Report: RI Economy Maintains Steady Performance in November

- Lardaro Report: RI Ends 2017 on Cautionary Note

- Lardaro Report: Economic Conditions Slip in January

- Lardaro Report: RI’s Disappointing Third Quarter Contributes to Lackluster 2018

- Lardaro Report: “Virtually Nothing to Cheer About” in October

- Lardaro Report: RI Finishes 2nd Quarter on “Somewhat Upbeat Note”

- Lardaro Report: RI is Not That Far Away From a Recession

- Lardaro Report: RI’s July Economic Conditions Rank Best of 2019

- Lardaro Report: RI’s Economic Activity Slows

- Lardaro Report: RI’s Economy Is Not As Weak As It Appears

- Lardaro Report: RI’s Economic Momentum Down, But Not Out

- Lardaro Report: RI Economy Closes 1st Quarter on Note of Concern