Lardaro Report: RI’s Economy Is Not As Weak As It Appears

Monday, November 11, 2019

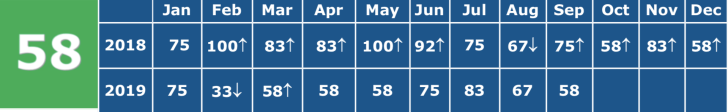

Rhode Island’s third-quarter economic performance appears at first glance to be disappointing, as the Current Conditions Index fell from its highest value for the year thus far, 83 in July, to 67 in August then down to a barely expanding value of 58 in September. While statistically this appears to reflect a clear weakening in Rhode Island’s third-quarter economic momentum, a closer, more in-depth look reveals that things are not necessarily as weak as one would conclude by merely focusing on the overall CCI numbers.

The CCI’s values each month are derived by looking at year-over-year (yearly) changes in each of its twelve indicators after seasonally adjusting the data. What drives changes in yearly values? Underlying trends in month-to-month (monthly) changes. And it is in this distinction between the two sets of values that I find grounds for some optimism in the recent performance of Rhode Island’s economy.

At present, a number of individual CCI indicators are performing badly on a yearly basis, most notably our Labor Force, Total Manufacturing Hours and Benefit Exhaustions. Yearly weakness in the latter two are particularly worrisome, as these reflect trends where manufacturing continues to trend lower while longer-term unemployment has of late been trending higher. Obviously, these are not unrelated.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTLurking behind problematic yearly performances are several promising monthly trends, which could ultimately reverse yearly weakness should they be sustained in the coming months. Most notable among these is Resident Employment, the number of employed Rhode Island residents. While this remains well below its 2006 level, it has now risen for every month since May. Ditto for the Employment Rate and Labor Force Participation Rate. Professional and Business Service employment has also strengthened monthly since May.

Last month, I raised the possibility that Rhode Island’s economy might be at an inflection point, where our negatives begin to wane in relative importance, resulting in more favorable ongoing economic performance. I continue to believe in that possibility while fully grasping that Rhode Island’s short-term fate rests almost entirely with the performances of Massachusetts and national economies. Will Rhode Island remain in second gear or upshift into third gear? Time will tell.

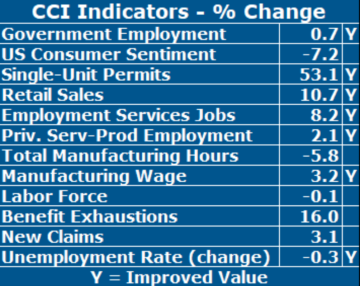

In September, seven of the twelve CCI indicators improved with many displaying strong performances while at the same time the indicators failing to improve displayed substantial weakness. The CCI failed to exceed its year-earlier value again, as only two of the five leading indicators contained in the CCI improved.

Our state’s Labor Force improved again on a monthly but not yearly basis for the fourth consecutive time since January. Long- term unemployment, as reflected by Benefit Exhaustions, failed to improve (rose) at a double-digit rate and its trend has turned positive (we want negative). New Claims for Unemployment Insurance, the most timely measure of layoffs, rose in September after falling four consecutive months. Retail Sales, our “star” indicator for quite some time now, improved at a double-digit rate in September. Employment Service Jobs, a leading indicator that includes temps, increased impressively in September (+8.2%), its sixth consecutive increase. Yet another bright spot was the growth in Private Service-Producing Employment, which rose for a sixth consecutive month (+2.1%). Finally, Government Employment increased again in September for the twelfth time in the last thirteen months, remaining well over 61,000.

My greatest concern continues to be the performance of our goods-producing sector, the most highly cyclical element of our economy. While the Manufacturing Wage rose (+3.2%), Total Manufacturing Hours, a proxy for manufacturing output, fell by 5.8 percent, its twelfth consecutive decline, while Single-Unit Permits, a measure of new home construction, surged by over 50 percent (very weak comp), but remains in a downtrend. US Consumer Sentiment failed to improve again, which could impact Single-Unit Permits and Retail Sales in the future.

Related Articles

- Lardaro Report: RI Ends 2017 on Cautionary Note

- Lardaro Report: RI Economy Maintains Steady Performance in November

- Lardaro Report: Economic Conditions Slip in January

- Lardaro Report: RI’s Economic Progress is “Very Promising”

- Lardaro Report: RI Ends Quarter 1 on Precautionary Note

- Lardaro Report: Economic Conditions Improve in 4th Quarter, But Issues Warning

- Lardaro Report: 3rd Quarter Good, But Not Great for RI Economy

- Lardaro Report: Economic Conditions Keep Momentum in May

- Lardaro Report: Favorable Momentum in 2017 Not Cause for Celebration

- Lardaro Report: RI Economic Conditions Stay Steady in July

- Lardaro Report: RI’s Economic Momentum Continues in August

- Lardaro Report: April Conditions Hit Lowest Value Since 2016

- Lardaro Report: RI’s Economy Stumbles in July

- Lardaro Report: RI’s Economic Momentum Down, But Not Out

- Lardaro Report: RI Economy Closes 1st Quarter on Note of Concern

- Lardaro Report: RI is Not That Far Away From a Recession

- Lardaro Report: RI Finishes 2nd Quarter on “Somewhat Upbeat Note”

- Lardaro Report: RI’s July Economic Conditions Rank Best of 2019

- Lardaro Report: RI’s Abysmal February Economic Performance