Lardaro Report: RI’s Abysmal February Economic Performance

Monday, April 15, 2019

We received very disappointing revisions to our state’s labor market data last month and are still trying to adapt to the stark realities it contained, most notably the host of disappointing statistics and trends revealed. Historically, we recover fairly quickly from such disappointments in the following months, in a sense “making up for lost time.” Well, that was then, this is now.

Rhode Island’s February economic performance was abysmal, to put it kindly. Payroll employment, which has yet to move above its December 2006 level, declined in February on both an annual and monthly basis. Resident employment, which never really came very close to reaching its prior peak, has remained stuck at the same level since last September. Our state’s Unemployment Rate fell below 4 percent again, but it is an exceptionally tainted (i.e., noisy) statistic whose “signal” for our state’s economy has long since vanished. The strongest indicator performance in February was Retail Sales, which has held up surprisingly well, although this is partly the result of its inclusion of online sales which are no doubt propping it up.

Overall, the highly cyclical leading economic indicators contained in the Current Conditions Index, Single-Unit Permits, Total Manufacturing Hours, and New Claims have weakened noticeably of late. The growing weaknesses in housing and manufacturing, both of which led us into the last recession, are particularly worrisome, since both have large multipliers which tend to exacerbate falling momentum as the economy weakens.

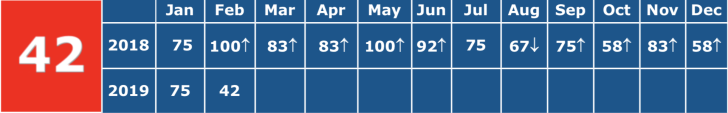

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTFor February, only five of the twelve CCI indicators improved, leading to a contraction value of 42. February marked the ninth consecutive month for which the CCI has failed to exceed its year -earlier value. Looking forward, the upwardly revised 2018 CCI values will make it increasingly difficult for us to improve on prior -year values. Clearly, Rhode Island’s economy is continuing to weaken. At this point, its loss of momentum is unmistakable. If employment continues to decline and Retail Sales falter, it will be time to think about making the R-word call. Fortunately, we’re not there yet, but perhaps not that far away either.

Only one of the five leading indicators contained within the CCI improved. Employment Service Jobs, a leading indicator that includes temps, rose by 0.9 percent in February, but its rates of growth have been declining since last August. New Claims, the most timely measure of layoffs, failed to improve yet again in February (+5.7%), marking its fifth failure to improve in the last eight months. It remains unclear whether it will resume a downtrend anytime this year. Layoffs and changes in employment are very obviously related. What we have witnessed recently, the combination of falling employment and rising layoffs is the exact opposite of what we will need in coming months.

US Consumer Sentiment fell again for the fifth time in the last seven months, no longer hurt by the shutdown, but affected by rising uncertainties. Rhode Island’s goods-producing sector fared poorly again in February. Single-Unit Permits, a measure of new home construction, fell at a double-digit rate (-11.7%), its eighth decline in the last nine months. Declining interest rates will likely not boost this indicator as much as you might think (RI has a static population). Total Manufacturing Hours, a proxy for manufacturing output, has now declined for the most recent five months. Its rate of decline accelerated dramatically over the past three months as both employment and the workweek contracted. The Manufacturing Wage actually rose in February (+2.5%), but this was only its second increase since September.

Our state’s Labor Force reached its most recent peak in October and has plateaued at that value ever since, albeit at declining rates of annual growth. In February, it fell relative to its level a year ago (-0.1%). Along with this, the labor force participation rate also declined in February. The Unemployment Rate fell to 3.9 percent, but as has been the case for well over a decade, this was very obviously not the result of robust job growth.

Retail Sales grew again in February (+6.3%), Government Employment rose from its level a year ago for a sixth consecutive month (+0.5%), Private Service-Producing Employment fell (-0.3%), and Benefit Exhaustions, the timeliest measure of longer-term unemployment, rose.

Related Articles

- Lardaro Report: RI’s Economic Momentum Continues in August

- Lardaro Report: RI Economic Conditions Stay Steady in July

- Lardaro Report: 3rd Quarter Good, But Not Great for RI Economy

- Lardaro Report: Economic Conditions Improve in 4th Quarter, But Issues Warning

- Lardaro Report: RI Economy Maintains Steady Performance in November

- Lardaro Report: Favorable Momentum in 2017 Not Cause for Celebration

- Lardaro Report: Economic Conditions Keep Momentum in May

- Lardaro Report: RI’s Labor Force Train Wreck

- Lardaro Report: February Conditions Higher Than at Any Point in 2016

- Lardaro Report: Conditions Reach Highest Level Since 2012

- Lardaro Report: RI’s Economic Recovery Becoming More Broadly Based

- Lardaro Report: RI Ends 2017 on Cautionary Note

- Lardaro Report: Economic Conditions Slip in January

- Lardaro Report: RI’s Disappointing Third Quarter Contributes to Lackluster 2018

- Lardaro Report: Current Conditions Fall to Lowest Value of Year

- Lardaro Report: “Virtually Nothing to Cheer About” in October

- Lardaro Report: RI’s Economy Gets Reprieve in November

- Lardaro: RI Economy Closes 2018 on Downbeat Note

- Lardaro Report: RI’s Economy Stumbles in July

- Lardaro: RI Ends 2nd Quarter on Positive Note, But June Below May

- Lardaro Report: RI’s Economic Progress is “Very Promising”

- Lardaro Report: RI Ends Quarter 1 on Precautionary Note

- Lardaro Report: April Conditions Hit Lowest Value Since 2016

- Lardaro: Rhode Island’s Economy Sees Big Gains in May

- Lardaro Report: RI’s Revised Labor Market Data