Lardaro Report: RI Enters Recession in “Relatively Weak Position”

Friday, March 20, 2020

What a difference a month makes! In last month’s report, based on data that was not yet revised, I began by stating: What a way to end the year! Rhode Island’s December performance was its best by far for all of 2019. At 92, the December Current Conditions Index value was its highest since June of 2018. Wow was that far off from what revisions show.

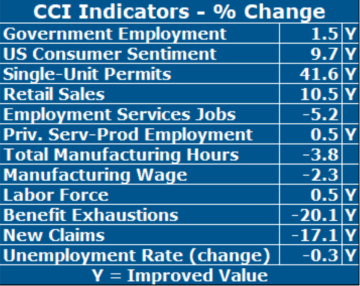

While prior levels of payroll employment were not revised lower as I had feared, one key indicator, Employment Service Jobs, a leading labor market indicator that was thought to have risen every month last year actually fell for all of 2019. Ditto for January of 2020. This indicator, which is a leading indicator of future employment, even then was signaling weakening job gains in 2020. As I write this (mid-March), that’s actually an incredible understatement. At any rate, incorporating the updated labor market data, the Current Conditions Index for all of 2019 was revised lower for nine months, higher for one, and unchanged for two. Worse yet, for four months last year, the CCI was at its neutral value of 50 while in four other months, the CCI managed to climb to only 58, barely above neutral. So, 2019 was not a terribly strong year for Rhode Island’s economy. It is clear that as I write this, Rhode Island has entered into the early stages of a recession that is also affecting the US and global economies. Rhode Island, therefore, finds itself entering this recession from a relatively weak position. If there is good news, although Rhode Island’s economy is FILO, the FI (First In) does not apply this time, given the abruptness of the decline in global economic activity. Sadly though, our status as LO (Last Out) remains entirely in tact, highlighted by our state’s disappointing 2019 economic performance.

Rhode Island’s elected officials, whom I absolutely refuse to refer to as leaders, have for years hidden behind an exceptionally misleading (i.e., noisy) statistic: our Unemployment Rate. Their implication about our dramatically reduced rate has always been that our jobless rate declined from double digits for all the usual reasons, most notably robust job growth. Welcome to Rhode Island. Unbeknown to almost anyone in this state, resident employment, the number of employed Rhode Islanders, the measure directly linked to the Unemployment Rate, has grown during the last recovery (get used to that) but as of our entry into the current recession, it remains below its value in 2006! How, then could such lukewarm employment growth have translated into dramatic declines in our jobless rate? Simple: Rhode Island’s Labor Force has been declining for close to a decade, a phenomenon I refer to as a “train wreck.” The secular decline only ended in early 2017. Even with the recent increases, our Labor Force remains far below its prior peak (in June 2010).GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

How much has weak job growth combined with a diminished labor force impacted our Unemployment Rate? If our labor force participation rate had remained at its average from the post-financial crisis recovery (around 67%), then using current population and employment rate values, the January 2020 Unemployment Rate would have been 7.7 percent. And that’s based on U3!

The strength of Rhode Island’s recovery has been overstated in a very clever way by our state’s elected officials for years. The reality is that the last recovery (that just ended) was not as strong as people were led to believe (by inference). Many Rhode Islanders have either been left behind our never managed to catch up. Now that a recession of uncertain magnitude and duration has begun, it is appropriate to refer to the old saying about the tide going out. The shallowness of the last recovery will become apparent very quickly, not so much in the magnitude, that is largely out of anyone’s control, but in terms of our ability to move into an eventual recovery.

As for individual January performances, all of these are now meaningless. Ironically, New Claims for January were sharply lower. As of mid-March, they have grown in the twenty percent-plus range based on mass layoffs on a not seasonally adjusted basis. I’m afraid to contemplate how much the seasonally adjusted value surged. Fasten your seat belts. This is going to get ugly. When it is over, we will not be returning to things as they were. Hopefully, that will also pertain to state government. The 120+ legislative days devoted to the PawSox will haunt us.

Related Articles

- Lardaro Report: RI’s Economy Stumbles in July

- Lardaro: RI Ends 2nd Quarter on Positive Note, But June Below May

- Lardaro Report: Current Conditions Fall to Lowest Value of Year

- Lardaro Report: RI’s Disappointing Third Quarter Contributes to Lackluster 2018

- Lardaro Report: “Virtually Nothing to Cheer About” in October

- Lardaro: Rhode Island’s Economy Sees Big Gains in May

- Lardaro Report: April Conditions Hit Lowest Value Since 2016

- Lardaro Report: RI Ends 2017 on Cautionary Note

- Lardaro Report: Economic Conditions Slip in January

- Lardaro Report: RI’s Economic Progress is “Very Promising”

- Lardaro Report: RI’s Economy Gets Reprieve in November

- Lardaro: RI Economy Closes 2018 on Downbeat Note

- Lardaro Report: RI’s Economic Activity Slows

- Lardaro Report: RI’s July Economic Conditions Rank Best of 2019

- Lardaro Report: RI’s Economy Is Not As Weak As It Appears

- Lardaro Report: RI’s Economy Regains Momentum in October

- Lardaro Report: RI’s Economy Struggles to Sustain Momentum

- Lardaro Report: RI Finishes 2nd Quarter on “Somewhat Upbeat Note”