Rhode Island’s Top 100 Non-Profits Have Over $16 Billion in Assets

Tuesday, September 22, 2015

GoLocalProv News Team and Kate Nagle

The hundred largest nonprofits in Rhode Island have combined assets over $16 billion, according to their latest IRS 990s -- and top ten (not including credit unions) amount for over $10 billion alone.

Topping the list? Colleges and hospitals -- and the state's largest philanthropic foundation.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

SLIDES: See Rhode Island's Top 100 Nonprofits by Assets BELOW

A GoLocal analysis of tax data compiled by nonprofit watchdog ProPublica found just how much the state's largest charitable organizations claimed in the asset column.

"In cases when you have universities and hospitals perceived to have a lot of money and revenue generating capacity, and unlike business, are not very likely to move -- a lot of the nonprofits are fairly bound to the soil they're on -- they're an attractive place for people to look for revenue," said Aaron Renn, Senior Fellow at the Manhattan Institute and national urban analyst. "Take Chicago, where a lot of nonprofits had historically gotten free water, now the city decided to charge them for water."

"The challenge for a city isn't necessarily how to you factor in non-profits. The more fundamental problem is that there aren't many successful commercial tax paying businesses in a lot of places," said Renn. "So the economies have become dominated by nonprofits. This is arising because the economy has collapsed in those cities, and the biggest issue is getting the economy back -- getting the profit generating sector going."

Value of Nonprofits

Brown University topped the list of nonprofits in Rhode Island for assets, with over $4 billion reported for their fiscal year ending June 2013.

"Brown is one of the largest taxpayers in the city. From July 2013-June 2014, the University has paid more than $7.9 million to the city in voluntary and property tax payments plus more than $2.3 million in water, sewer, and other fees," writes Brown on their website.

According to Brown's acting communications manager Mark Nickel, that tax number will rise to $8.2 million in soon-to-be released updated materials from Brown -- which touts such talking points as 1,325 Brown employees live in Providence, and that Brown has invested from $1 million in Thayer Street improvements to over $200 million in the Jewelry District over the past decade.

Some taxpayer groups however question the role that universities and hospitals have in the state as nonprofit entities.

"What I think is happening is some of the universities and foundations are obviously recipients of preferential tax treatment -- whether that's federal, state or local law-- now it appears many are taking advantage of the situation to have more and more taken off the tax roles," said Mike Stenhouse with the Rhode Island Center for Freedom and Prosperity.

"And we see the same foundations and universities getting involved in public policy issues," continued Stenhouse. "If it's not to siphon off tax funds for their own purposes, why are they having such an influential say in public policy?"

Social Services

While the state's top hundred nonprofits can claim millions in assets, national nonprofit strategist Patricia Schaefer spoke to the competitive -- and constantly evolving -- world of philanthropy.

"Thirty years ago, traditional foundations and philanthropists were largely in a reactive mode, relying on those in the field to inform them and make their best case for support," said Schaefer. "Today we have a highly preemptive model of philanthropy and newer philanthropists and entrepreneurs want to see things happening on the ground now - they want to be part of the mechanics of change, involving themselves in the creation of social change networks, as opposed to individual organizations."

As for the possiblity of local nonprofits being asked to further contribute to Providence -- and Rhode Island -- Renn provided his perspective.

"Providence is in a tough situation with Brown," said Renn. " I don't believe that [Brown] is hostile, they just don't want to turn into an ATM when the city isn't reforming other aspects that of they need to address, starting with the pension system."

Related Slideshow: The 100 Largest Non-Profits in Rhode Island

The following are the Rhode Island non-profits with the most assets, according to their last reported 990 filing.

The data was researched through ProPublica's 'Nonprofit Explorer" -- the entities that were ranked included colleges, universities, private schools, foundations, hospitals, healthcare, arts, and charitable community organizations.

The list does not include assets reported by credit unions, retiree healthcare funds, and certain trusts that pertain to out of state interests.

View Larger +

View Larger +

Prev

Next

#100

Company Name: Church Community Housing Corporation

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $18,414,913

View Larger +

View Larger +

Prev

Next

#99

Company Name: Saint Antoine Residence

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $19,104,042

View Larger +

View Larger +

Prev

Next

#98

Company Name: Westerly Land Trust

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2012

Total Assets: $19,209,042

View Larger +

View Larger +

Prev

Next

#97

Company Name: Gateway Healthcare

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $19,531,455

View Larger +

View Larger +

Prev

Next

#96

Company Name: Amy Plant Slatter Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $19,580,437

View Larger +

View Larger +

Prev

Next

#95

Company Name: Thundermist Health Center

Org. Type: 501(c)(3)

Fiscal Year Ending: August 2013

Total Assets: $20,114,766

View Larger +

View Larger +

Prev

Next

#94

Company Name: Moses Brown School Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2014

Total Assets: $20,471,216

View Larger +

View Larger +

Prev

Next

#93

Company Name: Lincoln School

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $20,951,163

View Larger +

View Larger +

Prev

Next

#92

Company Name: Biogen Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $21,156,769

View Larger +

View Larger +

Prev

Next

#91

Company Name: FM Global Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $21,398,128

View Larger +

View Larger +

Prev

Next

#90

Company Name: Sharpe Family Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $21,512,369

View Larger +

View Larger +

Prev

Next

#89

Company Name: Gordon School

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $22,865,048

View Larger +

View Larger +

Prev

Next

#88

Company Name: Steere House

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $22,970,587

View Larger +

View Larger +

Prev

Next

#87

Company Name: St. Elizabeth Community

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $24,392,335

View Larger +

View Larger +

Prev

Next

#86

Company Name: Shriners of Rhode Island Trust

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $24,638,985

View Larger +

View Larger +

Prev

Next

#85

Company Name: Child and Family Services of Newport

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $24,703,612

View Larger +

View Larger +

Prev

Next

#84

Company Name: Rhode Island College Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $24,983,500

View Larger +

View Larger +

Prev

Next

#83

Company Name: Naval War College Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $26,604,533

View Larger +

View Larger +

Prev

Next

#82

Company Name: Redwood Library and Athenaem

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $26,637,542

View Larger +

View Larger +

Prev

Next

#81

Company Name: University Surgical Associates

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $27,334,560

View Larger +

View Larger +

Prev

Next

#80

Company Name: Audubon Society of RI

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $27,786,166

View Larger +

View Larger +

Prev

Next

#79

Company Name: Children’s Friend

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $27,853,045

View Larger +

View Larger +

Prev

Next

#78

Company Name: University Medicine Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $28,132,698

View Larger +

View Larger +

Prev

Next

#77

Company Name: Home and Hospice Care of RI

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $29,179,344

View Larger +

View Larger +

Prev

Next

#76

Company Name: Amica Companies Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2012

Total Assets: $29,935,865

View Larger +

View Larger +

Prev

Next

#75

Company Name: Samuel Freeman Charitable Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $29,940,503

View Larger +

View Larger +

Prev

Next

#74

Company Name: Woonsocket Neighborhood Development Corp

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $30,332,328

View Larger +

Prev

Next

#73

Company Name: TriMix Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $30,587,000

View Larger +

Prev

Next

#72

Company Name: Providence Public Library Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $31,820,384

View Larger +

Prev

Next

#71

Company Name: YMCA Pawtucket

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $32,833,487

View Larger +

View Larger +

Prev

Next

#70

Company Name: Times2 Inc

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $33,670,874

View Larger +

View Larger +

Prev

Next

#69

Company Name: Newport Restoration Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $33,952,845

View Larger +

View Larger +

Prev

Next

#68

Company Name: Memorial and Library Association

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $34,034,112

View Larger +

Prev

Next

#67

Company Name: Feinstein Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $34,171,211

View Larger +

Prev

Next

#66

Company Name: PPAC

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $34,316,374

View Larger +

View Larger +

Prev

Next

#65

Company Name: Roger Williams Law School

Org. Type: (501)(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $34,536,000

View Larger +

Prev

Next

#64

Company Name: Plan International USA

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $36,951,753

View Larger +

Prev

Next

#63

Company Name: Meeting Street

Org. Type: 501(c)(3)

Fiscal Year Ending: August 2013

Total Assets: $38,933,494

View Larger +

View Larger +

Prev

Next

#62

Company Name: RI Blood Center

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $38,937,953

View Larger +

View Larger +

Prev

Next

#61

Company Name: OSHEAN, Inc.

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $38,945,842

View Larger +

Prev

Next

#60

Company Name: Greater Providence YMCA

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $39,710,483

View Larger +

View Larger +

Prev

Next

#59

Company Name: Gordon Research Conferences

Org. Type: 501(c)(3)

Fiscal Year Ending: October 2013

Total Assets: $40,643,987

View Larger +

View Larger +

Prev

Next

#58

Company Name: CVS Caremark Charitable Trust

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $41,398,945

View Larger +

View Larger +

Prev

Next

#57

Company Name: ProvPort Inc.

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $43,174,375

View Larger +

View Larger +

Prev

Next

#56

Company Name: St. Andrews School

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $43,939,583

View Larger +

View Larger +

Prev

Next

#55

Company Name: Jewish Federation Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $47,138,605

View Larger +

View Larger +

Prev

Next

#54

Company Name: Preservation Society of Newport County

Org. Type: 501(c)(3)

Fiscal Year Ending: March 2014

Total Assets: $49,797,781

View Larger +

View Larger +

Prev

Next

#53

Company Name: Jonathan Nelson Family Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $50,427,395

View Larger +

View Larger +

Prev

Next

#52

Company Name: Seth Sprague Educational and Charitable Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $50,926,807

View Larger +

View Larger +

Prev

Next

#51

Company Name: Rhode Island Hospital Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $53,927,147

View Larger +

View Larger +

Prev

Next

#50

Company Name: Landmark Medical Center

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $54,452,021

View Larger +

View Larger +

Prev

Next

#49

Company Name: Memorial Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $55,728,659

View Larger +

View Larger +

Prev

Next

#48

Company Name: Providence Community Health Centers

Org. Type: 501(c)(3)

Fiscal Year Ending: November 2013

Total Assets: $56,763,431

View Larger +

View Larger +

Prev

Next

#47

Company Name: LMW Healthcare

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $58,654,97

View Larger +

View Larger +

Prev

Next

#46

Company Name: Women and Infants Corporation

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $59,200,632

View Larger +

View Larger +

Prev

Next

#45

Company Name: Memorial Hospital Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $60,150,167

View Larger +

View Larger +

Prev

Next

#44

Company Name: International Tennis Hall of Fame

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $60,266,635

View Larger +

View Larger +

Prev

Next

#43

Company Name: North American Catholic Education Programming

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $60,857,704

View Larger +

View Larger +

Prev

Next

#42

Company Name: Westerly Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2012

Total Assets: $61,548,498

View Larger +

View Larger +

Prev

Next

#41

Company Name: Tockwotton Home

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $64,755,230

View Larger +

View Larger +

Prev

Next

#40

Company Name: American Athletic Conference

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $66,670,782

View Larger +

View Larger +

Prev

Next

#39

Company Name: Clay Mathematics Institute

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $69,270,772

View Larger +

View Larger +

Prev

Next

#38

Company Name: 1772 Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $71,604,385

View Larger +

View Larger +

Prev

Next

#37

Company Name: Homeownership Affordability Trust Fund

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $73,861,423

View Larger +

View Larger +

Prev

Next

#36

Company Name: St. Joseph’s Health Service

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $77,002,711

View Larger +

View Larger +

Prev

Next

#35

Company Name: Wheeler School

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2014

Total Assets: $85,169,605

View Larger +

View Larger +

Prev

Next

#34

Company Name: Karing

Org. Type: 501(c)(4)

Fiscal Year Ending: June 2013

Total Assets: $86,078,959

View Larger +

View Larger +

Prev

Next

#33

Company Name: Butler Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $87,976,25

View Larger +

View Larger +

Prev

Next

#32

Company Name: LG Balfour Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: March 2014

Total Assets: $97,794,510

View Larger +

View Larger +

Prev

Next

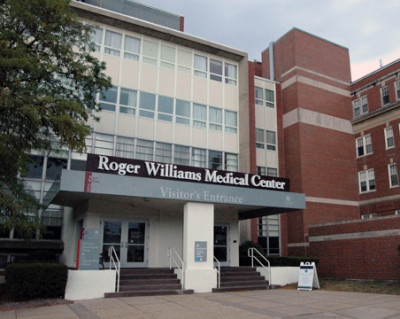

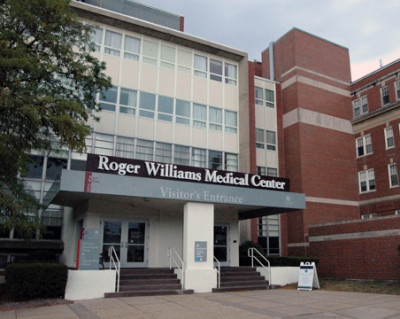

#31

Company Name: Roger Williams Medical Central

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $100,109,462

View Larger +

Prev

Next

#30

Company Name: Proprietors of Swan Point Cemetery

Org. Type: 501(c)(13)

Fiscal Year Ending: December 2012

Total Assets: $104,509,717

View Larger +

View Larger +

Prev

Next

#29

Company Name: Delta Dental

Org. Type: 501(c)(4)

Fiscal Year Ending: December 2013

Total Assets: $112,273,893

View Larger +

View Larger +

Prev

Next

#28

Company Name: South County Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $115,062,718

View Larger +

View Larger +

Prev

Next

#27

Company Name: Charles & Agnes Kazarian Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: November 2013

Total Assets: $124,783,232

View Larger +

View Larger +

Prev

Next

#26

Company Name: Bradley Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $129,964,006

View Larger +

View Larger +

Prev

Next

#25

Company Name: Dr. Ralph and Marian Falk Medical Research Trust

Org. Type: 501(c)(3)

Fiscal Year Ending: November 2013

Total Assets: $131,058,917

View Larger +

View Larger +

Prev

Next

#24

Company Name: Neighborhood Health Plan

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $134,475,983

View Larger +

View Larger +

Prev

Next

#23

Company Name: URI Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $135,974,992

View Larger +

View Larger +

Prev

Next

#22

Company Name: Care New England

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $129,665,881

View Larger +

View Larger +

Prev

Next

#21

Company Name: American Mathematical Society

Org. Type: (501)(c)3

Fiscal Year Ending: December 2013

Total Assets: $140,161,469

View Larger +

Prev

Next

#20

Company Name: Newport Hospital Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $150,962,397

View Larger +

View Larger +

Prev

Next

#19

Company Name: Salve Regina University

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $153,779,495

View Larger +

View Larger +

Prev

Next

#18

Company Name: Kent County Hospital

Org. Type: 501 (c)(3)

Fiscal Year Ending: September 2013

Total Assets: $169,139,183

View Larger +

View Larger +

Prev

Next

#17

Company Name: U.W. Eugene Higgins Charity

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $171,872,194

View Larger +

View Larger +

Prev

Next

#16

Company Name: Warren Alpert Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2012

Total Assets: $195,020,101

View Larger +

View Larger +

Prev

Next

#15

Company Name: St. George’s School

Org. Type: 501(c)(4)

Fiscal Year Ending: June 2013

Total Assets: $195,282,099

View Larger +

View Larger +

Prev

Next

#14

Company Name: Champlain Foundation (Third)

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $235,600,752

View Larger +

View Larger +

Prev

Next

#13

Company Name: New England Institute of Technology

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $218,633,441

View Larger +

Prev

Next

#12

Company Name: Plan International Inc.

Org. Type: 501(c)(3)

Fiscal Year Ending June 2013

Total Assets: $288,910,069

View Larger +

View Larger +

Prev

Next

#11

Company Name: Roger Williams University

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $295,411,000

View Larger +

View Larger +

Prev

Next

#10

Company Name: Newport Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $325,236,038

View Larger +

View Larger +

Prev

Next

#9

Company Name: Women and Infants Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $343,217,250

View Larger +

View Larger +

Prev

Next

#8

Company Name: Bryant University

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $375,442,504

View Larger +

View Larger +

Prev

Next

#7

Company Name: Miriam Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $439,298,535

View Larger +

View Larger +

Prev

Next

#6

Company Name: RISD

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $561,270,231

View Larger +

View Larger +

Prev

Next

#5

Company Name: Providence College

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $622,188,667

View Larger +

View Larger +

Prev

Next

#4

Company Name: The Rhode Island Foundation

Org. Type: 501(c)(3)

Fiscal Year Ending: December 2013

Total Assets: $736,167,411

View Larger +

View Larger +

Prev

Next

#3

Company Name: Johnson and Wales University

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $892,385,151

View Larger +

Prev

Next

#2

Company Name: Rhode Island Hospital

Org. Type: 501(c)(3)

Fiscal Year Ending: September 2013

Total Assets: $1,309,249,253

View Larger +

View Larger +

Prev

Next

#1

Company Name: Brown University

Org. Type: 501(c)(3)

Fiscal Year Ending: June 2013

Total Assets: $4,397,600,917

Related Articles

Enjoy this post? Share it with others.