City Writes Off Millions in Economic Development Loans

Tuesday, June 26, 2012

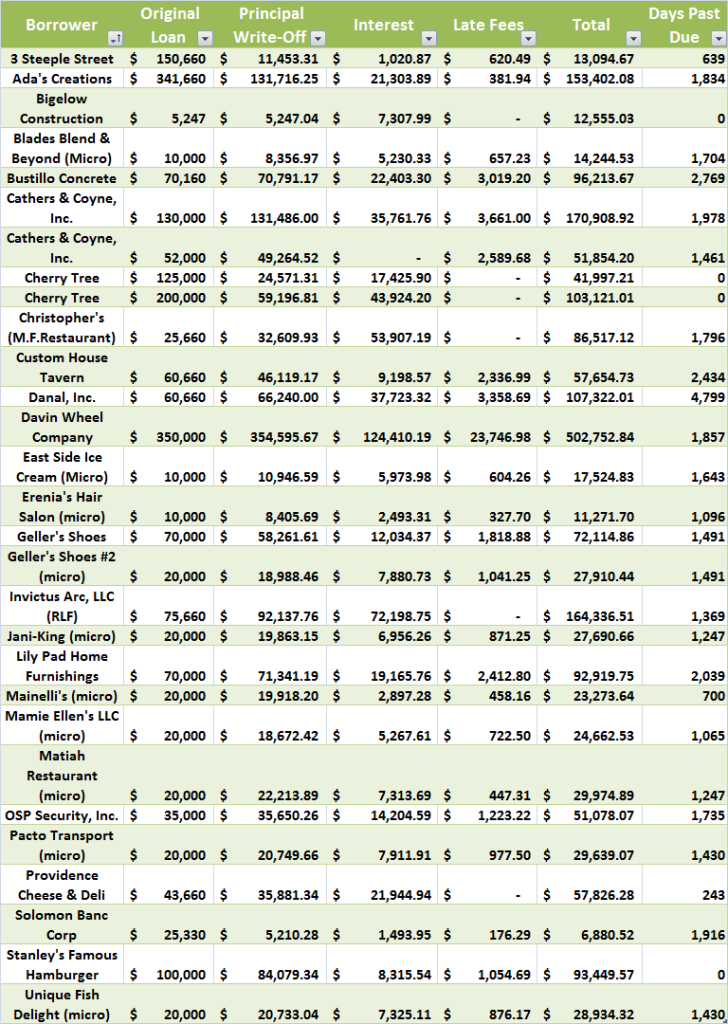

The Providence Economic Development Partnership (PEDP) last week voted to write off 29 taxpayer-backed loans for small businesses, leaving the capital city on the hook for $2,171,125.66, GoLocalProv has learned.

All but seven of those loans were more than 1,000 days past due and one –a $60,660 loan for Danal, Inc. issued in 1996— was 4,799 days late as of last week.

The majority of write-offs were applied to companies that barely made a dent in their original loan, including the Davin Wheel Company, which received a $350,000 loan in February 2006 and owed $502,752.84 with interest and late fees before the PEDP chose to eat their loss, records show.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTIn total, a half dozen six-figure loans were written off, including one for Ada’s Creations ($153,402.08), a South Side bar that had its liquor license suspended for 11 days earlier this year after a teenager was shot in the establishment’s parking lot. Ada’s received only a partial write-off and still owes the PEDP over $200,000.

While some of the loans date back as far as 1990, more than half were dished out between 2005 and 2009, including a $20,000 micro loan awarded to Mainelli's Restaurant on Chalkstone Ave. in December 2009. As of last week, the restaurant hadn’t made a payment in 700 days and owed $23,273.64 on its loan.

Risky Loans

The slew of write-offs came eight months after GoLocalProv first reported that a quarter of all loans issued by the PEDP were at least 90 days past due and that the city would be out over 3 million if the funds couldn’t be recovered. At the time PEDP lawyer Josh Teverow said the city was actively pursuing collections against 11 businesses that combined to owe $1,365,660. Seven of those loans were written off last week.

By design, PEDP loans, which are funded through the U.S. Department of Housing and Urban Development (HUD), are meant to be a lender of last resort for companies. Business owners are required to be turned away from at least two banks in order to qualify.

But the loans still have to be approved by the PEDP’s 15-member board of directors, which is chaired by Mayor Angel Taveras. The agency’s executive director is Jim Bennett, who also serves as the city’s Economic Development Director.

In the year years leading up to Taveras taking office, the delinquency rate of the loans soared, leading HUD to conduct a full review of the agency. That report is expected to be released next week, according to HUD spokesperson Rhonda Siciliano, who said the agency now has to approve certain PEDP loans before they are distributed.

During GoLocalProv’s initial inquiry into the loan fund, former PEDP executive director acknowledged that number of delinquent loans was high, but said part of that was to be expected considering many companies only come to the PEDP after they have exhausted all of their options.

“As a result our loans are very risky,” Deller said at the time. “Second, given this risk and the present economic climate, we have greater potential for delinquency. With that said, 25% delinquency is high. However, it is not our goal to put people out of business, but to give them every chance to succeed. We are concerned, we will work with our clients to give them every opportunity to succeed and we will continue to evaluate new loans to ensure that we aren't taking too much risk.”

Councilman Calls for More Oversight

But while the PEDP may have the best intentions, Councilman David Salvatore said it is still in need of more oversight. Salvatore, who is expected to be named chairman of the Finance committee this week, said he is committed to taking a closer look at the agency.

“The difficulties of the economy coupled with the City Council’s fiduciary responsibility to taxpayers, give good reason for expanded oversight surrounding economic development loans,” Salvatore said Monday. “The City Council’s committee on finance is committed to exploring oversight resources in the months to come.”

Salvatore said he understands the city needs to look for ways to improve the business climate, but it must continue to do its due diligence when it comes to investing.

“The bottom line is we must continue to look at new ways of curbing costs, while promoting economic development in Providence,” Salvatore said. “Clearly, if a municipality is participating with credit, then, as in the case of any other competent lending organization, the City of Providence should require an oversight process.

Dan McGowan can be reached at [email protected].