Why Connecticut Lost GE by Aaron Renn

Sunday, January 17, 2016

When Connecticut governor Dannel Malloy proposed $750 million in new business taxes last year as part of a $1.5 billion package of tax hikes, the state’s major companies weren’t amused. General Electric, in particular, questioned whether it would stay in Connecticut if the tax increases took effect. It turns out the company wasn’t bluffing. Connecticut did raise taxes, and GE has announced that it will move its headquarters from Fairfield to Boston. The Nutmeg State has seen its share of industrial relocations, restructurings, and downsizings; it has so many empty office parks that a local NPR station dubbed Connecticut a “suburban corporate wasteland.” Aetna demolished a 1.3-million-square-foot campus in Middletown. Pfizer knocked down a 750,000-square-foot research center in Groton.

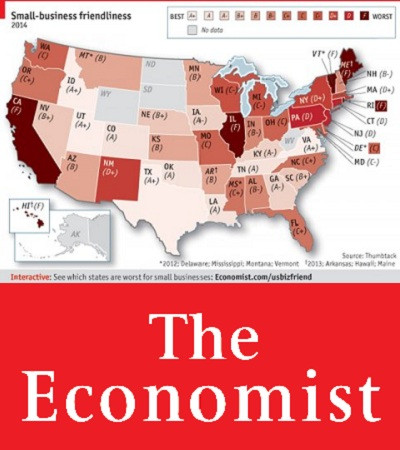

Connecticut’s business climate is poor. The Tax Foundation ranks its business-tax environment 44th in the country. GE’s decision to move is part of a larger story. Changes in the economy and culture, and improvements in governance of cities, have created a profound competitive challenge for Connecticut, one without easy solutions.

For decades, nearby New York City’s pain was Connecticut’s gain. New York was a grim, dangerous, failing city that almost went bankrupt in the 1970s. More than 100 Fortune 500 companies fled during that era, many heading to suburban New Jersey and Connecticut—including GE, which moved in 1974 from 570 Lexington Avenue to Fairfield, Connecticut. The same story played out in cities across America, with corporations fleeing dying downtowns for the safety of the suburban office campus.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTToday, cities are back. The policing revolution—helped by the waning of the crack epidemic—made cities safe again. Core public services were slowly restored, parks were rebuilt, and transit systems were cleaned up and refurbished. Investment started returning. The structure of the economy changed, too. Starting in the 1990s, technology radically transformed the business world and is now a major industry in its own right. The financial industry was deregulated. Globalization drove demand for new types of business services, reinforcing the need to stay on top of a constantly shifting landscape. People with advanced, specialized knowledge are the ones who help companies innovate now. These employees work in highly interactive ways that benefit from clustering together—disproportionately in urban areas like New York, Chicago, and Boston.

Big cities have become increasingly desirable to the young. The children of those who fled to suburbs to escape urban decline have embraced city living. Unlike the Baby Boomers, who were raised in an era when cities were getting worse and worse, the Millennials came of age as cities were being reborn. This produced a completely different psychology. With a larger segment of the next-generation workforce located in urban areas—and often not owning cars—many companies have had to open downtown offices again or relocate entirely to attract the talent they need.

As a result, the urban cores of New York City and Chicago have hit record employment levels. Companies like Google that didn’t even exist in the bad old days of the seventies and eighties now employ thousands of people in downtown environments. Manhattan is Google’s second-largest engineering office outside Silicon Valley. Boston has become a dominant location for biotech, with Cambridge’s Kendall Square alone adding over 10 million square feet of biotech space since 2009. It’s not surprising that the increasingly tech-driven GE is moving to Boston. Not only is Boston the premier urban center in New England; it has also long been America’s traditional second city of technology.

The tide of business relocation has turned against Connecticut. While not all downtown business districts are booming—those in New Haven, Hartford, and Bridgeport certainly aren’t—Connecticut happens to be located between two of the most resurgent ones in the country. In the old environment, Connecticut didn’t have to work that hard to attract business. Even today, its tax-climate rank of 44th is better than New York State’s (49th) and New Jersey’s (50th). For years, Connecticut could get away with being the best house on a bad block. During the seventies and eighties, corporations exiting decaying downtowns made a beeline for the suburbs—and for many, that meant Connecticut. Today, the flow of firms is just as likely to be going in the other direction. And the rise of the technologically enabled business means that it’s now possible to scatter even white-collar functions all over the globe. Connecticut is competing for the highest-end jobs not just with downtowns and regions in other states but also with cities around the world.

It doesn’t matter anymore that Connecticut’s tax environment is (marginally) better than New Jersey’s. Businesses can go anywhere. The finance industry, for example, has found places like Charlotte a much more congenial location to set up shop. The suburban office park is not going away, but in the future, it’s headed for places like Houston, where ExxonMobil is building a 10,000-employee campus; Dallas, where Toyota is setting up its North American campus; or even Bangalore, with its massive outsourcing operations. All these locales have vastly superior cost climates to Connecticut, which has little chance of attracting any business that doesn’t have a clear geographic requirement for being in the northeastern United States. Unsurprisingly, while even the less-than-stellar national economy grew total jobs by 5.3 percent from 2000 to 2014, Connecticut’s job growth was down 1.6 percent. Connecticut is increasingly the odd man out, falling short both to resurgent downtowns and to cheaper Sunbelt and global cities.

All is not lost. Connecticut still has advantages in its high-quality workforce and proximity to New York City. But rather than adjusting to new realities, Governor Malloy added insult to injury with his tax increases. GE’s departure should be a wakeup call in Hartford that marketplace patience with the state’s harsh business climate is wearing thin.

Aaron M. Renn is a senior fellow at the Manhattan Institute and a contributing editor of City Journal.

This article originally ran in City Journal on January 14, 2016

Related Slideshow: RI Business Rankings in US

See how Rhode Island stacked up.

Related Articles

- 10 Biggest Issues Facing Providence in 2016

- Ten Biggest Issues in the City for 2016

- St. George’s Agrees to Hire Independent Investigators to Examine Sexual Abuse

- NEW: Petition Started to Stop Bristol 4th of July Parade Route Changes

- NEW: Newport Gulls Manager Mike Coombs Retires

- Jencunas: Raimondo a Major Factor in Bringing GE to RI

- Here’s Where Americans Live The Longest

- Don Roach: Obama Gets Gun Control Wrong…Again

- St. George’s Sexual Assault Survivors Call For Independent Investigation

- Toll Opponents Targeting RI Legislative Leaders Next Week with “Phone Flash Mob”

- Music Legend Diana Ross Coming to PPAC in April

- Reports Say GE Picking Boston for New HQ Over Providence

- No Toll Bill Introduced at RI General Assembly

- RI Supreme Court Justice Blocked Effort to Unveil St. George’s Abuse in 1980s

- Raimondo Getting Great National PR, While Struggling in RI

- St. George’s and Victims’ Group Agree to Tap Former MA Attorney General to Lead Investigation

_400_400_90_400_400_90.jpg)

_400_400_90.jpg)

_400_400_90_80_80_90_c1.jpg)

_80_80_90_c1.jpg)