Smart Benefits: IRS Releases New ACA Guidance

Monday, January 18, 2016

In its 31 pages, IRS Notice 2015-87 clarifies some lingering questions about the Affordable Care Act’s employer mandate, including:

Adjusted Affordability Threshold.

Coverage offered by an employer is deemed affordable if the employee’s required contribution doesn’t exceed a specified percentage of the employee’s household income. Because household income is virtually impossible for an employer to calculate, the IRS created three safe harbors that can be used in place of the household income test: W-2, Rate of Pay and Federal Poverty Level.

While the IRS has indexed the household income affordability level, from 9.5% for 2014, to 9.56% for 2015 and 9.66% for 2016, until this notice, the affordability safe harbors had not been indexed, and remained at 9.5%. The new guidance provides that the references to 9.5% are adjusted to 9.56% for plan years beginning in 2015, and 9.66% for plan years beginning in 2016.

Adjusted Penalty Amounts.

Although the ACA regulations provided that penalty amounts would be adjusted for inflation, the IRS didn’t release the specific dollar amounts used to calculate penalties for 2015 and 2016. The new guidance confirms that for calendar year 2015, the adjusted $2,000 penalty amount (for employers not offering coverage) is $2,080 and the adjusted $3,000 penalty amount (for employers offering coverage that isn’t affordable or doesn’t provide minimum value) is $3,120. For calendar year 2016, the adjusted $2,000 penalty amount is $2,160, and the adjusted $3,000 penalty amount is $3,240.

Refined Hours of Service Rules.

The IRS will revise its “hours of service” rules to clarify that employers need not count as hours of service periods of time during which an employee isn’t performing services but is receiving workers’ compensation benefits.

The term “hour of service” does include periods during which an individual is not performing services but is receiving payments due to short-term disability or long-term disability if the individual retains the status as an employee of the employer, unless the payments are made from an arrangement to which the employer did not contribute directly or indirectly. Any arrangements under which the individual paid with after-tax contributions would be treated as an arrangement to which the employer did not contribute and payments from the arrangement would not give rise to hours of service.

Effect of Opt-Out Payments, HRA Contributions, and Cafeteria Plan Flex Credits on Affordability.

Opt-Out Payments

In the guidance, the IRS said it intends to issue regulations in the near future that would require employers to take opt-out payments into account when calculating whether health plan coverage is affordable.

The forthcoming regulations won’t impact affordability calculations for the 2015 Forms 1095-C going out to employees in March 2016. Moreover, for employers with existing opt-out payment programs in place by December 16, 2015, the regulations are not expected to affect the affordability calculations for the 2016 forms sent out in early 2017. Any employer adopting an opt-out payment program after December 16, 2015, will have to immediately begin including the opt-out payment into its affordability calculations.

Employers who have opt-out payments in place will want to wait for the IRS to issue its regulations before deciding to revise or eliminate the program, as the IRS may provide some exceptions or other provisions to consider.

Employer HRA Contributions

Amounts made available for the current plan year that an employee may use to pay premiums for an eligible employer-sponsored plan, and may also use for cost-sharing and/or for other health benefits not covered by that plan in addition to premiums, are counted towards the employee’s required contribution (thereby reducing the dollar amount of the employee’s required contribution).

For example, if the employee contribution for health coverage is $200 per month, and the employer makes available $1,200 per year under an HRA ($100 per month) that the employee may only use to pay the employee share of contributions for the major medical coverage, the employee’s required contribution for the medical plan is $100 ($200 - $100) per month. Importantly, the HRA must satisfy the requirements for integration with the employer’s health plan (watch this space for more details on the integration rules).

Cafeteria Plan Flex Credits

For purposes of affordability, an employee’s required contribution is reduced by employer contributions under a cafeteria plan that (1) may not be taken as a taxable benefit; (2) may be used to pay for minimum essential coverage; and (3) may be used only to pay for medical care. A contribution under an arrangement that satisfies all three criteria is referred to as a “health flex contribution.” A health flex contribution reduces an employee’s required contribution dollar-for-dollar. Conversely, an employer flex contribution that is not a health flex contribution does not reduce an employee’s required contribution. For example, if an employer flex contribution that is available to pay for health care is also available to pay for any non-health care benefits (e.g., dependent care or group term life insurance), that contribution is not a health flex contribution and, as a result, does not reduce the required employee contribution.

A health flex contribution – for example, an employer contribution to a health-only FSA - will be taken into account for affordability purposes just as the integrated HRA contribution is in the example above.

The Notice includes a transition rule, available only to existing arrangements, under which, for plan years beginning before January 1, 2017, an employer flex contribution that is not a health flex contribution will be treated as reducing the amount of an employee’s required contribution.

Rob Calise is the Managing Director, Employee Benefits. of Cornerstone|Gencorp, where he helps clients control the costs of employee benefits by focusing on consumer driven strategies and on how to best utilize the tax savings tools the government provides. Rob serves as Chairman of the Board of United Benefit Advisors, and is a board member of the Blue Cross & Blue Shield of RI Broker Advisory Board, United HealthCare of New England Broker Advisory Board and Rhode Island Business Healthcare Advisors Council. He is also a member of the National Association of Health Underwriters (NAHU), American Health Insurance Association (AHIA) and the Employers Council on Flexible Compensation (ECFC), as well as various human resource associations. Rob is a graduate of Bryant University with a BS in Finance.

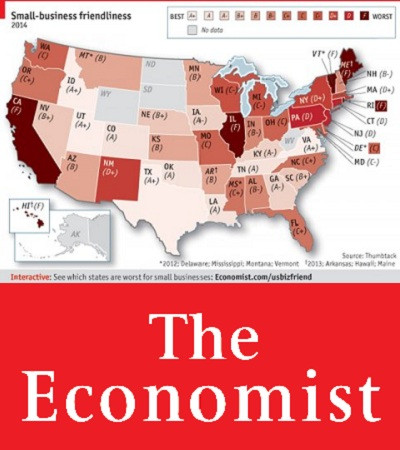

Related Slideshow: RI Business Rankings in US

See how Rhode Island stacked up.

Related Articles

- Smart Benefits: Determine Independent Contractor vs. Employee for ACA Compliance

- Smart Benefits: New IRS Notice Issued on Cadillac Tax

- Smart Benefits: Prepare for Open Enrollment Season

- Smart Benefits: IRS Posts ACA Compliance Resource for Large Employers

- Smart Benefits: Veterans Exempt from Employee Count Under ACA

- Smart Benefits: File 2014 Taxes—or Risk Losing Subsidy

- Smart Benefits: 2016 Health Insurance Rates Approved

- Smart Benefits: IRS Releases ACA Taxpayer Data for 2014

- Smart Benefits: New OHIC Standards to Improve Health Care Delivery

- Smart Benefits: Delaware Says No to State Exchange

- Smart Benefits: Is Your Package Competitive? What’s New in Employee Benefits

- Smart Benefits: Safe Harbor for Online Insurance Policies Ends Nov. 1

- Smart Benefits: Small Businesses Remain Those with 50 or Less Employees

- Smart Benefits: 10 Days to Shop for New HealthSource Plan for Jan. 1

- Smart Benefits: ACA Insurance Reforms Finalized

- Smart Benefits: Boost Employee Retirement Contributions in the New Year

- Smart Benefits: ACA’s “Cadillac Tax” Delayed

- Smart Benefits: ACA Employer Reporting Deadlines Extended

- Smart Benefits: CMS Proposes Improvements for Marketplace

- Smart Benefits: Private Employers Offer Loan Repayment to Attract Young Workers

- Smart Benefits: Benefits Increasingly Key to Recruitment

- Smart Benefits: Important Reminders for 2016 Exchange Open Enrollment

- Smart Benefits: Year-End ACA Tax Tip for Employers

- Smart Benefits: Retirement Plan Contribution Limits Remain Unchanged for 2016

- Smart Benefits: Three Hot HR Topics for 2016

_400_400_90_400_400_90.jpg)

_400_400_90.jpg)

_400_400_90_80_80_90_c1.jpg)

_80_80_90_c1.jpg)