Riley: RhodeMap RI is Deeply Flawed

Tuesday, November 25, 2014

How do Central Planners plan when they have no idea what the budgets of the various cities and towns can handle? Without understanding the current economics and each towns ability to finance any plans how did this Group arrive at a State Economic Development Plan? Reading through HUD Sustainable development plans and the various agendas of Grow Smart RI, RhodeMap RI and other like minded promoters of “social equity” it becomes more and more apparent that there is little or no thought given to improving economic development.

The opening page of the 186 page document entitled “Economic Development Plan” is Lincoln Chafee talking about the plan to oversee “diversity, public education, energy, climate change, public health, transportation, performance measurement, environment, social equity and a diverse population. “

The plan presented was funded in Rhode Island by Washington DC’s Housing and Urban Development and lead by the RI Division of Planning. The grant was in the name of Sustainable Communities Regional Planning Grant. The stated goal of the grant is to foster a more “sustainable” economy by coordinated planning and investment in housing, job creation, workforce training and transportation.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTBut Quickly the real purpose of this planning is revealed well before that of “economic development” consider the following paragraph “An essential goal of the RhodeMap RI process was to address social equity, particularly looking at systems, programs and ideas that have the effect of marginalizing certain groups of people. As ideas about job growth, investment, training and others were explored, discussions about social equity were a constant reminder to measure potential economic strategies with the question “Who benefits?” Such questioning quickly reveals that without strategies specifically targeted at populations with greater barriers to opportunity, those barriers may never be overcome.”

The authors go on to explain that Rhode Island cannot succeed without this plan that includes the arts organizations, public-private partnerships and housing advocates. ???

“State as Convener: From businesses, to arts organizations, to housing advocates – we have heard that the State and its partners can play the role of convener - providing a hub for information across many topics and a place where different businesses, non-profits, citizens and others can find each other and work together. Public-private partnerships are needed for many of the strategies in this plan, and the state will not succeed without such collaboration.”

Where does this comment come from? Has no other place in America been successful without such central planning? Is Rhode Island unique in needing the arts, various Bureaucracies and housing advocates in order to succeed? This plan declares we can’t succeed without these entities as though it is a fact. Where does this thinking come from? Maybe my view of success and the authors’ version of “success” are very different,

Then, there is the very sticky issue of funding the Growth Center approach to this plan. Growth Centers will be identified and then HUD will ask for increased taxes from localities to help pay for these efforts at “Social Equity."The State and federal Government not only will ask, but they will require taxpayer participation. For those who believe their taxes cannot be raised due to Senate 3050 (2007 law capping tax levy), not so fast. This Chafee /RhodeMap RI plans to tax many of you above the tax cap in the name of low cost Housing and “Sustainable” development.

The report suggests the following:

Consider exempting Growth Centers from the state’s tax levy cap to remove disincentives

for public and private investment.

“Updated in 2007, the state’s property tax levy cap limits the allowable growth in total revenues

from property taxes to a fixed rate of four percent each year. Any revenue exceeding this cap

Must be returned to the taxpayers and absorbed by a municipality through spending reductions.

The levy is not a restriction on the growth of the tax rate, but rather on the total revenue collected.

Exceptions to the levy are granted for the following situations:

- Loss of non-property tax revenue;

- Fiscal emergency;

- Increase in debt service obligation;

- Growth that necessitates increased expenditure for infrastructure or municipal services.

“An assessment performed by Grow Smart RI revealed that, while many municipalities have used the

First three exemptions listed above, none have used the fourth. The fact that no municipality has ever sought approval to exceed the levy cap based on “growth” underscores the concern about stalled economic development at the municipal level. The statute assumes growth would occur first and then necessitate infrastructure investment, when in fact substantial growth might not be able to take place without first making the public investment in infrastructure to accommodate desired growth.

The recommendation from this economic development plan is to revisit this issue and add designated Growth Centers to the list of exemptions for the tax levy cap. This legislative amendment will not only allow municipalities to realize the fiscal benefits of smart growth, but will also encourage public infrastructure investment in these areas.”

Folks, this document is lengthy and I found the scope of the plan frightening as it augurs for a huge increase in governmental intrusion in to our lives. The plan regularly postulates without supporting facts, it suggests experimentation, and proposes implementation without once even addressing the current economics. Our state is facing structural revenue issues over the next 5 years. More ominously, our municipalities have staggering debt from pension and Opeb under funding and several cities, most obviously Providence, will not make it without first going Bankrupt. This plan has no answer to that condition or even recognition of this fact. How can this be an economic development plan without discussing the economics? I recommend that the legislature set aside this report and send the authors back to the commune that this report sprang from. It is evident that the Status Quo is unacceptable and I agree with the authors on that point. However the report suggests the same people, with increased government intrusion, will somehow improve horrible mismanagement of our tax dollars thus far. It is unfathomable that this ridiculous RhodeMap RI plan implemented by the same people in office now will be suddenly successful. The authors suggest little or no reduction in current Government, in fact they propose to add to the current failure of our local government by sharing power with the federal Government and thus increasing the fines, penalties and resulting exposure to eminent domain that is very much part of this plan.

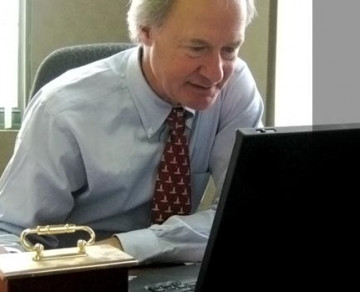

Michael G. Riley is vice chair at Rhode Island Center for Freedom and Prosperity, and is managing member and founder of Coastal Management Group, LLC. Riley has 35 years of experience in the financial industry, having managed divisions of PaineWebber, LETCO, and TD Securities (TD Bank). He has been quoted in Barron’s, Wall Street Transcript, NY Post, and various other print media and also appeared on NBC news, Yahoo TV, and CNBC.

Related Slideshow: The 15 Costliest Government Programs in RI

Related Articles

- Michael Riley: From Head-start to Harvard to the Hoosegow Part 2

- Michael Riley: From Head-start to Harvard to the Hoosegow?

- Riley: Let the Rhode Island Treasurer’s Race Begin with Facts

- Riley: Caprio Track Record Good, Seth Magaziner Claims Questioned

- Riley: RI Treasurer’s Race Part 4: Public Fund Summit 2014

- Riley: CF Bailout: Largest Theft of Taxpayer Money in RI History?

- Michael Riley: GASB 68 Portends Huge Problems for City and State

- Michael Riley: Don’t Pay

- Michael Riley: Failed Pension Commission Ponders Permanent Oversight Commission

- Michael Riley: West Warwick and Gallogly Pull Hoax on Taxpayers

- Michael Riley: 38 Studios Insider Trade and Municipal Fraud

- Riley: Taveras, Mancini & Wainwright Investment Counsel, LLC

- Riley: Mancini, Wainwright and Taveras Part 2

- Michael Riley: Projo, Elorza and Cianci are all Blind to Reality

- Michael Riley: Alerting Treasurers, Governors: Providence Pension Fund Collapsing

- Riley: Providence Journal and Seth Magaziner Perfect Together

- Riley: Providences Wainwright Caught in Renaissance Hedge Fund Lie

- Riley: Post Election, Lots of Work to Be Done in Providence

- Michael Riley: The Reality of Providence Pension Liability

- Michael Riley: Integrity? Whatever…

- Michael Riley: The RI Treasurer Democratic Primary Race Gets Uglier

- Michael Riley: Rhode Island Treasurer is About Integrity and Experience

- Michael Riley: Can Taveras Clean Up His Act for the New Mayor?

- Michael Riley: Pension Obligation Bonds? Oh My!!

- Riley: The Plans of RhodeMap RI May Scare People