Riley: Did Chris Christie Discover Gold?

Tuesday, May 23, 2017

Recently Governor Chris Christie proposed placing the New Jersey Lottery system and revenues under the care and management of the State Pension plan for 30 years.

The idea apparently has been brewing for a while and at first glance looks like a drastic action.

This idea was highlighted in Russell Moore’s excellent article yesterday.

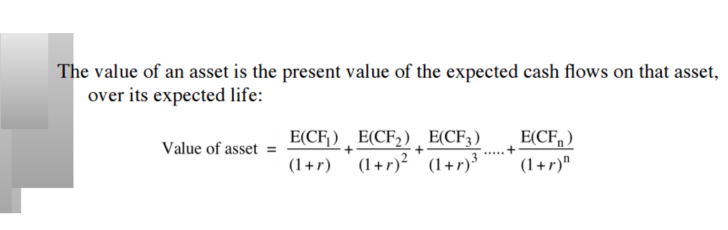

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTThis intriguing proposal is interdependent on some very complicated workings and accounting. It starts with the accepted financial idea that the RI Lottery has annual cash flows of variable predictability.

The financial concept is the following, as my former professor Aswath Damadoran describes below.

Rhode Island Lottery net revenues to the general fund were $369.8 million as of fiscal year end June 3, 2016. The Moore proposal and NJ contemplate placing an asset “The Lottery” which NJ says produces nearly $1 billion a year in revenue and they have estimated the value of the asset to be placed in the pension fund as $13 Billion.

The plan is to then return the lottery revenues to the General Coffers in 30 years. Most of us will all be plant food by then, including Chris Christie, so this appears to be a typical misleading political maneuver. But for the sake of investigation I want to work through the numbers and the complications. I have not seen how New Jersey arrived at its valuation for the Lottery of $13 billion. Simple estimating implies an RI Lottery asset “worth” $4.5 Billion.

There are many complications involved in this estimate. Those complications include that the lottery system cannot legally be fully privatized. So, creating a theoretical value is suspect. Nevertheless, there is a cash flow expected and subject to estimates that can be discounted to a present value. What discount rate was used? And what should be used? Does every lottery system have different risks and therefor different discount rates? Then there is the huge accounting issue and GASB. How does the Pension actuary discount 30 years of cash flows from the lottery?

While these are serious complications, apparently, somebody in New Jersey has worked through these issues and made assumptions. I want to see these assumptions and calculations then apply Rhode Island’s numbers to get an idea of the effect such a proposal would have here.

What is the privatization of a public assets?

Highways, Toll Bridges and Public Utilities have all been privatized, sold by Governments to private investors. Unfortunately, privatization of public assets , and unusual debt financing, like issuing Pension Obligation Bonds, are often early markers for approaching bankruptcy. The Ratings agencies have already warned Rhode Island and Providence against one time fixes for structural financial problems. Here is how a recent academic white paper put it:

“Governments undertaking privatization have pursued a variety of objectives. In some cases, privatization is a means of achieving gains in economic efficiency, given the extensive prevalence of poor economic performance of public enterprises in many countries and limited success with their reform. Privatization can also be a mechanism for improving the fiscal position, particularly in cases where governments have been unwilling or unable to continue to finance deficits in the public enterprise sector, such as in Argentina. Liquidity-constrained governments facing fiscal pressures have sometimes privatized with a view to financing fiscal deficits with the proceeds. And privatization can also be a means of developing domestic capital markets, which is also correlated with growth.”

Are we New Jersey or Argentina?

Substitute Argentina with Providence or Rhode Island in the above paragraph and I think that’s where we are. We are praying for a way out of our fiscal mismanagement and anything looks hopeful.

Instead it really is just kicking the can. Massachusetts Governor William Weld opined on privatization a few years back.

I will follow up on the math and the accounting issues in this NJ proposal. My thanks to Russell Moore for waking me up.

Michael G. Riley is vice chair at Rhode Island Center for Freedom and Prosperity and is managing member and founder of Coastal Management Group, LLC. Riley has 35 years of experience in the financial industry, having managed divisions of PaineWebber, LETCO, and TD Securities (TD Bank). He has been quoted in Barron’s, Wall Street Transcript, NY Post, and various other print media and also appeared on NBC News, Yahoo TV, and CNBC.

Related Slideshow: Timeline - Rhode Island Pension Reform

GoLocalProv breaks down the sequence of events that have played out during Rhode Island's State Employee Pension Fund reform.

Related Articles

- Riley: Will Trump’s SEC Chair Go After Misleading Mayors?

- Riley: Outside Forensic Audit Will Show Providence Financial Lies

- Riley: Raimondo’s Biggest Problem is Providence

- Riley: Did Stock Market Rally Under Trump Help Rhode Island?

- Riley: Investment Fee Abuse in Rhode Island Public & Private Investments

- Riley: Time to End Politics in the Rhode Island Treasury

- Riley: More Providence Pension Abuse of Public Employees

- Riley: Providence in Big Trouble - Pension Plan Assets Lowest Since 2007

- Riley: Did Smiley Use Bankruptcy Threat to Get Grant, Proving Prov is Lying?

- Riley: Lousy Pension Returns Put One More Nail in Providence Coffin

- Riley: Close, But No Cigar for Providence

- Riley: Donald Trump Involved With Ponzi Scheme Criminals?

- Riley: 2017 RI Projected Pension Returns Scary and Worsening

- Riley: Major Rhode Island Pension Funds Lag Market Once Again

- Riley: Magaziner Wades Into Rhode Island Municipal Pension Crisis

- Riley: Rhode Island Gives Pat on Back to Bankrupt Cities

- Riley: Did Magaziner & Raimondo Invest in Vulture Hedge Funds?

- Riley: May Madness

- Riley: Politics and Pensions - Has Raimondo Given Up?

- Riley: Time to Review Why 16 RI Municipal Pension Funds Shouldn’t Be Shut Down

- Riley: Beat the Treasurer

- Riley: Pros Predictions for Beating the Treasurer in 2017

- Riley: President Trump Helps Magaziner to First Positive Annual Return

- Riley: Barron’s Touts Dow 30,000 Unfortunately RI Needs Dow 45,000

- Riley: RI Pensions - No Management Fees, No Politics