Moore: Elorza Releases Devastating Report; Is Anyone Listening?

Monday, April 18, 2016

If one follows Rhode Island politics, and brings up the sorry state of Providence's finances in mixed company--at a dinner party, a coffee house, hanging with friends--inevitably, someone will remark that cities all over New England have their issues.

While that statement contains a grain of truth, it downplays the severity of the city's financial woes. It's a classic case of whistling past the graveyard--minimizing a crisis and hoping everything will turn out well.

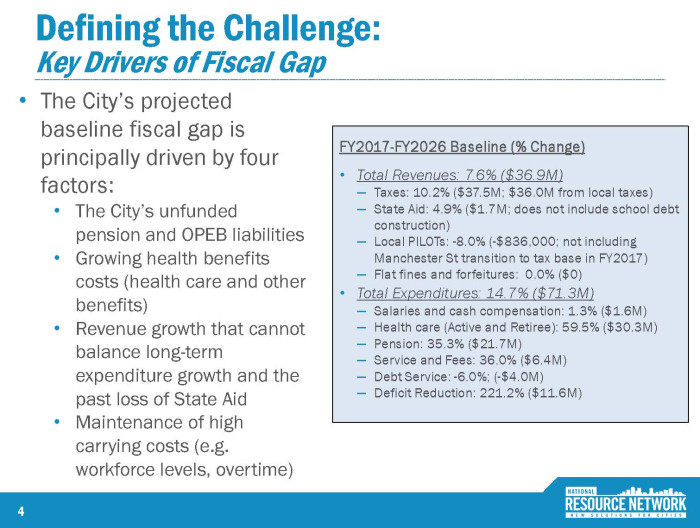

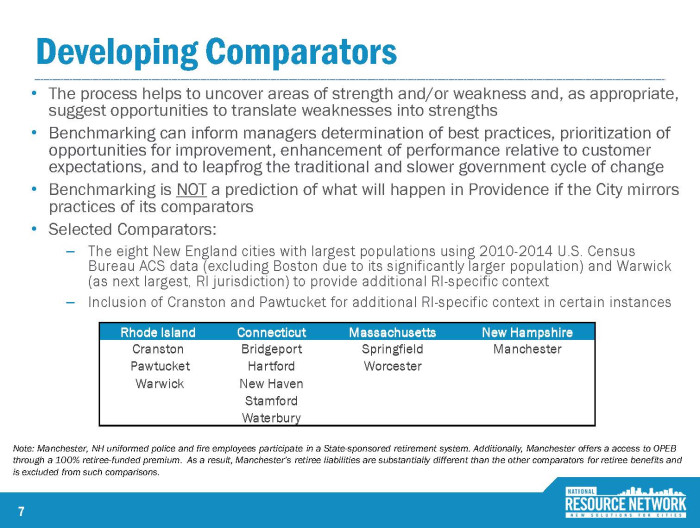

A new report issued by The National Resource Network called "City of Providence Ten Year Plan", does an excellent job detailing the capital city's financial woes. What's great about this report isn't the fact that it explains the obvious--that the city's long term liabilities (pension and health care benefits promised to retirees) weigh the city down--but that it provides a benchmark to other New England cities.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTIt provides a valuable context that, so far as I know, hasn't been provided recently. The data shows us that while all similarly sized cities in New England have fiscal woes, Providence's problems are more severe.

A Sorry State

For instance, New Haven, Connecticut provides a decent comparison point. New Haven has about 40,000 less people. Providence's population is $178,562, New Haven's is 130,553. But it has a similar amount of people living below the poverty level (Providence has 29 percent, New Haven has 26). It also has similar unemployment levels. New Haven's is slightly higher at 7.7 percent compared to Providence's 7.5 percent rate. The two city's have an almost identical household income--both are around $37,500.

That means while Providence is 36 percent larger, it's annual required contribution to fund the pension system is 50-percent bigger. Providence needs to inject into about $62.1 million into the pension system every year. New Haven needs to spend $42.3 million to keep its system afloat. (And let's not forget that Providence assumes a high expected return on investment, which makes the annual required contribution seem lower).

Yet that's not even the biggest problem. Providence's larger issue is its unfunded health care obligations. They're an even bigger source of financial distress.

Lagging Our Peers

The city has an unfunded health care liability of slightly more than $1 billion dollars (that's a thousand million). New Haven (again, a similar sized city) has an unfunded health care liability of $441 million. That means Providence's liabilities are about 125 percent larger. In real dollars, it means Providence spends about $28 million more every year to pay for health care promised to retirees.

In total, Providence spends about $48 million more on its retirement obligations than New Haven. And New Haven is not the picture of fiscal responsibility by any means.

And it's not just New Haven. Providence's liabilities look worse than every other city cited in the benchmark report.

It doesn't Warren Buffet to understand the severity of this problem. Simply put: the city has way too much debt. It doesn't have enough revenue, or even the capability to obtain the revenue, to support those debts.

What Would Warren Buffet Do?

Collectively, we can all whine, cry, and moan about our debt problem. And when I say "our", I mean it. As Providence goes, so goes Rhode Island. Everyone outside of the city helps support it through state aid.

The city has thee choices. It can try to slow the decline and put problems off for another day as long as possible. City services will suffer and decline as more and more revenue is allocated towards the liabilities.

The city can declare bankruptcy and a judge can wipe out large portions of this debt since it's unable to pay.

Or, all stakeholders can work together to enact some benefit reforms. This is the best option for everyone. Yes, it will be painful for those who thought they were getting more than they will end up with. But there will be pain regardless of which path the city takes.

What's the Solution?

The Jorge Elorza administration has come under scrutiny for a lack of transparency lately. In many cases, the criticism is just. Yet Elorza deserves some credit for releasing this study. It shines a new light on Providence's fiscal situation because it provides context. Yes folks, Elorza inherited a mess.

Now the question becomes which option will Elorza embark on as the city moves forward? Elorza is a very intelligent guy, who should have known about the city's challenges before he took office. Every mayor should. (Yes Angel Taveras, this means you.)

The easy answer is to manage a slow decline. Yet that's not what's best for Providence.

Here's hoping Elorza has the fortitude to face Providence's challenges head on. He should. He begged for this extremely tough job in 2014.

Russell Moore has worked on both sides of the desk in Rhode Island media, both for newspapers and on political campaigns. Send him email at [email protected]. Follow him on twitter @russmoore713.

Related Slideshow: Providence Finances - Benchmark Report - 2016

Related Articles

- Moore: Relocation Expert Says RI Can Lure GE

- Moore: My RI Christmas Wish List

- Moore: Rhode Island Needs a Holiday!

- Moore: End Providence Pension Spiking

- Moore: Unlike RI, Puerto Rico Takes on Ratings Agencies

- Moore: Fix the 6-10 Connector For Freedom’s Sake

- Moore: Bring Back The Dancing Cop

- Moore: Toll Plan Will Radically Restructure RI Borrowing

- Moore: Elorza, Firefighters Must Reach Settlement on Platoon Shift

- Moore: Statewide Teacher Contract Will Benefit RI

- Moore: Elorza’s Demotion of Fire Chief is a Head-Scratcher

- Moore: GE Decision Shows RI Must Be Business Friendly

- Moore: Brookings Recommendations Would Be Costly

- Moore: Apple’s Prudent Resistance to FBI Overreach

- Moore: Trump and Sanders Appeal to the Disenfranchised

- Moore: Deep-Seated Issues in the Elorza Administration Arise

- Moore: Marketing Fiasco Symbolizes RI Government Dysfunction

- Moore: Raimondo is Not Wrong to Hire Out-of-State Vendors

- Moore: Mount Saint Charles Sends The Wrong Message

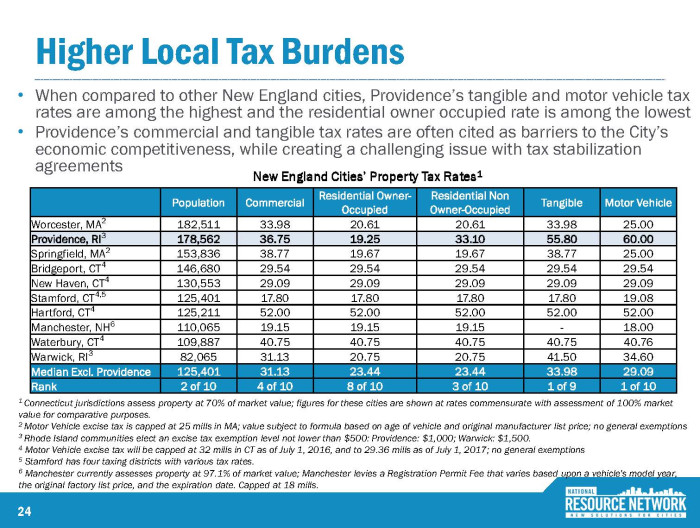

- Moore: Providence’s Commercial Tax Conundrum

- Moore: “Rhode Island is Famous For You,” Buddy

- Moore: Fitch’s Providence Downgrade is Overdue

- Moore: Fetishes and LSD - Raimondo’s Controversial Appointments

- Moore: Time To Legalize Marijuana