The Highest Car Taxes in RI for 2013

Friday, March 29, 2013

Car taxes remain high across Rhode Island communities two years after the General Assembly removed the exemption on cars valued $6,000 or less, new state data shows.

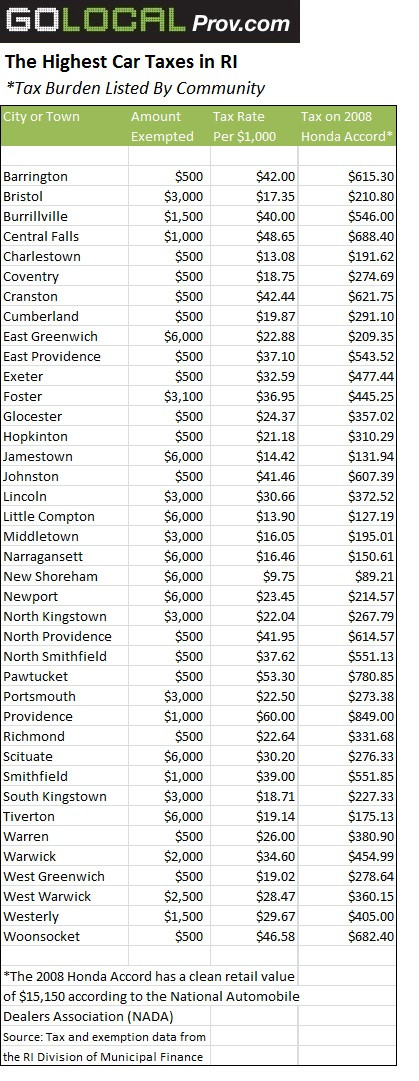

Cities remain the communities with the highest car tax burdens, led by Providence, with a $1,000 exemption and a rate of $60 per $1,000 in value based on 2013 figures. The capital city is followed by Pawtucket, Central Falls, Woonsocket, and Cranston with rates ranging from $42.44 to $53.30 and exemptions alternating between the state minimum of $500 and $1,000.

But the top ten municipalities with the most onerous car taxes also include communities like Barrington, Smithfield, and North Smithfield.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTTo see all the communities and their tax rates, go here.

In order to provide a fair comparison, GoLocalProv considered both the amount of the exemptions and the tax rate. The below tables rank cities and towns based upon how much would be owed for one of the most popular selling cars, a 2008 Honda Accord, which has a maximum retail value of $15,150, according to the National Automobile Dealers Association.

The owner of a 2008 Honda Accord would owe $849 in car taxes in Providence. The same car would cost its owner $89.21 on Block Island, the lowest taxed community, and $127.19 in Little Compton, the next lowest. The two communities both have retained the $6,000 exemption and have tax rates of $9.75 and $13.90.

The statewide average rate is $29 and the average exemption is $2,259.

Providence car taxes ‘out of control’

Providence takes the top of the rankings with a rate $7 above the next highest community—the largest gap between any two consecutive cities or towns.

Providence’s rate was once even higher, standing at $76.78 in 2010. In the midst of the budget crisis in 2011, the city lowered the rate but it also lowered the exemption—effectively a tax hike on owners of lower-value cars.

“I truly, honestly do believe that the car tax is out of control here in the City of Providence and something needs to be done about it,” said Councilman Michael Correia. He pledged to work with state lawmakers and fellow council members to lower the tax burden.

“The exemption is low and the tax rate is high,” said Councilman Sam Zurier. “Both are a problem. We need to address each when we can. But it’s going to be a while before we are able to do that.”

Zurier pointed to the economic development plan that was released this week by Mayor Angel Taveras. The plan includes a call for a seven-year freeze on commercial tax rates, which a national study has shown to be the second highest in the nation, according to Zurier. “The only one higher than us is Detroit, which is not good company to be in,” he said.

Boosting economic development, Zurier added, will bring in more revenue, enabling the city to eventually lower taxes on everyone.

He also noted that the city is also scheduled for a statistical revaluation of property values this year, which is expected to result in increased tax payments from some homeowners and decreases for others. The changes in residential assessments, coupled with a potential freeze on commercial rates, leave the city little maneuvering room to address car tax rates, Zurier said.

Providence may be at the top of the list, but high car taxes is an issue common to the state’s urban centers, said Gary Sasse, a fiscal adviser to the Providence City Council. He also said it would have been impossible to tackle the $110 million deficit the city once faced without some tax increases and he credited the council with backing what he described as a balanced approach, as opposed to saddling residential taxpayers with all of the burden.

Battle to restore the $6,000 exemption

Car taxes have become a constant source of taxpayer ire not just in Providence, but across the state, two years after the General Assembly removed the $6,000.

Several state reps have proposed measures in this session to soften the blow. One bill would restore the full $6,000 exemption for motor vehicle taxes. Another would institute a kind of statewide flat tax.

A sponsor of one of the measures, state Rep. Gregory Costantino, D-Lincoln, said numerous constituents had approached him when he was running for office about car taxes. “I think a lot of taxpayers in my district were hurt by the fact that they took the $6,000 exemption away,” said Costantino, whose district also encompasses portions of Smithfield and Johnston.

He said the car tax disproportionately affects lower-income and middle-class Rhode Islanders.

The bill Costantino is co-sponsoring, H5361, would restore the full exemption. It is currently before the House Finance Committee, which has yet to take action on it. “I think we just have to start looking outside the box and let’s get a conversation going on again,” Costantino said. (The lead sponsor is Rep. William O’Brien, D-North Providence.)

A key question, he added, is how the lost revenue from lower car taxes would be recuperated. One possible solution is suggested in his bill: an additional one percent sales tax on any sailing vessels priced at more than $100,000 and another additional one percent property tax on vessels worth more than $100,000.

‘Nobody wanted to eliminate’ exemption

Sasse said he favors a gradual phase-in of the original $6,000 exemption. Sasse, who was the director of the Department of Administration near the end of the Gov. Carcieri administration, recalls the decision to remove the exemption. “Nobody wanted to elminate the exemption,” Sasse said. “It was done very reluctantly.”

But, with the state in throes of the recession, he said officials faced little choice. Now, he says the state is in a position to start rolling back that decision.

Sasse said the biggest tax problem in Rhode Island are high property taxes. There are two approaches to providing property tax relief, he noted. One, advocated by Gov. Chafee, boosts municipal aid by $15 million, presumably easing their need to raise more revenues locally. The other approach is direct relief to taxpayers.

Sasse said both approaches have merit, but he favors the latter one. He said the “easiest, most direct” means of lightening the property tax burden on Rhode Islanders is by raising the exemption on car taxes.

An alternative solution

Yet another approach to the problem is backed by state Rep. Joe Shekarchi, D-Warwick. His bill, H5369, aims to resolve one of the more frustrating consequences of the $6,000 exemption elimination—the wide variation in tax payments across the state, as some communities voluntarily retained the exemption while others dropped to the new state minimum of $500.

His bill would institute a two-tiered flat car tax. Owners of cars three years old or less would owe a flat $600. Those with cars older than three years would have to pay $360, whether they lived in Providence or Portsmouth.

Shekarchi has described the auto tax as “one of the most regressive” in the state. If the tax is a necessity, he says his approach is the fairest one to taxpayers.

The bill is scheduled for a hearing before the House Finance Committee April 2. (Shekarchi said the bill is currently being revised, but details of what is contained in the new version were not available in time for publication.)

Low exemption not the only problem

The near-elimination of the exemption is not the only issue facing taxpayers. Another is the method the state uses to set values of cars, according to the Rhode Island affiliate of the ACLU.

The Rhode Island Vehicle Values Commission uses the rates published by the National Automobile Dealers Association. For a given car, four rates are listed: the rough trade in, the average trade-in, the clean trade-in, and the clean retail prices. “The clean retail is the highest value that the NADA book sets,” said Steven Brown, the director of the state ACLU.

He said the clean retail value treats a car as essentially almost new, even though many of the cars taxed using such a value are in no such condition.

For the 2008 Honda Accord, the clean retail value is listed as $15,150. The next lowest value is the clean trade-in, at $12,625. The lowest listed value is $10,425, which is the rough-trade in.

“It makes a huge financial difference,” Brown said.

Assuming the state used the next highest rate of $12,625, the owner of a 2008 Honda Accord registered in Providence would owe $697.50 in car taxes, instead of $849. At the lowest listed value, the owner would owe nearly $300 less than what he has to pay now.

The ACLU is not recommending any one of the other three prices, saying such considerations are beyond its expertise. But it says the clean retail value is unfair and unrealistic.

The use of the clean retail value—what Brown described as a “strict one price fits all standard”—raises due process concerns that the ACLU has raised at the state Vehicle Values Commission in the Octobers of 2011 and 2012, when the commission is required to hold hearings on its methodology. Brown said “any rational person” should be able to see how the clean retail value applies to only a very small subset of cars that are out on the road.

Brown says the state should consider other factors in setting values, such as advertised prices in newspaper ads. Other factors would also give taxpayers a broader basis on which to appeal municipal assessments of their car values to the state commission, Brown added.

As it stands now, he said taxpayer appeals are essentially limited to claims that local officials made copy errors in applying the information from the NADA book.

“It remains a serious issue,” Brown said.

So far, the valuation method hasn’t changed. The chair of the commission, Linda Cwiek told GoLocalProv that members are simply following the law as it is currently written. Cwiek, who is also the town assessor for North Kingstown,suggested that a change of the magnitude suggested by Brown needs to come from a higher authority than the commission—the General Assembly.

In fact, a third bill, H5246, does just that, changing the value the state uses from the clean retail to the average trade-in value. For the 2008 Honda Accord that’s a difference in assessed value of $15,150 to $11,650. The bill is sponsored by Rep. Joseph McNamara, D-Cranston. Shekarchi said the revision of his bill will bring it closer to McNamara’s proposal, adding that each one is a co-sponsor of the other’s bill.

“This is an issue near and dear to … our hearts,” Shekarchi said.

Stephen Beale can be reached at [email protected]. Follow him on Twitter: @bealenews.

Related Articles

- The Highest Car Taxes In Rhode Island

- Car Tax Dodgers—Providence Plans Crackdown

- Dozens Protest Providence Car Taxes

- NEW: State Senator Seeks To Raise Car Tax Exemption

- Pawtucket Investigating Lincoln Fire Chief for Avoiding Car Taxes

- Providence Residents Planning Car Tax Rally