The Highest Car Taxes In Rhode Island

Monday, September 19, 2011

As residents in some municipalities continue to rail against the lowering of car tax exemptions, Rhode Island’s poorest cities and towns are also charging their residents the highest car tax rates, a statewide review of municipal finances shows.

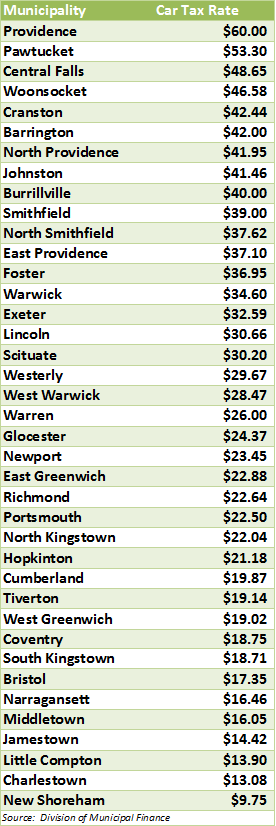

Leading the way is Providence, which is charging $60 per $1,000 in assessed value, by far the highest in the state. The capital city, which came under fire last week as protesters gathered on the steps of City Hall to criticize a budget change that lowered the car tax exemption from $6,000 to $1,000, has a car tax rate more than six times higher than New Shoreham, which has the lowest rate in the state.

Also near the top of taxing mountain are Pawtucket ($53.30), Central Falls ($48.65) and Woonsocket ($46.58), three municipalities that have been forced to rely on tax increases over the past decade as their financial situations have continued to deteriorate. Central Falls filed for bankruptcy last month and Pawtucket and Woonsocket have each been forced to borrow money simply to make payroll in recent years.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTCranston, Barrington, North Providence, Johnston and Burrillville are the other cities and towns charging at least $40 per $1,000 in assessed value in Rhode Island.

High Taxes/Low Exemptions

In addition to the high rates, more residents are being asked to pay taxes on their cars thanks to changes made to the exemption law in 2010. As part of last year’s state budget adopted by the General Assembly and signed by the governor, the state did away with the $6,000 auto excise tax exemption that was uniformly administered by all cities and towns. Under that exemption, anyone owning an auto that was worth less than $6,000 did not have to pay excise tax on the vehicle; those with vehicles valued higher than $6,000 were taxed by their communities on the amount over that threshold.

According to figures provided by the RI Division of Municipal Finance in the Department of Revenue, eight communities have maintained the $6,000 excise tax exemption, while 18 have lowered it to $500. The remainder of the communities have lowered the exemption to a point in between, such as $3,000 or $1,500.

Providence actually lowered its tax by more than $16 for 2012, but the city broadened its base by reducing the exemption to $1,000. During a rally held last Thursday, former City Council candidate Hamlet Miguel Lopez said the high taxes are forcing residents to make difficult choices.

“A lot of people are upset right now,” Lopez said. “People are choosing between a plate of food or paying their rent and now they’re having to pay more in car taxes.”

State Senator Wants To Raise Exemptions

At least one State Senator is calling for changes to be made for next year. State Senator James Sheehan said understands the need for cities and towns raise more revenue, but that now isn’t the right time be increasing the tax burden on residents.

Sheehan is proposing a middle ground where the minimum car tax exemption is raised from $500 to $3,500.

“Many community residents who have received their auto tax bills this year have seen a significant hike in what they owe. Some auto owners who paid no tax last year are facing a tax bill this year,” Sheehan said. “It is hard to fault cities and towns for doing this, since they are all facing their own financial problems. But this is just a horrible time to be adding to the tax burden of our residents, especially in those communities that have decided to set the exemption at its lowest allowable point of $500.”

Sheehan called the $500 exemption “just too low.”

“In light of the pressure this tax has placed on working class Rhode Islanders, the state needs to take action,” said Senator Sheehan. “Allowing cities and towns to lower the exemption from $6,000 to $500 is just too enormous a change all at once. The $500 exemption threshold is just too low.”

Hurting Those Who Can Least Afford It

Another State Senator also raised concerns over car taxes during the last General Assembly session. Sen. Frank Lombardo III proposed legislation that would have allowed anyone who receives Social Security retirement benefits or who is disabled and who meets certain income and net worth levels to receive a municipal exemption of $6,000 on the excise tax on their motor vehicles. The bill did not pass.

“As is usually the case, those who are hurt the most are those who can least afford to pay more,” Lombardo said. “It’s hard enough for working people to have to pay more. Seniors living on fixed incomes and disabled citizens suddenly have another harsh decision to make – do they give up food or medicine to pay this new higher bill.”

At the time, Lombardo said he understood the situation cities and towns were in, but he also argued that the most vulnerable residents should be protected.

“I realize the difficult economic situation of the state and also of most of its citizens, and I understand that there needs to be shared sacrifice,” said Senator Lombardo. “But I would make an exception for retirees and the disabled who are at a certain economic level. They are already vulnerable and the enactment of this legislation could make them a little less so.”

If you valued this article, please LIKE GoLocalProv.com on Facebook by clicking HERE.