RI’s Foreclosure Crisis - City by City Breakdown

Thursday, March 29, 2012

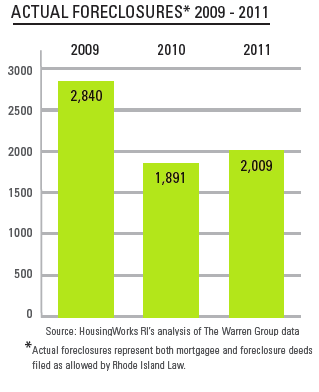

More than 187 homes per month have been foreclosed on over the past three years and the state is unlikely to recover from the housing crisis anytime soon, according to a report issued today by HousingWorks RI.

In total, 6,740 homes were foreclosed on between 2009 and 2011 and more than 10,000 mortgages were either in the foreclosure process or at least 90 days behind on payments during the final three months of last year.

HousingWorks RI executive director Nellie Gorbea said the state’s poor economy and high unemployment rate has created a sustained pattern for foreclosures in recent years. In 2011 alone, 2,009 homes were foreclosed on, a slight increased over the numbers from 2010.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST“It is definitely clear that Rhode Island is in a real foreclosure crisis,” Gorbea said.

Hardest Hit Communities

The report suggests very few communities have been able to stay clear of the state’s unpredictable housing market, but those in the urban corridor have been particularly devastated by foreclosures. The report found that nearly one-third of all foreclosure deeds filed over the last three years were multi-family homes. In Central Falls, for example, 80 percent of foreclosures were multi-family properties.

The tiny bankrupt city has likely been the hardest hit community in the state when it comes to foreclosures. Over 13 percent of the city’s 1,157 mortgaged homes were foreclosed over the last three years.

Nearly a quarter of all foreclosures during the time period took place in Providence. The capital city has seen 1,672 foreclosures, which accounts for almost 10 percent of all mortgaged homes. About 63 percent of all foreclosures in the city were multi-family homes.

“Each multi-family foreclosure affects multiple rental homes, which in turn threatens tenants with possible eviction,” the report states. “For every multi-family property foreclosed, approximately two to three families find themselves without shelter.”

Warwick led the way between 2009 and 2011 in foreclosures on single-family homes. The state’s second largest city saw 686 of its single-family homes foreclosed on over the last the three years.

For Gorbea, the report highlights the fact that more needs to be done to help struggling Rhode Islanders.

“If anything, this foreclosure report definitely suggests that investing in strategies that guarantee a long-term supply of affordable homes can make sure Rhode Island emerges from [this crisis].”

Government has Turned its Back on Homeowners

Still, others say both the state and federal government must share in the blame when it comes to the country’s foreclosure problems. Rhode Island’s spike in foreclosures in 2011 is particularly concerning to attorney Cory Allard, who said banks across the country have been able to get away with forgery and fraud in the foreclosure process. He blamed Attorney General Peter Killmartin for remaining silent when it comes to prosecuting those crimes.

“The primary reason that Rhode Island foreclosures increased in 2011 is because the state government and judiciary have turned their backs on protecting individual homeowners,” Allard said. “The real estate conveyancing statutes and foreclosure statutes are essentially consumer protection laws protecting a homeowner from a stranger to title repossessing their home.”

Because there has been little enforcement over foreclosure laws, Allard said banks have been able to get away with taking a person’s home even when they didn’t have the legal standing to do so.

“Over half of the foreclosures reported in Rhode Island last year were based on questionable title documentation,” Allard said.

State Senator Beth Moura agreed with Allard. She said that until problems are addressed on the federal level, the foreclosure crisis will continue. Moura singled out Fannie Mae and Freddie Mac as deserving much the blame.

“The higher the loss Fannie and Freddie can illustrate on paper, the more funds they are able to ask Congress for,” Moura said. “They have no incentive to approve loan modifications. In fact, I see them pull out all the stops to deny people.”

Moura said there is no easy way to go after entities “who have no skin in the game” like Fannie Mae and Freddie Mac.

“None of this is their money, and they have a blank check to get as much taxpayer money as they can justify a need for,” she said. “In my opinion they are both criminal organizations that should be seized, audited, dissolved and the criminals charged.”

More Affordable Housing

But others say state leaders have the opportunity to help Rhode Island crawl out of the foreclosure crisis. Gorbea said she is hopeful the General Assembly will allow $25 million affordable housing bond to appear on the ballot this November. She said polls indicate Rhode Islanders support providing more money to build homes in the state.

“We're actually in talks with the General Assembly about increasing if to $50 million,” she said. “Voters definitely believe there is a housing crisis in Rhode Island. They’re concerned about the affordability of housing in Rhode Island.”

In 2006, voters passed a similar bond that guaranteed $50 million to affordable housing. In a state that doesn’t have a consistent funding policy for affordable housing, the bonds are considered a lifeline of sorts. Gorbea said the money was used to build 530 long-term rentals and 40 ownership homes out of what used to be foreclosed homes.

The report notes that unlike Massachusetts and Connecticut, the state has yet to make a commitment to long-term affordable housing.

“For Rhode Island to remain truly competitive in attracting and retaining businesses and growing a vibrant workforce, the state must elevate long-term affordable housing into its overall economic development strategy and develop a consistent funding policy for long-term affordable housing development and operation,” the report states. “The $25 million housing bond included in the Governor’s FY2013 budget is a first step, but lawmakers must consider a $50 million housing bond in order to maintain the success of the state’s Building Homes Rhode Island program. Investment in affordable housing programs will help the state emerge from the foreclosure crisis economically stronger.”