Providence Still on the Hook for $1.2 Million in Bad PEDP Loans

Tuesday, October 23, 2012

One in three taxpayer-funded loans through the Providence Economic Development Partnership (PEDP) are still at least 90 days past due and the city stands little chance of collecting on much of the $1,210,336 it is owed from 42 businesses that have defaulted on their loans, GoLocalProv has learned.

The figures come nearly a year after a lawyer representing the PEDP told GoLocalProv that 25 percent of all PEDP loans were considered in default (at least 90 days behind). A Department of Housing and Urban Development (HUD) report released earlier this year suggested the default rate was “approximately 60 percent” between July 2001 and June 2011.

At a meeting scheduled for today, the board is expected to respond to the HUD report, which cited the city for lacking “adequate oversight” over the loan program over a ten-year period that spanned several Mayoral administrations, including the entire time Congressman David Cicilline led the capital city (the sitting Mayor has chaired the PEDP board since 2004).

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTThe 42 loans still currently in default are separate from the 29 bad loans the quasi-public agency’s board of directors voted to write off last May. The majority of those loans, which totaled more than $2.1 million counting interest and penalties, went to businesses that are now defunct.

Smoke & Mirrors

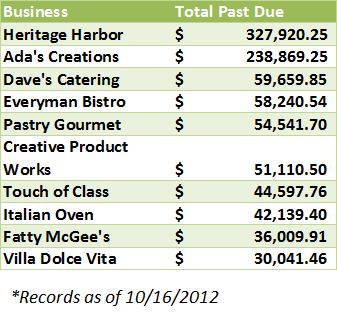

Of the defaulted loans still considered “on the books,” 14 are at least 1,000 days past due. The Heritage Harbor Museum, which owes the city $327,920.25, was 929 days behind on its payments as of last Tuesday, according to a PEDP aging report.

Ada's Creations, a South Side establishment well-known for hosting political fundraisers, received a partial write-off in May, but still owes the city $238,869.25. The business hasn’t made a payment on its loan in nearly 2,000 days.

The large loans given to Heritage Harbor and Ada’s Creations account for just under half of the total amount past due from all loans currently considered in default, but many of the businesses that received loans are now closed. The Everyman Bistro, for example, owes the city $58,240.54, but the restaurant off Valley Street closed several years ago.

So why do closed businesses remain on the PEDP’s books? If too many loans are written off, HUD, which provides funding to the PEDP, may force the agency to cover the lost money. Earlier this month, GoLocalProv obtained a recording of a 2011 PEDP board meeting where former executive director Thom Deller called the PEDP’s reporting practices “smoke and mirrors.” Last year, Deller defended the PEDP's default rate, explaining that borrowers had to be turned down by at least two banks before applying for a loan.

“One of the reasons our collection is high or our default rate is low is that we will keep loans on the books even when they’re not paying just because we don’t want to, there’s some implications if we start defaulting loans,” Deller said during the meeting. “We get above a certain amount of money, the city is supposed to reimburse the program for that amount of cash.”

The PEDP’s board has since agreed to consider writing off loans twice per year moving forward and HUD has praised Jim Bennett, the city’s economic development director, for making progress when it comes to reforming the agency. Bennett has suspended loans for the time being.

“In general, we found that city staff has made progress in strengthening the financial management systems for PEDP,” HUD’s report stated.

PEDP Becomes Political Dartboard

The PEDP has come under fire over the past year after current and former City Council members said they were kept in the dark regarding decisions made by the agency. Critics have pointed to a $103,000 loan awarded to a former campaign volunteer for Cicilline to suggest the loan fund was used for political favors.

Last week, Oklahoma Senator Tom Coburn named the agency in his annual “Waste Book,” which breaks down what his staff considers waste and fraud in government spending.

“At the time, former Mayor David Cicilline, who now represents Rhode Island’s 1st congressional district, oversaw the program,” Coburn’s report states. “On the hook for the money, Providence may have to repay taxpayers if the expenses are ruled ineligible. CDBG funds are generally to be used for programs to benefit low- to moderate-income people, such as low-income housing and anti-poverty measures.”

While Cicilline has refused multiple requests for a sit-down interview on the PEDP (GoLocalProv has offered to send questions in advance of any interview), campaign manager Eric Hyers has defended the agency’s practices while the Congressman was Mayor.

"David Cicilline worked hard to reform the loan program when he was Mayor,” Hyers said earlier this month “He reconstituted the loan committee and created a panel of local bankers and loan experts, who vetted and approved every loan. Again, by definition, this is a program for very high-risk loans, and to qualify for a loan, a business had to be turned down from two other banks."

But Cicilline’s Republican opponent Brendan Doherty has called the PEDP and example of “staggering evidence that David Cicilline mismanaged the city of Providence at a time when every dollar was critical.”

“This is particularly upsetting because it takes money from all of our pockets,” he said. “This is about access and excess. It’s time now for HUD to fix it--and for the voters to hold Congressman David Cicilline accountable.”

Dan McGowan can be reached at [email protected]. Follow him on Twitter: @danmcgowan.