NEW: Rhode Island to Recieve $172 Million from Landmark Foreclosure Settlement

Thursday, February 09, 2012

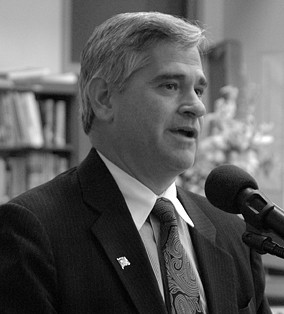

Attorney General Peter F. Kilmartin today formally joined the landmark joint federal-state agreement with the nation’s five largest mortgage service providers over foreclosure abuses and nationwide mortgage servicing practices. The $25 billion settlement provides an estimated $172 million in relief to Rhode Island homeowners and addresses future mortgage loan servicing practices.

U.S. Attorney General Eric Holder, U.S. Housing and Urban Development (HUD) Secretary Shaun Donovan and a bipartisan group of state attorneys general announced the national settlement today at a press conference in Washington, D.C.

The settlement will provide relief to help struggling homeowners avoid foreclosure, bring badly needed reform to the mortgage servicing industry, ensure that foreclosures are lawfully conducted and penalize the banks for past misconduct.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST“This agreement provides much needed relief to Rhode Island borrowers, and also puts a stop to many of the bad behaviors that contributed to the mortgage mess in our state and across the country,” said Attorney General Kilmartin.

The state’s estimated share of the settlement is $172 million:

· Rhode Island borrowers will receive an estimated $152 .6 million in benefits from loan term modifications, including principal reduction and other relief.

· Rhode Island borrowers who lost their home to foreclosure from January 1, 2008 through December 31, 2011 and suffered servicing abuse would qualify for $3.1 million in cash payments to borrowers.

· The value of refinanced loans to Rhode Island’s underwater borrowers would be an estimated $7.3 million.

· The state will receive a direct payment of $8.9 million to help fund consumer protection and state foreclosure protection efforts.

Nationally:

· Servicers commit a minimum of $17 billion directly to borrowers through a series of national homeowner relief effort options, including principal reduction.

· Servicers commit $3 billion to an underwater mortgage refinancing program.

· Servicers pay $5 billion to the states and federal government ($4.25 billion to the states and $750 million to the federal government).

· Homeowners receive comprehensive new protections from new mortgage loan servicing and foreclosure standards.

· An independent monitor will ensure mortgage servicer compliance.

· Borrowers and investors can pursue individual, institutional or class action cases regardless of agreement.

The final agreement, through a consent judgment, will be filed in U.S. District Court in Washington, D.C., and will have the authority of a court order. An independent monitor will supervise this process and regularly report to the attorneys general to ensure that this assistance to borrowers is actually provided. If banks fail in their commitments, they are required to pay $1.40 for every $1 they fall short on their commitment. The attorneys general also retain the right to sue to enforce the settlement.

The settlement does not grant any immunity from criminal offenses and will not affect criminal prosecutions. It does not prevent homeowners or investors from pursuing individual, institutional or class action civil cases against the five servicers. The settlement also enables those state attorneys general with jurisdiction and federal agencies to investigate and pursue other aspects of the mortgage crisis, including securities cases.

State and federal efforts to investigate wrongdoing in the housing market continue. On January 27, 2012, U.S. Attorney General Eric Holder along with Housing and Urban Development (HUD) Secretary Shaun Donovan, Securities and Exchange Commission (SEC) Director of Enforcement Robert Khuzami and New York Attorney General Eric Schneiderman announced the formation of the Residential Mortgage-Backed Securities Working Group. The working group will investigate those responsible for misconduct contributing to the financial crisis through the pooling and sale of residential mortgage-backed securities.

“This does not end our work. The settlement is only one of many steps we need towards a comprehensive, nationwide solution,” continued Kilmartin. “Today we need to start utilizing the relief we have obtained to provide maximum benefits through Rhode Island. I intend to work with our Governor, our General Assembly and with other agencies that can assist our citizens in obtaining their rightful shares of the substantial money we bring into Rhode Island today.”