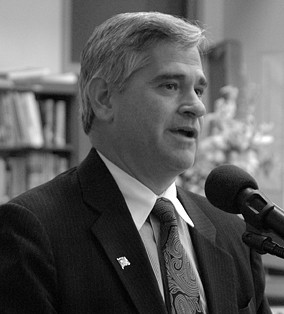

NEW: Kilmartin to Sign Joint State-Federal Mortgage Servicing and Foreclosure Settlement

Tuesday, February 07, 2012

Attorney General Peter F. Kilmartin today announced his intention to sign on to the joint federal-state agreement with the nation’s five largest mortgage servicers over foreclosure abuses and nationwide mortgage servicing practices. The proposed agreement will provide direct relief to Rhode Island homeowners and address future mortgage loan servicing practices.

Iowa Attorney General Tom Miller’s office issued a statement last evening indicating that more than 40 states signed on to the proposed settlement agreement, enabling the parties to move forward into the very final stages of remaining work. Federal and state officials, as well as representatives from the banks, continue to address matters that they must complete before finalizing any settlement.

The proposed settlement primarily seeks to provide immediate relief to help struggling homeowners avoid foreclosure, bring badly needed reform to the mortgage servicing industry, ensure that foreclosures are lawfully conducted and penalize the banks for past misconduct

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTThe proposed settlement does not grant any immunity from criminal offenses and will not affect criminal prosecutions. It does not prevent homeowners or investors from pursuing individual, institutional or class action civil cases against the five servicers. The settlement also enables those state attorneys general with jurisdiction and federal agencies to investigate and pursue other aspects of the mortgage crisis, including securities cases.

State and federal efforts to investigate wrongdoing in the housing market continue. On January 27, 2012, U.S. Attorney General Eric Holder along with Housing and Urban Development (HUD) Secretary Shaun Donovan, Securities and Exchange Commission (SEC) Director of Enforcement Robert Khuzami and New York Attorney General Eric Schneiderman announced the formation of the Residential Mortgage-Backed Securities Working Group. The working group will investigate those responsible for misconduct contributing to the financial crisis through the pooling and sale of residential mortgage-backed securities.

Attorney General Kilmartin said, “The proposed settlement holds banks accountable for past mortgage servicing and foreclosure fraud and abuses and provides relief to homeowners without sacrificing future opportunities to fix a broken system. The settlement is only one of many steps we need towards a comprehensive, nationwide solution.”