United Way RI Brings Free Tax Services on Road With 8 Scheduled Events

Wednesday, February 03, 2016

GoLocalProv Business Team

The

United Way of Rhode Island (UWRI) is preparing for the return of the Volunteer Income Tax Assistance (VITA) Site/Earned Income Tax Credit (EITC) initiative.

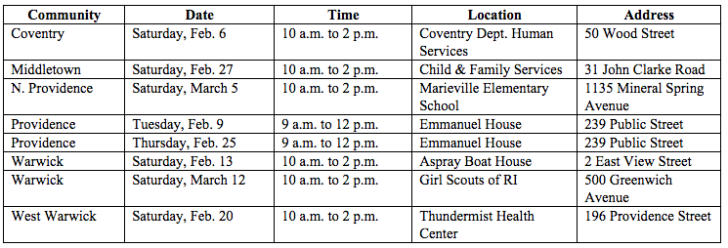

This year, United Way is adding a new element in order to reach more Rhode Islanders who are able to benefit from the program: community direct, mobile VITA/EITC free tax preparation events using its 2-1-1 Outreach RV. The organization has scheduled eight events from February 6 to March 12.

Those interested in attending must call 2-1-1 to make an appointment.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

UWRI VITA/EITC

United Way's VITA/EITC effort ensures working families or individuals who earn less than $54,000 annually have access to free tax services and receive the money they are due in credits and refunds.

In Rhode Island, along with the new mobile events, the program features sites across the state, each a community agency certified by the IRS

Volunteers will help taxpayers complete their income tax returns, many offering services in both English and Spanish at each site.

VITA/EITC eligibility is as follows:

Single, head of household Married, filing jointly

- $14,820: no qualifying children - $20,330: no qualifying children

- $14,820: one qualifying child - $14,820: one qualifying child

- $14,820: two qualifying children - $14,820: two qualifying children

- $14,820: three or more qualifying children - $14,820: three or more qualifying children

Taxpayers attending any VITA/EITC sit must bring Social Security Card(s) for self, spouse and all dependents; picture ID for self and spouse (if applicable); all 2015 W-2, 1099 and 1095-A forms; copy of 2014 Federal Tax Return if available; child and dependent care expense and Tax Identification Number (SSN, EIN) of care provider; and check or savings account number with routing number for direct deposit.

Last year, 11,500 Rhode Island taxpayers took advantage of the program across 25 sites statewide, returning $17 million to the state's economy by way of credits and refunds to working families and individuals.

United Way of RI

United Way of Rhode Island has been working to improve the quality of life in Rhode Island for over 80 years.

For more information, click here.

Related Slideshow: The Highest Taxed Communities for 2015

How do the taxes in your community compare to other cities and towns in Rhode Island?

GoLocalProv has ranked communities from the least to the highest taxed on the basis of their tax rates, using newly released data from the state Division of Municipal Finance. The below slides list the tax rate per $1,000 in value for homes, commercial property, personal property, and motor vehicles for the 2015 fiscal year, which began last July and ends next June.

Along with the rates are examples of what taxes might cost a typical resident in each city or town. For residential taxes, this calculation is based on the current statewide median price for a single family home, which is $215,000. For communities with them, homestead exemptions are factored in using the latest available figures. For motor vehicles, the example used is a 2008 Honda Accord, valued at the maximum retail price of $15,150. The total cost of home and car taxes is then represented as a percentage of the median income for that community, offering a rough measure of how affordable taxes are for those residents as compared with the taxes in another city or town.

Data sources: the Rhode Island Division of Municipal Finance, the Rhode Island Association of Realtors, the Rhode Island League of Cities and Towns, the National Automobile Dealers Association, and the U.S. Census Bureau.

View Larger +

View Larger +

Prev

Next

#39 New Shoreham

FY 2015 Tax Rates Per $1,000 in Value

Residential: $5.34

Commercial: $5.34

Personal Property: $5.34

Motor Vehicle: $9.75

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $1,148.10

For a 2008 Honda Accord: $147.71

Total Taxes as a % of Median Income:1.43%

Note: Real property is assessed at 80 percent of value. This is reflected in the community's ranking.

View Larger +

View Larger +

Prev

Next

#38 Little Compton

FY 2015 Tax Rates Per $1,000 in Value

Residential: $5.64

Commercial: $5.64

Personal Property: $11.28

Motor Vehicle: $13.90

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $1,212.60

For a 2008 Honda Accord: $210.59

Total Taxes as a % of Median Income: 1.56%

View Larger +

View Larger +

Prev

Next

#37 Jamestown

FY 2015 Tax Rates Per $1,000 in Value

Residential: $8.75

Commercial: $8.75

Personal Property: $8.75

Motor Vehicle: $14.42

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $1,881.25

For a 2008 Honda Accord: $218.46

Total Taxes as a % of Median Income: 2.46%

View Larger +

View Larger +

Prev

Next

#36 Charlestown

FY 2015 Tax Rates Per $1,000 in Value

Residential: $9.90

Commercial: $9.90

Personal Property: $9.90

Motor Vehicle: $13.08

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $2,128.50

For a 2008 Honda Accord: $198.16

Total Taxes as a % of Median Income: 3.20%

View Larger +

View Larger +

Prev

Next

#35 Bristol

FY 2015 Tax Rates Per $1,000 in Value

Residential: $13.06

Commercial: $13.06

Personal Property: $13.06

Motor Vehicle: $17.35

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $2,807.90

For a 2008 Honda Accord: $262.85

Total Taxes as a % of Median Income: 5.04%

Note: Bristol had a revaluation or statistical update effective December 31, 2013

View Larger +

View Larger +

Prev

Next

#34 Narragansett

FY 2015 Tax Rates Per $1,000 in Value

Residential: $10.04

Commercial: $15.06

Personal Property: $15.06

Motor Vehicle: $16.46

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $2,158.60

For a 2008 Honda Accord: $249.37

Total Taxes as a % of Median Income: 3.58%

View Larger +

View Larger +

Prev

Next

#33 Westerly

FY 2015 Tax Rates Per $1,000 in Value

Residential: $10.64

Commercial: $10.64

Personal Property: $10.64

Motor Vehicle: $29.67

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $2,287.60

For a 2008 Honda Accord: $449.50

Total Taxes as a % of Median Income: 4.64%

View Larger +

View Larger +

Prev

Next

#32 Portsmouth

FY 2015 Tax Rates Per $1,000 in Value

Residential: $15.80

Commercial: $15.80

Personal Property: $15.80

Motor Vehicle: $22.50

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $3,397.00

For a 2008 Honda Accord: $340.88

Total Taxes as a % of Median Income: 5.10%

Note: Motor vehicles are assessed at 70 percent of value. This is reflected in the community's ranking.

View Larger +

View Larger +

Prev

Next

#31 South Kingstown

FY 2015 Tax Rates Per $1,000 in Value

Residential: $15.48

Commercial: $15.48

Personal Property: $15.48

Motor Vehicle: $18.71

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $3,328.20

For a 2008 Honda Accord: $283.46

Total Taxes as a % of Median Income: 4.91%

View Larger +

View Larger +

Prev

Next

#30 Newport

FY 2015 Tax Rates Per $1,000 in Value

Residential: $12.06

Commercial:$16.72

Personal Property: $16.72

Motor Vehicle: $23.45

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $2,592.90

For a 2008 Honda Accord: $355.27

Total Taxes as a % of Median Income: 5.11%

View Larger +

View Larger +

Prev

Next

#29 Middletown

FY 2015 Tax Rates Per $1,000 in Value

Residential:$16.07

Commercial: $21.34

Personal Property: $16.07

Motor Vehicle: $16.05

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $3,455.05

For a 2008 Honda Accord: $243.16

Total Taxes as a % of Median Income: 5.23%

View Larger +

View Larger +

Prev

Next

#28 Exeter

FY 2015 Tax Rates Per $1,000 in Value

Residential: $14.63

Commercial: $14.63

Personal Property: $14.63

Motor Vehicle: $32.59

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $3,145.45

For a 2008 Honda Accord: $493.74

Total Taxes as a % of Median Income: 3.82%

View Larger +

View Larger +

Prev

Next

#27 Tiverton

FY 2015 Tax Rates Per $1,000 in Value

Residential: $19.30

Commercial: $19.30

Personal Property: $19.30

Motor Vehicle: $19.14

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,149.50

For a 2008 Honda Accord: $289.97

Total Taxes as a % of Median Income: 6.46%

View Larger +

View Larger +

Prev

Next

#26 North Kingstown

FY 2015 Tax Rates Per $1,000 in Value

Residential: $18.91

Commercial: $18.91

Personal Property: $18.91

Motor Vehicle: $22.04

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,065.65

For a 2008 Honda Accord: $333.91

Total Taxes as a % of Median Income: 5.49%

View Larger +

View Larger +

Prev

Next

#25 Richmond

FY 2015 Tax Rates Per $1,000 in Value

Residential: $20.94

Commercial: $20.94

Personal Property: $20.94

Motor Vehicle: $22.64

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,502.10

For a 2008 Honda Accord: $343.00

Total Taxes as a % of Median Income: 5.88%

Notes:

1. Motor vehicles are assessed at 80 percent of value. This is reflected in the community's ranking

2. Richmond had a revaluation or statistical update effective Dec. 31, 2013

View Larger +

View Larger +

Prev

Next

#24 Hopkinton

FY 2015 Tax Rates Per $1,000 in Value

Residential: $20.64

Commercial: $20.64

Personal Property: $20.64

Motor Vehicle: $21.18

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,437.60

For a 2008 Honda Accord: $320.88

Total Taxes as a % of Median Income: 7.13%

Note: Hopkinton had a revaluation or statistical update effective Dec. 31, 2013

View Larger +

View Larger +

Prev

Next

#23 Cumberland

FY 2015 Tax Rates Per $1,000 in Value

Residential: $17.08

Commercial: $17.08

Personal Property: $29.53

Motor Vehicle: $19.87

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $3,672.20

For a 2008 Honda Accord: $301.03

Total Taxes as a % of Median Income: 5.42%

Note: Cumberland had a revaluation or statistical update effective Dec. 31, 2013

View Larger +

View Larger +

Prev

Next

#22 Coventry

FY 2015 Tax Rates Per $1,000 in Value

Residential: $20.40

Commercial: $24.58

Personal Property: $20.40

Motor Vehicle: $18.75

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,386.00

For a 2008 Honda Accord: $284.06

Total Taxes as a % of Median Income: 7.12%

Note: Coventry had a revaluation or statistical update effective Dec. 31, 2013

View Larger +

View Larger +

Prev

Next

#21 Warren

FY 2015 Tax Rates Per $1,000 in Value

Residential: $20.07

Commercial: $20.07

Personal Property: $20.07

Motor Vehicle:$26.00

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,315.05

For a 2008 Honda accord: $393.90

Total Taxes as a % of Median Income: 8.62%

View Larger +

View Larger +

Prev

Next

#20 East Greenwich

FY 2015 Tax Rates Per $1,000 in Value

Residential: $23.26

Commercial: $23.26

Personal Property: $23.26

Motor Vehicle: $22.88

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $5,000.90

For a 2008 Honda accord: $346.63

Total Taxes as a % of Median Income: 5.48%

View Larger +

View Larger +

Prev

Next

#19 Burrillville

FY 2015 Tax Rates Per $1,000 in Value

Residential: $18.88

Commercial: $18.88

Personal Property: $18.88

Motor Vehicle: $40.00

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,059.20

For a 2008 Honda Accord: $606.00

Total Taxes as a % of Median Income: 7.01%

View Larger +

View Larger +

Prev

Next

#18 Barrington

FY 2015 Tax Rates Per $1,000 in Value

Residential: $18.30

Commercial: $18.30

Personal Property: $18.30

Motor Vehicle: $42.00

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $3,934.50

For a 2008 Honda Accord: $636.30

Total Taxes as a % of Median Income: 4.43%

View Larger +

View Larger +

Prev

Next

#17 West Greenwich

FY 2015 Tax Rates Per $1,000 in Value

Residential: $22.55

Commercial: $22.55

Personal Property:$33.85

Motor Vehicle: $19.02

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,848.25

For a 2008 Honda Accord: $288.15

Total Taxes as a % of Median Income: 6.36%

Notes:

1. Does not include rate for vacant land which is $16.07

2. West Greenwich has a homestead exemption

3. West Greenwich had a revaluation or statistical update effective Dec. 31, 2013

View Larger +

View Larger +

Prev

Next

#16 Foster

FY 2015 Tax Rates Per $1,000 in Value

Residential: $21.06

Commercial: $21.06

Personal Property: $28.96

Motor Vehicle: $36.95

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,527.90

For a 2008 Honda Accord: $559.79

Total Taxes as a % of Median Income: 6.26%

View Larger +

View Larger +

Prev

Next

#15 Scituate

FY 2015 Tax Rates Per $1,000 in Value

Residential: $18.98

Commercial: $21.94

Personal Property: $40.38

Motor Vehicle: $30.20

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,080.70

For a 2008 Honda Accord: $457.53

Total Taxes as a % of Median Income: 5.52%

Note: Motor vehicles are assessed at 95 percent of value. This is reflected in the community's ranking.

View Larger +

View Larger +

Prev

Next

#14 North Smithfield

FY 2015 Tax Rates Per $1,000 in Value

Residential: $16.02

Commercial: $17.77

Personal Property: $42.80

Motor Vehicle: $37.62

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $3,444.30

For a 2008 Honda Accord: $569.94

Total Taxes as a % of Median Income: 5.21%

View Larger +

View Larger +

Prev

Next

#13 Glocester

FY 2015 Tax Rates Per $1,000 in Value

Residential: $21.77

Commercial: $24.74

Personal Property: $43.34

Motor Vehicle: $24.37

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,680.55

For a 2008 Honda Accord: $369.21

Total Taxes as a % of Median Income: 6.31%

Note: Glocester had a revaluation or statistical update effective Dec. 31, 2013

View Larger +

View Larger +

Prev

Next

#12 Lincoln

FY 2015 Tax Rates Per $1,000 in Value

Residential: $23.57

Commercial: $26.94

Personal Property: $37.02

Motor Vehicle: $30.66

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $5,067.55

For a 2008 Honda Accord: $464.50

Total Taxes as a % of Median Income: 7.33%

Note: Lincoln Has a homestead exemption.

View Larger +

View Larger +

Prev

Next

#11 Warwick

FY 2015 Tax Rates Per $1,000 in Value

Residential: $20.06

Commercial: $30.09

Personal Property: $40.12

Motor Vehicle: $34.60

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,312.90

For a 2008 Honda Accord: $524.19

Total Taxes as a % of Median Income: 7.93%

View Larger +

View Larger +

Prev

Next

#10 West Warwick

FY 2015 Tax Rates Per $1,000 in Value

Residential:

- For apartments with 6+ units: $36.28

- For Two to Five Family buildings: $36.45

- For Single family homes: $25.3

Commercial: $30.85

Personal Property: $40.13

Motor Vehicle: $28.47

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $5,458.85

For a 2008 Honda Accord: $431.32

Total Taxes as a % of Median Income: 11.46%

Note: For rankng purposes, an average of the three residential rates was used.

View Larger +

View Larger +

Prev

Next

#9 Smithfield

FY 2015 Tax Rates Per $1,000 in Value

Residential: $17.13

Commercial: $17.13

Personal Property: $59.70

Motor Vehicle: $39.00

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $3,682.95

For a 2008 Honda Accord: $590.85

Total Taxes as a % of Median Income: 5.89%

View Larger +

View Larger +

Prev

Next

#8 Cranston

FY 2015 Tax Rates Per $1,000 in Value

Residential: $22.84

Commercial: $34.26

Personal Property: $34.26

Motor Vehicle: $42.44

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,910.60

For a 2008 Honda Accord: $642.97

Total Taxes as a % of Median Income: 9.45%

View Larger +

View Larger +

Prev

Next

#7 East Providence

FY 2015 Tax Rates Per $1,000 in Value

Residential: $22.95

Commercial: $25.40

Personal Property: $56.67

Motor Vehicle: $37.10

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,934.25

For a 2008 Honda Accord: $562.07

Total Taxes as a % of Median Income:11.09%

Notes:

1. Rates are for FY 2014

2. East Providence has homestead exemptions

View Larger +

View Larger +

Prev

Next

#6 Johnston

FY 2015 Tax Rates Per $1,000 in Value

Residential: $28.75

Commercial: $28.75

Personal Property: $59.22

Motor Vehicle: $41.46

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $6,181.25

For a 2008 Honda Accord: $628.12

Total Taxes as a % of Median Income: 11.99%

Note: Johnston has homestead exemptions

View Larger +

View Larger +

Prev

Next

#5 Pawtucket

FY 2015 Tax Rates Per $1,000 in Value

Residential: $23.06

Commercial: $30.88

Personal Property: $52.09

Motor Vehicle: $53.30

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,957.90

For a 2008 Honda Accord: $807.50

Total Taxes as a % of Median Income: 14.28%

View Larger +

View Larger +

Prev

Next

#4 Woonsocket

FY 2015 Tax Rates Per $1,000 in Value

Residential: $35.94

Commercial: $39.99

Personal Property: $46.58

Motor Vehicle: $46.58

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $7,727.10

For a 2008 Honda Accord: $705.69

Total Taxes as a % of Median Income: 21.99%

Note: Woonsocket has homestead exemptions

View Larger +

View Larger +

Prev

Next

#3 North Providence

FY 2015 Tax Rates Per $1,000 in Value

Residential: $27.94

Commercial: $34.68

Personal Property: $69.91

Motor Vehicle: $41.95

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $6,007.10

For a 2008 Honda Accord: $635.54

Total Taxes as a % of Median Income: 13.04%

Notes:

1. North Providence has homestead exemptions

2. North Providence had a revaluation or statistical update effective Dec. 31, 2013

View Larger +

View Larger +

Prev

Next

#2 Providence

FY 2015 Tax Rates Per $1,000 in Value

Residential:

- For owner-occupied residential property: $19.25

- For non-owner-occupied residential property: $33.75

Commercial: $36.75

Personal Property: $55.80

Motor Vehicle: $60.00

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $4,138.75

For a 2008 Honda Accord: $909.00

Total Taxes as a % of Median Income: 13.20%

Note: For ranking purposes, the average of two residential rates was used

View Larger +

View Larger +

Prev

Next

#1 Central Falls

FY 2015 Tax Rates Per $1,000 in Value

Residential: $27.26

Commercial: $39.48

Personal Property: $73.11

Motor Vehicle: $48.65

Tax Cost for Residents

Taxes for a Single Family Home Valued at $215,000: $5,860.90

For a 2008 Honda Accord: $737.05

Total Taxes as a % of Median Income: 22.54%

Note: Central Falls has homestead exemptions

Related Articles

Enjoy this post? Share it with others.