Smart Benefits: PCORI Fees Due July 31 for Some Employers

Monday, June 22, 2015

The annual Patient-Centered Outcomes Research Institute (PCORI) fee and the related IRS Form 720 are due no later than July 31st.

The fee supports the Institute's research on the comparative effectiveness of different types of treatment for certain diseases in order to improve quality of treatment and reduce unnecessary spending. For fully insured plans, the fee is paid by the insurer. The plan sponsor of self-funded plans must file and pay the fee for those plans. Health reimbursement arrangements (HRAs) are considered self-funded plans, so employers need to file for those plans, even if the insurer files for the related fully insured medical plan.

The fee applies from 2012 to 2019 and is due by July 31 of the year following the calendar year in which the plan year ended. It’s based on the average number of lives covered, so employees, retirees and COBRA participants and their covered dependent spouses and children all count. However, only the employee, retiree or COBRA participant needs to be counted for an HRA or a health flexible spending account (FSA)

For plan years that ended on or before September 30, 2014, the fee is $2 per covered live. For plan years that ended between October 1, 2014, and December 31, 2014, the fee is $2.08.

Several options are available for calculating the fee:

- Actual count method – The plan counts its covered lives on each day of the plan year, and averages the result.

- Snapshot method – The plan determines the number of covered lives on the same day (plus or minus three days) of each quarter or month, and averages the result. (This method also allows the plan to count employees and retirees with self-only coverage separately from those with dependent coverage, and then multiply the count of employees and retirees who have dependent coverage by 2.35 to approximate the number of covered dependents, rather than actually counting them.)

- Form 5500 method – The plan determines the number of participants at the beginning and end of the plan year as reported on Form 5500. If dependents are covered, the plan adds the participant count for the start and the end of the plan year to get the total reportable lives. If dependents are not covered, the plan adds the participant count for the start and the end of the plan year and averages the result (this method cannot be used by insurers). Form 5500 must be filed by July 31 to use this option.

The same method must be used throughout a reporting year, but it may be changed from year to year.

A Q&A by the IRS on the PCORI fee is available here.

Rob Calise is a founding partner of Cornerstone Group, where he helps clients control the costs of employee benefits by focusing on consumer driven strategies and on how to best utilize the tax savings tools the government provides. Rob serves as Chairman of the Board of United Benefit Advisors, and is a board member of the Blue Cross & Blue Shield of RI Broker Advisory Board, United HealthCare of New England Broker Advisory Board and Rhode Island Business Healthcare Advisors Council. He is also a member of the National Association of Health Underwriters (NAHU), American Health Insurance Association (AHIA) and the Employers Council on Flexible Compensation (ECFC), as well as various human resource associations. Rob is a graduate of Bryant University with a BS in Finance.

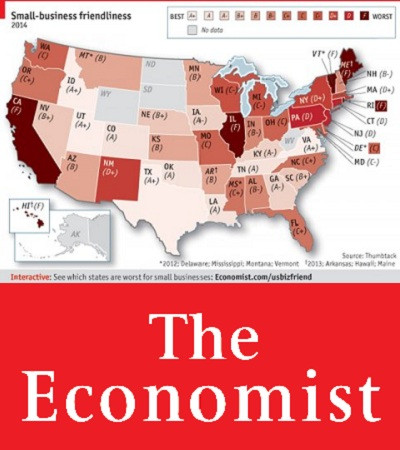

Related Slideshow: RI Business Rankings in US

See how Rhode Island stacked up.

Related Articles

- Smart Benefits: 8 Reasons to Have an Employee Handbook

- Smart Benefits: FLSA Exempt Status Change for Home Care Workers Halted

- Smart Benefits: Fines for Small Business Premium Reimbursement Delayed

- Smart Benefits: RI’s Uninsured Down Nearly 4% in 2014

- Smart Benefits: RI Joins Other States in Extending Exchange Enrollment Deadline

- Smart Benefits: Voluntary Benefits Up with Employers and Employees

- Smart Benefits: HealthSource RI Gets More Federal Funding

- Smart Benefits: Start 2015 by Planning for Health Reform Changes in 2016

- Smart Benefits: The Employer Mandate Has Arrived

- Smart Benefits: Obamacare vs RI Exchange- Which Enrollment Approach Worked Best?

- Smart Benefits: New Forms for Filing this Tax Season

- Smart Benefits: HHS to Up Investigations of Exchanges

- Smart Benefits: HHS Reports On Coverage Gains Since ACA

- Smart Benefits: Public Comment Period for Cadillac Tax Closed

- Smart Benefits: Self-Funded Insurance - A Growing Option Among Employers

- Smart Benefits: Carriers File Requested Rates for 2016

- Smart Benefits: “Embedded” Out-of-Pocket Limits Required for Group Plans in 2016

- Smart Benefits: Preventive Services Requirement Clarified

- Smart Benefits: Exchange Funding - What’s Next?

- Smart Benefits: New Study Shows Exchange Satisfaction Higher

- Smart Benefits: New FMLA Spouse Definition Now In Effect

- Smart Benefits: Are You Audit-Ready?

- Smart Benefits: New SBC Template Delayed ‘Til 2016

- Smart Benefits: EEOC Notice Clarifies ADA-Compliant Wellness Programs

- Smart Benefits: Healthy Self” Campaign Highlights Preventive Services

_400_400_90_400_400_90.jpg)

_400_400_90.jpg)

_400_400_90_80_80_90_c1.jpg)

_80_80_90_c1.jpg)