Smart Benefits: 5 Common Compliance Mistakes Employers Make

Monday, March 17, 2014

Employers must comply with a myriad of federal regulations when it comes to employee benefits. In fact, there are more than 100 regulations related to ERISA, DOL, PPACA, HIPAA, COBRA, FMLA and Medicare, among others.

Some employers have difficulty staying abreast of all the rules while others don’t think certain laws apply to them because of their size. The result? Many employers overlook key regulations – risking financial penalties for non-compliance.

Here are five commonly missed requirements:

1. WRAP Plan Documents and Summary Plan Descriptions (SPDs). All employers, regardless of size and whether fully insured or self-funded, must create and maintain plan documents on file. These are not the same as the carrier master contracts, certificates of coverage or benefit plan descriptions – which don’t meet the requirements set forth by ERISA or DOL. Instead, employers must have a WRAP plan document and a summary plan description that bridge the gaps within the carrier documents, and allow filing of 5500s under one umbrella plan. The plan document must be made available to any employee who requests to review it, and the summary plan description must be distributed to all employees. And any material modifications to benefits must be captured in these documents and communicated to employees within required timeframes.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST2. 5500 Filings . Any employer with 100 or more participants in a plan must file annual 5500 filings with the IRS. These filings show how much money is spent on insurance premium, how many participants are in a plan, and how much of the premium is paid to a broker or consultant, among other required information. This rule applies to each medical, dental, vision, life and disability plan that has more than 100 participants. Employers who are behind in filing can apply for the delinquent filers program, which carries reduced penalties and can help employers get up-to-date with compliance.

3. COBRA . For employers with more than 20 employees, COBRA applies for participants who lose medical and dental coverage. It also applies for Flexible Spending Accounts, Health Reimbursement Arrangements and even wellness programs, so these benefits may need to be offered to COBRA-eligible participants, too. The employer must calculate a COBRA working rate – increased by each benefit that applies – and provide it to the participant.

4. Annual Discrimination Testing. Annual discrimination testing must be done for Cafeteria 125 plans, including medical and dependent care Flexible Spending Accounts, Health Reimbursement Arrangements and premium-only plans, to show that higher wage earners and key employees are not receiving special treatment in these areas, and lower wage employees are not be discriminated against on the basis of accessing these benefits.

5. Health Insurance Market Place Exchange Notice . While most employers knew this initial notice needed to be distributed to employees by October 1, 2013, in preparation for the new state and federal healthcare exchanges that opened January 1, 2014, many employers don’t realize that this is an annual requirement. That means the notice needs to be distributed by October 1st each year going forward.

Employers shouldn’t take risks when it comes to benefits compliance. To ensure they’re meeting the requirements, they should seek guidance from attorneys or benefit advisors, or perform proactive compliance audits to check for areas where help is needed. That way, employers can address issues and be prepared in case of a DOL audit.

Amy Gallagher has over 21 years of healthcare industry experience guiding employers and employees. As Vice President at Cornerstone Group, she advises large employers on all aspects of healthcare reform, benefit solutions, cost-containment strategies and results-driven wellness programs. Amy speaks regularly on a variety of healthcare-related topics, and is often quoted by national publications on the subject matter. Locally, Amy is a member of SHRM-RI, the Rhode Island Business Group on Health, and the Rhode Island Business Healthcare Advisory Council.

Related Slideshow: Check Out The Grades: Rhode Island Hospitals Report Card

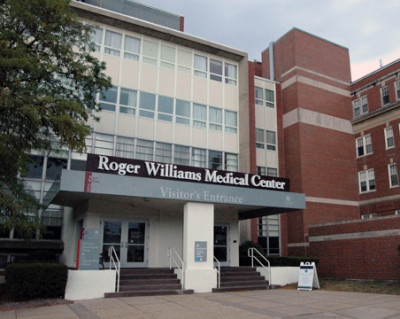

A recent survey released by The Leapfrog Group assigns a Hospital Safety Score, using the report card system of A to F to each of the hospitals in Rhode Island. These grades are based on expert analysis of injuries, infections and errors that cause harm or death during a hospital stay.

Let's see how each of Rhode Island's hospitals were graded from highest to lowest:

Related Articles

- Smart Benefits: 5 Reasons Why Healthcare Reform Hurts Workers

- Smart Benefits: Blue Cross Blue Shield RI Gets Rate Hike Approval

- Smart Benefits: Counting Employees Right For Healthcare Compliance

- Smart Benefits: Employers/Insurers To Foot Healthcare Reform Fees

- Smart Benefits: Health Insurance Stores? Yes.

- Smart Benefits: Hospital Payment Disparity in RI

- Smart Benefits: Make the Most of Your Health Plan in 2014

- Smart Benefits: New Full-Time Status Calculation Full of Confusion

- Smart Benefits: Obamacare Brings Big Changes to Small Employers

- Smart Benefits: RI Employers Need To Prepare For Exchanges NOW

- Smart Benefits: Switching to HSAs May Reduce Healthcare Spending

- Smart Benefits: Volunteering on Company Time

- Smart Benefits: 14 Things To Know About Obamacare

- Smart Benefits: 5 Ways to Save Money on Prescriptions

- Smart Benefits: Bright Future for Primary Care in Rhode Island

- Smart Benefits: Coverage for Civil Union Couples

- Smart Benefits: Enrollment in Health Exchanges Not So Simple

- Smart Benefits: Health Insurers Go Retail

- Smart Benefits: How 3 New RI Laws Will Affect Employers

- Smart Benefits: Mobile Apps + iPads The Key To Wellness Success

- Smart Benefits: New Healthcare Plan Survey—How’d RI Do?

- Smart Benefits: Obamacare Delay Helps Employers Prepare

- Smart Benefits: RI Exchange Leads Way With Focus On Small Business

- Smart Benefits: Taxpayers Could Get Stung By Local Healthcare Cost

- Smart Benefits: Wellness Programs That Pay Off

- Smart Benefits: 2013 Health Insurance Rate Increases Expected Soon

- Smart Benefits: 7 Hot New Wellness Tools

- Smart Benefits: Calmar Cancels Out Pain

- Smart Benefits: Don’t Let Older Workers Go

- Smart Benefits: Expect Double-Digit Health Insurance Hikes in 2014

- Smart Benefits: Health Plan Audits—Is Your Company Ready?

- Smart Benefits: How RI Physicians Rate Local Insurers

- Smart Benefits: More Employers Offering More Health Plan Choices

- Smart Benefits: New Healthcare Reform Fee Means Higher Premiums

- Smart Benefits: Obamacare Mandates: What Is And Isn’t Delayed

- Smart Benefits: RI’s Healthcare Rate Increases for 2013

- Smart Benefits: The Latest Healthcare Reform Cost

- Smart Benefits: Where RI Candidates Stand on Healthcare Reform

- Smart Benefits: 3 Ways Obamacare Hurts Employees

- Smart Benefits: 9 Tips for Health Benefits Open Enrollment Season

- Smart Benefits: Can Better Doc Choices Lower Costs?

- Smart Benefits: Employer Exchange Model Notice Released Early

- Smart Benefits: Flexible Spending Accounts Get More Flexible

- Smart Benefits: Healthcare Is A-Changing

- Smart Benefits: Insurers File 1st Round of Rate Increase Requests

- Smart Benefits: More Exchanges, More Choice for Small Employers

- Smart Benefits: New Rating Requirements For Fairer Premiums

- Smart Benefits: Pay or Play Delay Could Bode Well for Employers

- Smart Benefits: Reverse Auctions Bring Down Health Benefit Costs

- Smart Benefits: The Naked Truth About Healthcare Costs

- Smart Benefits: Why You May Not Want To Grow Your Business

- Smart Benefits: 3 Ways to Make Wellness Standards Work

- Smart Benefits: A Bad Week Brings Reactionary Changes to Obamacare

- Smart Benefits: Carriers Step Up No Matter What Supreme Court Says

- Smart Benefits: Employers Are Okay With Sleeping On The Job

- Smart Benefits: Free Contraception for Women Starts August 1

- Smart Benefits: Healthcare Reform Delays Hit Consumers Hard

- Smart Benefits: Is Employer-Sponsored Wellness Here To Stay?

- Smart Benefits: More Rate Hikes For 2014

- Smart Benefits: New Study Shows Health Costs Hurt Small Biz Hiring

- Smart Benefits: Polls Show Most Americans Skeptical of Obamacare

- Smart Benefits: Romney Vs. Obama on Healthcare

- Smart Benefits: The New Year Means New Benefit Decisions

- Smart Benefits: Will HealthSource RI Meet Enrollment Expectations?

- Smart Benefits: 5 Health Benefit Cost-Cutting Trends To Watch In 2014

- Smart Benefits: BCBSRI Wants Higher Rate Hikes—Will it Get Them?

- Smart Benefits: Congress Moves to Strengthen HSAs

- Smart Benefits: Employers Are Tangled Up in Healthcare Reform

- Smart Benefits: Gay Marriage Ruling + Employer Compliance

- Smart Benefits: Healthcare Reform Drives Coverage Innovation

- Smart Benefits: Large Employers Need to Report in 2015 Under ACA

- Smart Benefits: More States Reject State-Run Health Exchanges

- Smart Benefits: Newport Preservation Society Wins On Wellness

- Smart Benefits: Private Exchanges Open Up New Opportunities In RI

- Smart Benefits: Small Employers Must Cover ‘Essential’ Benefits

- Smart Benefits: The Secret to a Winning Wellness Program

- Smart Benefits: Will Paul Ryan’s Plan for Medicare + Medicaid Fly?

- Smart Benefits: 5 Healthcare Trend Predictions for 2013

- Smart Benefits: Be Prepared For Fall Open Enrollment Changes

- Smart Benefits: Consumer Engagement is Key to Better Healthcare

- Smart Benefits: Employers Need To Prepare For Health Exchanges

- Smart Benefits: HSA Contribution Limits Rise For 2014

- Smart Benefits: Healthcare Reform Will Limit Plan Design Choices

- Smart Benefits: Low Exchange Enrollment Means More Taxpayer Costs

- Smart Benefits: More Taxes, Less Pay

- Smart Benefits: Next Steps in Healthcare Reform for Employers

- Smart Benefits: RI Among Worst States for Competitive Healthcare

- Smart Benefits: Small Employers—RI Exchange Or Private Plan?

- Smart Benefits: Tufts’ RightChoice Keeps it Simple for Consumers

- Smart Benefits: Will You Be Affected by the New Medicare Tax?

- Smart Benefits: 5 New Healthcare Reform Taxes

- Smart Benefits: Better Data for Better Care

- Smart Benefits: Controlling Healthcare Costs Through Choice

- Smart Benefits: Employers Who Ignore Obamacare Will Pay

- Smart Benefits: HSAs Look Good as Obamacare Decision Looms

- Smart Benefits: Healthcare Reform—Big Rewards for Wellness in ‘14

- Smart Benefits: MA’s Tax Breaks For Wellness Sets a Good Example

- Smart Benefits: NE Health Exchanges—Who’s Ahead, Who’s Behind?

- Smart Benefits: No Healthcare Rebates for RI Employers

- Smart Benefits: RI Cracks Down on Health Insurer Rating Practices