Saul Kaplan: Our Obsession With Scalability Must End

Friday, October 31, 2014

Welcome to the era of business model proliferation.

Our obsession with scalability is getting in the way of unleashing the potential of the 21stcentury. We are so fixated with scalability we have taken our eye off of delivering value at every scale including the most important scale of one. The Industrial Era did that to us. Reaching the mass market takes precedence over delivering value to each customer. New customer acquisition trumps delivering value to existing customers. It’s not only business that is obsessed with scale. Our obsession with scaling a national education, health care, and government system has also taken our eye off of delivering value to each student, patient, and citizen. We have been talking about the idea of mass customization for years while we continue to hang on to business models that were designed for scale more than for delivering customer value.

The Industrial Era brought us the reign of the predominant business model. Every industry quickly became dominated by one business model that defined the rules, roles, and practices for all competitors and stakeholders. We became a nation of share takers clamoring to replicate industry best practices to gain or protect every precious market share point. Companies moved up or down industry leadership rankings based on their ability to compete for market share. Business schools minted CEOs who became share-taking clones of one another. It was all about scale. Bigger was always better. So what if the predominant business model doesn’t serve everyone’s needs? So what if it doesn’t even serve existing customers well? Scalability and share taking became about protecting the predominant business model by preventing the emergence of new business models. Incumbents do everything in their power to erect regulatory and legal moats to keep new business models out of the market.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTYou know the scalability frenzy is out of control when iconic entrepreneur, Facebook founder Mark Zuckerberg, proclaims;

“For us, products don’t get interesting to turn into businesses until they have about one billion users.”

No wonder entrepreneurs are obsessed with scalability. Everyone wants to be the next Mark Zuckerberg. Entrepreneurs always fall into the scalability trap of trying to imagine what it will take for a model to reach large numbers of customers before they have demonstrated that they can create, deliver, and capture value for only a few. Over many years of mentoring entrepreneurs I have observed them, particularly tech entrepreneurs, spend too much sweat equity and startup capital focused on developing code and a beta version of a web platform before they have a clear value proposition and a testable business model concept that can withstand initial customer contact.

Serial entrepreneur and Y Combinator co-founder Paul Graham says it well:

“As long as you can find just one user who really needs something and can act on that need, you’ve got a toehold in making something people want, and that’s as much as any startup needs initially.”

I always advise entrepreneurs to take a minimum viable business model to the market before thinking about scalability. Start by uncovering the job someone is trying to do, figure out how you can get the job done better, and demonstrate it. Entrepreneurs skip this step at their own peril. Develop a business model prototype and test it with a few people. If the business model prototype works, then and only then, start working on what it will take to scale it to reach more customers. It takes successful entrepreneurs three, four, sometimes five tries to get a business model right. Why worry about scalability until you land on one that works for the customer? Focusing on scale too early leads to too many elegant solutions too far removed from real customer contact resulting in too many dead ends.

Institutional leaders are even more obsessed with scalability than entrepreneurs. They fixate on protecting their current scale and assess all new customer value creating ideas through the lens of their current business model. If opportunities to create customer value in new ways are distracting to the organization or would cannibalize current business they’re routinely dismissed. The questions asked and metrics applied to evaluate new opportunities are more about scalability and fit, than about creating new customer value. The baseline for evaluation is the current business model. Market making opportunities are routinely screened out or ignored for more predictable share taking opportunities to increase scale. This is why CEO’s are so hungry for merger and acquisition opportunities. It’s all about scale, not changing the customer value equation. New business models force institutional leaders to rethink scalability.

We live in an era that screams for less share taking and more market making. Market makers don’t accept the idea that a predominant business model has to dictate the industry landscape. They create a new market with a different playbook. We have access to more enabling technology than we humans and the stubborn institutions we live and work in know how to absorb. Today, it’s possible to unleash an infinite number of exciting business models to create, deliver, and capture customer value. Today’s consumers refuse to accept that there is only one predominant business model in every industry and that they have to take or leave its offerings. Consumers now demand personalized experiences, products, and services.

Consumers are bringing the era of the predominant business model to an end. Business models don’t last as long as they used to. Predominant business models are crumbling all around us. The new strategic imperative for all institutional leaders is R&D for business models as a core competency. It was easier to be a CEO in a world constrained by a predominant business model. In a world defined by business model proliferation CEOs have the trickier task of both pedaling the bicycle of today’s business model while leading the exploration for a steady flow of new business models. If they don’t there is a market maker out there who will.

It’s time end our obsession with scalability. There are too many consumer, student, patient, and citizen needs left unmet by predominant business models in every industry. There are too many new business model concepts stuck on white boards and in consulting decks. We are still allowing predominant business models to slow down and block the emergence of new business models that can better meet our needs. It’s time to move from the era of the predominant business model to the era of business model proliferation. Let a thousand business models bloom.

Saul Kaplan is the Founder and Chief Catalyst of the Business Innovation Factory (BIF). Saul shares innovation musings on his blog at It’s Saul Connected and on Twitter at @skap5.

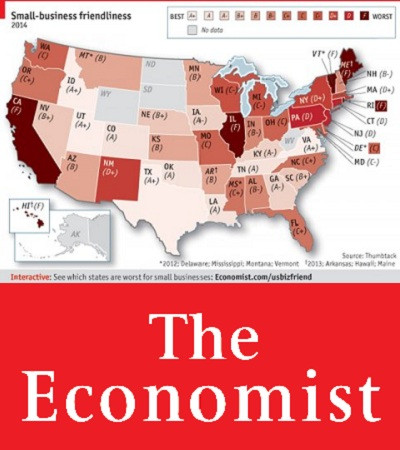

Related Slideshow: RI Business Rankings in US

See how Rhode Island stacked up.

Related Articles

- Saul Kaplan: Reframe Failure As Intentional Iteration

- Saul Kaplan: Is Your CEO Serious About Innovation? Ask 10 Questions

- Saul Kaplan: This Is the Antidote to the Dark Side of Technology

- Saul Kaplan: The Kids’ Table

- Saul Kaplan: If All Of Work Were Gamified

- Saul Kaplan: Calling All Polymaths

- Saul Kaplan: Thankful Innovation Junkie

- Saul Kaplan: This Is Why Religion Is Just a Technology

- Saul Kaplan: On the Internet, What You Don’t Know Can Hurt You

- Saul Kaplan: Hourglass Theory of Life

- Saul Kaplan: Innovation Lessons from the Battlefield to the Boardroom

- Saul Kaplan: Here’s Why It’s Not All About Your Personal Success

- Saul Kaplan: The Splendid Exile of the Genius Richard Saul Wurman

- Saul Kaplan: 3 Simple Words to Revolutionize the World

- Saul Kaplan: Sometimes Disruption Has To Hit You Right In The Mouth

- Saul Kaplan: Preach to the Choir

_400_400_90_400_400_90.jpg)

_400_400_90.jpg)

_400_400_90_80_80_90_c1.jpg)

_80_80_90_c1.jpg)