LEGAL MATTERS: Stop Debt Collection Calls At Work

Wednesday, November 13, 2013

John T. Longo, GoLocalProv Legal Contributor

At least once a month I get a frantic call from someone being harassed by a debt collector at work. The person is always embarrassed and desperate to have the calls stop. Sometimes the person owes the debt; often they do not. In the really sad cases, the person has already paid the collector something but he is now demanding more. Here is what to do if you are getting collection calls at your job.

Is it a Fake Debt Collector?

There is a good chance – 50% based on my experience - the debt collector is really just a criminal trying to shake you down. (Listen to a fake debt collection call here.) He probably got your personal information from a resume you posted on a job site, your LinkedIn profile, or from a loan you might have applied for online. Then he did a Google search to figure out your boss’s name or some other details about you he can use to trick you. When he gets you on the phone he will threaten to have you arrested or served with a lawsuit at work. He may claim to be an ‘investigator’ and urge you to take care of the debt before it becomes a criminal case. His goal is to pressure you into paying right away before you realize you are being scammed.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

You will know you are dealing with a fake debt collector if they insist you pay them in a way that cannot be traced. They may insist you wire them money using Western Union, or that you buy a pre-paid credit card or GreenDot Money Packs from 7/11, or that you give them your checking account number. Never pay any debt that way! If a debt collector insists you pay them in any of those ways, hang up and never talk to them again.

Fake debt collectors will keep calling until they realize you are not going to pay. Arguing with them, or threatening them, is a waste of your time. Suing them is also usually a waste of time because you can never find them. Just hang up on them and file complaints with the Federal Trade Commission and the FBI’s Internet Crime Center.

Tell Them To Stop; Sue If They Don’t

Debt collectors are allowed to call you at work until they have reason to know such calls are inconvenient for you or prohibited by your employer. So if they are either, tell them on the phone and send them a letter reminding them. (They will demand you give them another number but you do not have to.) If they call you at work again, you can sue them for violating your rights under the federal Fair Debt Collection Practices Act and probably get your attorney fees paid and put $1,000 in your pocket.

Even if they legally call you at work, debt collectors can never say or suggest to anyone other than you and your spouse that you owe money. You should consider immediately sue any debt collector that tells the receptionist, or threatens to tell your boss, that you owe money.

Deal With The Debt

Stopping the calls at work will not make the debt go away. It will stop the embarrassment and give you a chance to develop a plan to deal with your debts. If they are overwhelming, you may need to file bankruptcy. If not, read about your options here. And don’t get tied up with any debt settlement, or debt negotiation, outfit you find online.

Related Slideshow: New England Communities With the Most Political Clout 2013

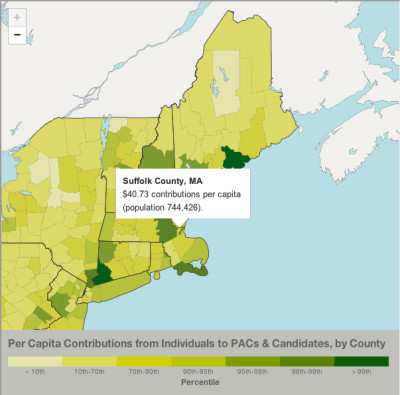

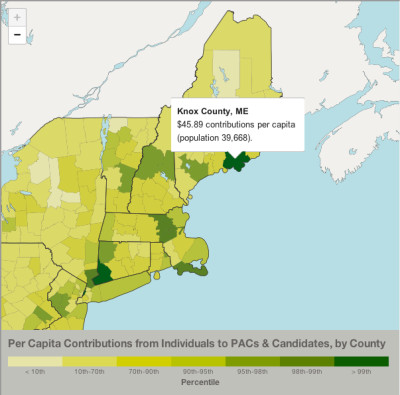

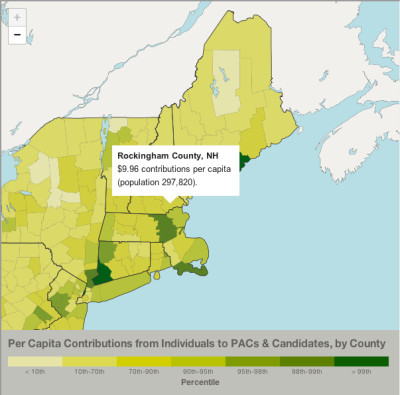

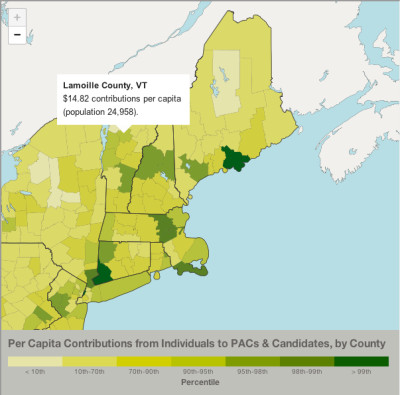

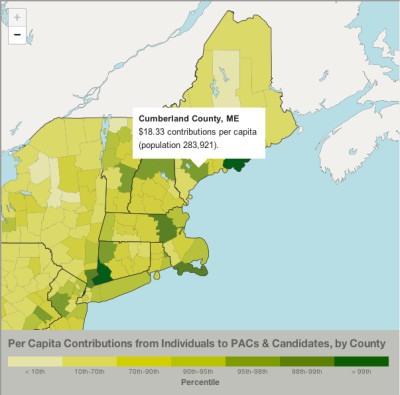

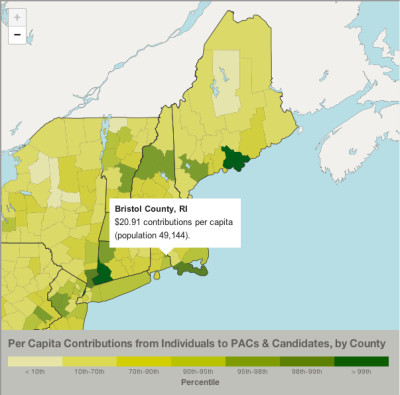

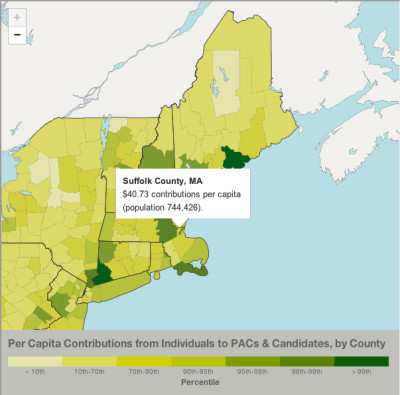

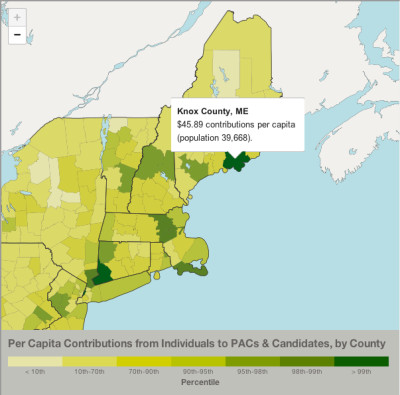

The Sunlight Foundation, in conjunction with Azavea, released data maps this week showing political contribution dollars to federal elections dating back to 1990 -- by county.

GoLocal takes a look at the counties in New England that had the highest per-capita contributions in the 2012 election cycle -- and talked with experts about what that meant for those areas in New Engand, as well as the candidates.

_400_395_90.jpg) View Larger +

View Larger +

Prev

Next

25. Merrimack County, NH

Contributions, per capita, 2012: $9.86

Total contributions: $1,447,713

Merrimack County is named after the Merrimack River and is home to the states capital, Concord. Merrimack County has a total area of 956 square miles and a population of 146,761.

View Larger +

View Larger +

Prev

Next

24. Cheshire County, NH

Contributions, per capita, 2012: $9.88

Total contributions: $759,209

Cheshire is one of the five original counties in New Hampshire and was founded in 1771. The highest point in Cheshire County is located at the top of Mount Monadnock, which was made famous by the poets Ralph Waldo Emerson and Henry David Thoreau.

View Larger +

View Larger +

Prev

Next

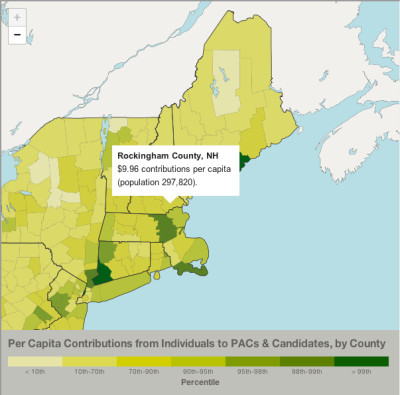

23. Rockingham County, NH

Contributions, per capita, 2012: $9.96

Total contributions: $2,965,530

Rockingham has 37 communities and has a population of 297,820. Rockingham County also was home to the famous poet, Robert Frost

View Larger +

View Larger +

Prev

Next

22. Belknap County, NH

Contributions, per capita, 2012: $10.02

Total contributions: $604,512

Belknap County is one of the ten counties in New Hampshire and has a population of 60,327. It is located in the center of New Hampshire and the largest city is Laconia.

View Larger +

View Larger +

Prev

Next

21. Hampshire County, MA

Contributions, per capita, 2012: $10.41

Total contributions: $1,664,077

Hampshire County has a total area of 545 square miles and is located in the middle of Massachusetts. Hampshire County is also the only county to be surrounded in all directions by other Massachusetts counties.

View Larger +

View Larger +

Prev

Next

20. Barnstable County, MA

Contributions, per capita, 2012: $10.90

Total contributions: $2,348,541

Barnstable County was founded in 1685 and has three national protected areas. Cape Cod National Seashore is the most famous protected area within Barnstable County and brings in a high amount of tourists every year.

View Larger +

View Larger +

Prev

Next

19. Berkshire County, MA

Contributions, per capita, 2012: $12.49

Total contributions: $1,624,400

Berkshire County is located on the western side of Massachusetts and borders three different neighboring states. Originally the Mahican Native American Tribe inhabited Berkshire County up until the English settlers arrived and bought the land in 1724.

View Larger +

View Larger +

Prev

Next

18. Essex County, MA

Contributions, per capita, 2012: $13.22

Total contributions: $9,991,201

Essex is located in the northeastern part of Massachusetts and contains towns such as Salem, Lynn, and Andover. Essex was founded in 1643 and because of Essex historical background, the whole county has been designated as the Essex National Heritage Area.

View Larger +

View Larger +

Prev

Next

17. Chittendon County, VT

Contributions, per capita, 2012: $13.86

Total contributions: $2,196,107

Chittenden has a population of 158,504, making it Vermont’s most populated county. Chittenden’s largest city is Burlington, which has about one third of Vermont’s total population.

View Larger +

View Larger +

Prev

Next

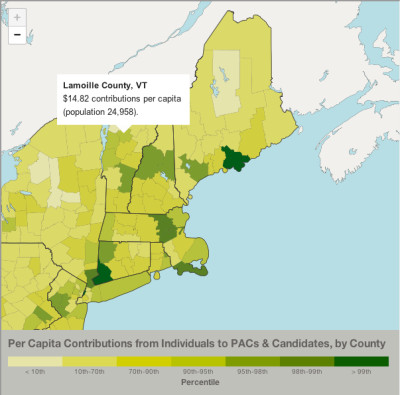

16. Lamoille County, VT

Contributions, per capita, 2012: $14.82

Total contributions: $369,854

Lamoille County was founded in 1835 and has a population of 24,958. The county has 464 square miles, of which 461 of them are land.

View Larger +

View Larger +

Prev

Next

15. Addison County, VT

Contributions, per capita, 2012: $15.49

Total contributions: $569,299

Located on the west side of Vermont, Addison County has a total area of 808 square miles. Addison's largest town is Middlebury, where the Community College of Vermont and Middlebury College are located.

View Larger +

View Larger +

Prev

Next

14. Newport County, RI

Contributions, per capita, 2012: $16.02

Total contributions: $1,214,26

Newport County is one of the five Rhode Island Counties and was founded in 1703. Just like Connecticut, none of Rhode Island counties have an any governmental functions.

View Larger +

View Larger +

Prev

Next

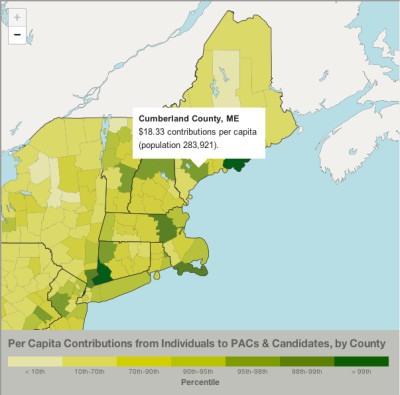

13. Cumberland County, ME

Contributions, per capita, 2012: $18.33

Total contributions: $5,205,507

Cumberland County has a population of 283,921 and is Maine’s most populated county. The county was named after the William, Duke of Cumberland, a son of King George II.

View Larger +

View Larger +

Prev

Next

12. Windsor County, VT

Contributions, per capita, 2012: $20.57

Total contributions: $1,156,149

Windsor County is the largest county in Vermont and consists of 971 square miles of land and 5 square miles of water.

View Larger +

View Larger +

Prev

Next

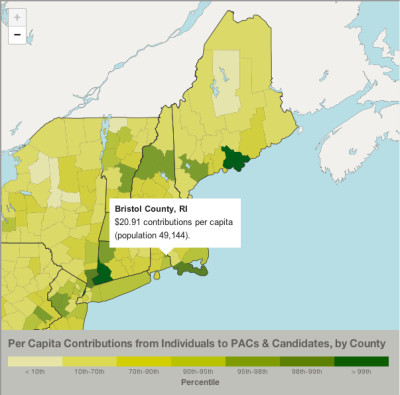

11. Bristol County, RI

Contributions, per capita, 2012: $20.91

Total contributions: $1,027,472

Bristol County has a population of 49,144 and is the third smallest county in the United States. Bristol County was originally apart of Massachusetts, but was transferred to Rhode Island in 1746.

View Larger +

View Larger +

Prev

Next

10. Grafton County, NH

Contributions, per capita, 2012 :$20.95

Total contributions: $1,868,739

With a population of 89,181, Grafton County is the second largest county in New Hampshire. Home of New Hampshire’s only national forest, White Mountain National Forest takes up about half of Grafton’s total area

View Larger +

View Larger +

Prev

Next

9. Carrol County, NH

Contributions, per capita, 2012: 2012: $22.81

Total contributions: $1,012,10

Created in 1840, Carroll County has a population of 47,567. Carroll County was also named after Charles Carroll, the last surviving signer of the United States Declaration of Independence.

View Larger +

View Larger +

Prev

Next

8. LItchfield County, CT

Contributions, per capita, 2012: $22.86

Total contributions: $4,286,143

Although it is Connecticut’s largest county, Litchfield has the lowest population density in all of Connecticut. Since 1960 all Connecticut counties have no county government.

_400_395_90.jpg) View Larger +

View Larger +

Prev

Next

7. Middlesex County, MA

Contributions, per capita, 2012: $32.81

Total contributions: $50,432,154

Middlesex County has a population of 1,503,085 and has been ranked as the most populous county in New England. The county government was abolished in 1997, but the county boundaries still exists for court jurisdictions and other administrative purposes.

View Larger +

View Larger +

Prev

Next

6. Nantucket County, MA

Contributions, per capita, 2012: $33.41

Total contributions: $344,021

Nantucket County consists of a couple of small islands and is a major tourist destination in Massachusetts. Normally Nantucket has a population of 10,298, but during the summer months the population can reach up to 50,000.

View Larger +

View Larger +

Prev

Next

5. Norfolk County, MA

Contributions, per capita, 2012: $35.87

Total contributions: $24,459,854

Named after a county from England, Norfolk County is the wealthiest county in Massachusetts. As of 2011, Norfolk was ranked the 32nd highest income county in the United States.

View Larger +

View Larger +

Prev

Next

4. Dukes County, MA

Contributions, per capita, 2012: $36.32

Total contributions: $618,960

Consisting of Martha’s Vineyard and the Elizabeth Islands, Dukes County is one of Massachusetts’ top vacation spots. Originally Dukes County was apart New York, however it was transferred to Massachusetts on October 7, 1691.

View Larger +

View Larger +

Prev

Next

3. Suffolk County, MA

Contributions, per capita, 2012: $40.73

Total contributions: $30,323,537

Suffolk County has a population of 744,426 and contains Massachusetts’s largest city, Boston. Although Suffolk’s county government was abolished in the late 1900’s, it still remains as a geographic area.

View Larger +

View Larger +

Prev

Next

2. Knox County, ME

Contributions, per capita, 2012: $45.89

Total contributions: $1,820,410

Knox County was established on April 1st, 1860 and was named after American Revolutionary War General Henry Knox. The county has a population of 39,668 and is the home of the Union Fair.

View Larger +

View Larger +

Prev

Next

1. Fairfield County, CT

Contributions, per capita, 2012: $55.65.

Total contributions: $51,970,701

In a population of 933,835, Fairfield County is the most densely populated county in Connecticut, and contains four of the state's largest cities -- Bridgeport, Stamford, Norwalk and Danbury.

PrevNext

_80_80_90_c1.jpg)

25. Merrimack County, NH

24. Cheshire County, NH

23. Rockingham County, NH

22. Belknap County, NH

21. Hampshire County, MA

20. Barnstable County, MA

19. Berkshire County, MA

18. Essex County, MA

17. Chittendon County, VT

16. Lamoille County, VT

15. Addison County, VT

14. Newport County, RI

13. Cumberland County, ME

12. Windsor County, VT

11. Bristol County, RI

10. Grafton County, NH

9. Carrol County, NH

8. LItchfield County, CT_80_80_90_c1.jpg)

7. Middlesex County, MA

6. Nantucket County, MA

5. Norfolk County, MA

4. Dukes County, MA

3. Suffolk County, MA

2. Knox County, ME

1. Fairfield County, CT

Related Articles

Enjoy this post? Share it with others.

_400_395_90.jpg)

_400_395_90.jpg)

_80_80_90_c1.jpg)

_80_80_90_c1.jpg)