Lardaro Report: RI Economy Stalls

Monday, October 14, 2013

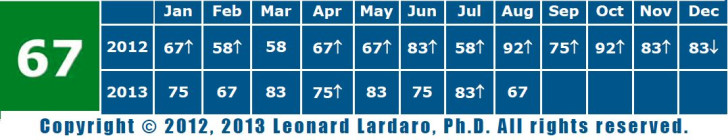

URI Economist Len Lardaro's most recent report identifies that the RI economy may be slowing. According to his Current Condition Index released for August, RI's economy dipped significantly from July to August - his most recent month reported.

Lardaro report: As the third quarter progresses, there is both good news and bad news about the performance of Rhode Island’s economy. The good news is that the July Current Conditions Index’s value was revised higher, from 75 to 83. The bad news is that the CCI for August declined to 67, as only eight of twelve indicators improved relative to their values one year ago. Furthermore, August was only the second month this year for which the CCI failed to exceed its year-earlier value (June was the other). My primary concern moving forward, which I have written about for several months now, is that the CCI for the remainder of this year will very likely fail to beat last year’s values, which would reflect a clear slowdown in our rate of growth relative to the end of last year. This should not come as a complete surprise given the clear acceleration in the pace of economic activity for Rhode Island as 2012 came to an end. Sadly, but not surprisingly, the combination of fiscal drag from Washington and the government shutdown should only make these yearly divergences worse.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

At times like this it is informative to look at the performance of the leading indicators contained in the CCI. For August, all four of these had difficult “comps” from a year ago. Only two, however, were able to improve relative to those comps. Don’t expect this to be the last time we encounter this phenomenon.

Let me reiterate an important point that will become ever-more relevant that is related to the seeming paradox of how our state's economy can be showing good momentum yet fail to return to where it was in 2006 and 2007. Current levels of economic activity depend on both the rates of growth we are experiencing and the prior activity levels themselves. Rhode Island’s economy was extremely hard hit during The Great Recession, so, when our recent rates of growth are applied to these depressed activity levels, we continue to see relatively small changes in the actual level of economic activity. As our rate of growth is slowing, it will now take even longer to return to where we were pre-recession.

As stated earlier, two of the CCI’s four leading indicators improved in August. The uptrend in Single-Unit Permits, a leading indicator of housing, continues, although this indicator failed to improve in August (last August its rate of growth was 34%). In 70+ each month. US Consumer Sentiment improved for the seventh consecutive month in August, rising 10.7 percent. Expect to see it began to weaken, given our nation’s fiscal dysfunction.

The remaining leading indicators are related to the labor market.

The first of these, Employment Service Jobs, which includes temporary employment, a prerequisite to overall employment growth, fell for the first time in over a year. It registered a decline of 2.1 percent relative to its 5 percent rise last August. While this indicator has generally improved since last April, its slowing rate of improvement coupled with an August decline calls into question whether it will sustain its uptrend.

New Claims for Unemployment Insurance, the most timely measure of layoffs, appears to now be in an uptrend (note: we want this to decline), as it has now risen for five of the last seven months. A trend of rising layoffs will adversely affect other CCI indicators in coming months, most notably Retail Sales. The final leading indicator, TotalManufacturing Hours, which measures strength in our manufacturing sector, barely rose (by 0.6%). Its recent performance has been spotty in light of stronger global economies that boost exports and a weakening US economy.

Related Slideshow: New England States’ Grades for Debt Protection

A new report by the National Consumer Law Center shows how states rank for debt protection laws for consumers, to preserve basic items of property from seizure by creditors -- and Rhode Island received a "C" grade overall, which the NCLC qualifies has having "many gaps and weaknesses."

Related Articles

- Guest MINDSETTERS™ William Walaska & David Bates: Working to Turn the Economy Around

- NEW: RI Economy Continues to Grow, Report Says

- What Rhode Island Can Do to Move the Economy Forward

- Guest MINDSETTER™ James Sheehan: RI Needs to Bold in Rebuilding Economy

- NEW: Report Says RI Economy Picking Up Steam

- Aaron Regunberg: How Walmart Workers Could Save the U.S. Economy

- Is RI’s Economy on the Rebound?

- New RI Web Site Ties Legislatures Failure to Economy - www.OSTPA1.com

- Alex and Ani Fuels Economy - Creates Thousands of Jobs in RI

- LISTEN: RI Economy on the Rebound?

- Report: Rhode Island’s Economy is Slowing

- Block/RI Taxpayers Organization Challenge General Assembly on Economy

- Lardaro Report: RI Economy Stalls

- Rhode Island’s Struggling Economy: Top Stories in RI in 2012

- CCI Report Shows RI Economy ‘Shifting Into High Gear’

- URI Expert: RI Economy Following ‘Stop and Go’ Pattern

- State Seeking Strategic Plans to Address Economy

- Curtis Parvin: Impersonal Consumerism in a Failing Economy

- URI Expert: RI Economy Gaining Momentum

- Study Finds Racial Gaps Putting RI’s Economy, Future at Risk

- Executive Office Of Commerce Won’t Help RI Economy—Critics

- NEW: Langevin to Talk Jobs, Economy During Westerly Community Day

- Travis Rowley: This Economy Is Gay